Demand for Fitness Apps in Japan 2025 to 2035

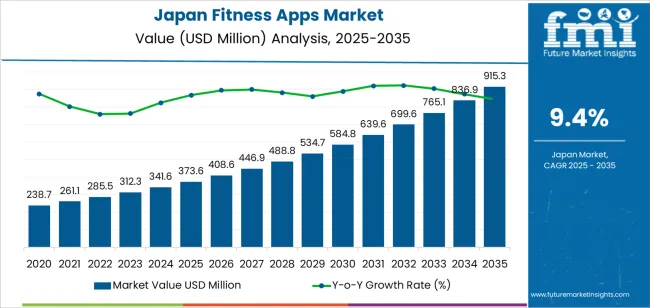

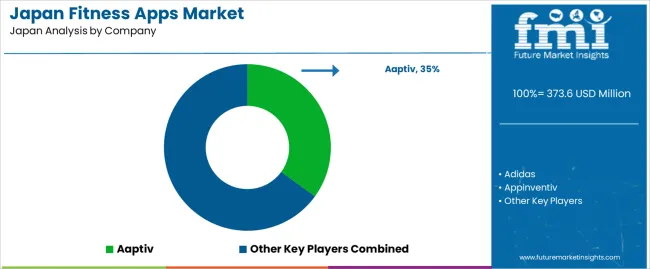

The Japan fitness apps demand is valued at USD 373.6 million in 2025 and is estimated to reach USD 915.3 million by 2035, supported by a CAGR of 9.4%. Demand is influenced by increased use of mobile-based health tools, steady interest in structured exercise programs, and wider availability of personalised digital coaching. Fitness applications support daily activity tracking, guided workouts, and nutritional monitoring, which aligns with rising engagement in home-based and hybrid exercise routines. Broader smartphone penetration and consistent app-store distribution also facilitate adoption across different age groups.

Exercise and weight-loss applications form the leading type. These platforms provide guided training modules, calorie-tracking features, and progressive workout plans that help users follow structured routines. Their use of adaptive difficulty settings and multimedia instructions supports steady uptake among individuals seeking practical exercise formats without specialised equipment. Integration with wearable devices further extends their functionality by enabling continuous monitoring of activity and vital-sign metrics.

Quick Stats for Japan Fitness Apps Demand

Japan Fitness Apps Sales Value (2025): USD 373.6 million

Japan Fitness Apps Forecast Value (2035): USD 915.3 million

Japan Fitness Apps Forecast CAGR (2025–2035): 9.4%

Leading Type in Japan Fitness Apps Demand: Exercise and weight-loss applications

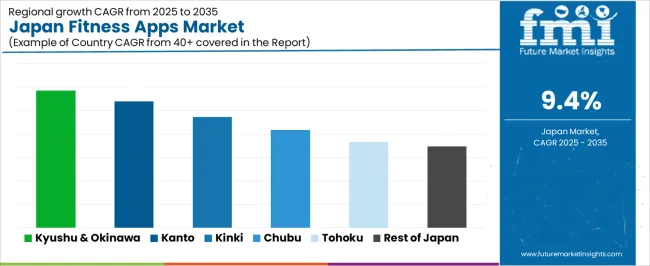

Key Growth Regions in Japan Fitness Apps Demand: Kyushu & Okinawa, Kanto, Kinki

Top Players in Japan Fitness Apps Demand: Aaptiv; Adidas; Appinventiv; Applico; Appster; Azumio, Inc.

Kyushu & Okinawa, Kanto, and Kinki register the highest demand. These regions have concentrated urban populations, established broadband access, and significant participation in lifestyle-oriented digital services. Their retail and commercial ecosystems also support partnerships between app developers, fitness studios, and wellness providers, contributing to broader user acquisition. Aaptiv, Adidas, Appinventiv, Applico, Appster, and Azumio, Inc. are the principal suppliers. Their portfolios include subscription-based training applications, AI-enabled wellness tools, and mobile platforms designed for cardiovascular workouts, strength routines, and behavioural health tracking.

What is the Growth Forecast for Fitness Apps Industry in Japan through 2035?

Peak-to-trough analysis indicates a pronounced early peak between 2026 and 2029 as adoption expands across urban users, corporate-wellness programmes, and health-monitoring communities. This period benefits from rising smartphone penetration, greater interest in personalised workout plans, and wider integration of app-based tracking with wearables. Subscription models, data-driven coaching, and hybrid digital-fitness services reinforce this early uplift, giving the segment strong upward momentum.

A moderate trough is likely between 2030 and 2032 as usage patterns stabilise and competition intensifies among domestic and international app developers. During this phase, users consolidate around established platforms, and growth becomes tied to incremental feature upgrades rather than broad new-user expansion. Procurement by enterprises and insurers also follows more predictable renewal cycles. After 2032, the segment begins a measured recovery driven by improved biometric-tracking accuracy, expanded language-localised content, and deeper integration with sleep, nutrition, and mental-wellness modules. The peak-to-trough structure reflects a transition from rapid early adoption to a more mature, retention-focused phase shaped by consistent digital-health engagement across Japan’s consumer base.

Japan Fitness Apps Key Takeaways

Metric

Value

Japan Fitness Apps Sales Value (2025)

USD 373.6 million

Japan Fitness Apps Forecast Value (2035)

USD 915.3 million

Japan Fitness Apps Forecast CAGR (2025-2035)

9.4%

Why is the Demand for Fitness Apps in Japan Growing?

Demand for fitness apps in Japan is increasing as more consumers seek convenient, digital solutions for health, exercise and wellness tracking. High smartphone penetration and broad use of wearable devices provide a strong foundation for growth. Japanese users place value on apps that deliver personalised workout plans, voice coaching in Japanese, and integration with local fitness culture. The trend toward home-based training and on-demand fitness content supports app uptake among both working adults and older age groups.

Corporate wellness programmes and subscription-based models further expand the addressable industry. Constraints include data privacy concerns among some users, cultural expectations for in-person training and gym membership, and fragmentation among apps in terms of quality and language support. Some developers may face difficulty sustaining user engagement over time due to competition and user attrition.

Which Type, Platform, and Device Segments Lead Demand for Fitness Apps in Japan?

Demand for fitness apps in Japan reflects user interest in exercise guidance, nutrition planning, and activity monitoring across mobile and wearable devices. Adoption patterns vary with personal health goals, preferred operating systems, and device ecosystems. Type preferences correspond to structured workout support, calorie tracking, and daily movement monitoring. Platform distribution highlights user behaviour across iOS, Android, and alternative systems. Device-type patterns show how consumers interact with health data, notifications, and tracking interfaces.

By Type, Exercise and Weight-Loss Apps Account for the Largest Share of Demand

Exercise and weight-loss applications hold 44.8% of national demand and represent the leading type category. Users rely on guided workouts, progress tracking, and personalised training modules to support structured fitness routines. Diet and nutrition apps represent 30.0%, offering calorie monitoring, meal planning, and nutrient analysis tools. Activity-tracking apps hold 25.2%, supporting users who monitor steps, heart rate, movement patterns, and lifestyle indicators. Type distribution reflects varying user goals, ease of digital engagement, and the need for targeted support across fitness, dietary control, and daily activity management within Japan’s wellness ecosystem.

Key drivers and attributes:

Exercise-focused apps support structured workout routines.

Diet apps aid calorie and nutrient monitoring.

Activity-tracking tools record daily movement.

Use patterns reflect health goals and behavioural habits.

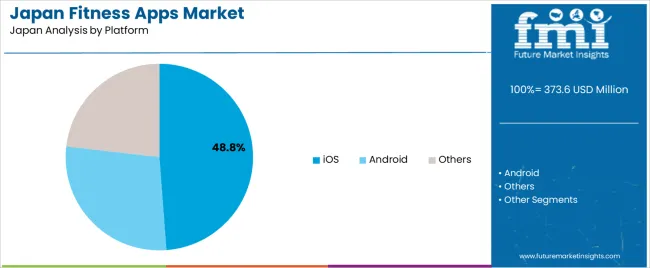

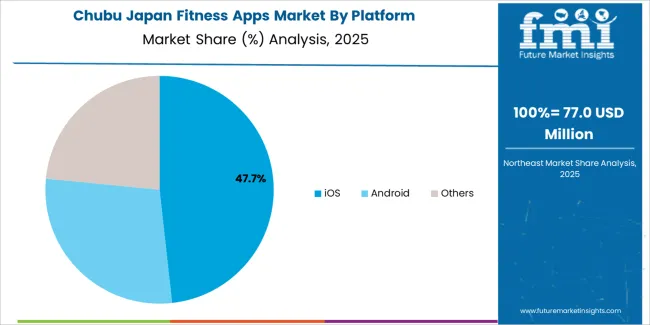

By Platform, iOS Accounts for the Largest Share of Demand

iOS holds 48.8% of national demand and represents the dominant platform for fitness app usage. Consistent device performance, integrated health frameworks, and widespread use of premium fitness apps contribute to strong adoption. Android represents 28.0%, supporting diverse device options and budget-friendly user segments. Other platforms hold 23.2%, including web-based interfaces, smartwatch-native systems, and cross-platform fitness services. Platform distribution reflects device ownership trends, app-store ecosystems, and user preferences for interface stability and data synchronisation across Japan’s digital health environment.

Key drivers and attributes:

iOS benefits from strong hardware–software integration.

Android supports broad affordability and device choice.

Alternative platforms include web and multi-device ecosystems.

Selection follows device availability and user familiarity.

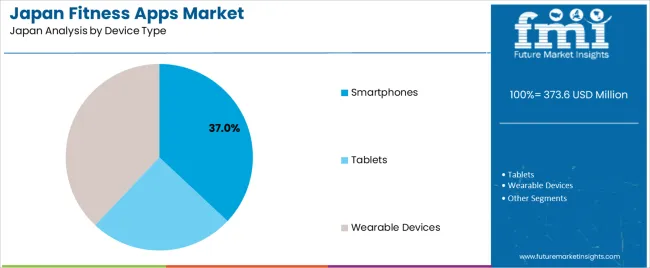

By Device Type, Wearable Devices Account for the Largest Share of Demand

Wearable devices hold 38.0% of national demand and represent the leading device type for fitness application use. Continuous data capture allows monitoring of heart rate, sleep cycles, distance walked, and routine activity patterns. Smartphones represent 37.0%, supporting app-based tracking, notifications, and metric logging across daily activities. Tablets hold 25.0%, used mainly for viewing analytics, running full-screen workout sessions, or accessing guided programmes. Device-type distribution reflects consumer engagement with health metrics, convenience of continuous monitoring, and the integration of fitness data into daily routines across Japan’s digital health landscape.

Key drivers and attributes:

Wearables enable continuous physiological monitoring.

Smartphones provide versatile app interaction.

Tablets support expanded visual interfaces.

Device choice aligns with tracking preference and routine design.

What are the Drivers, Restraints, and Key Trends of the Demand for Fitness Apps in Japan?

Growing health awareness, high smartphone and wearable penetration, and flexible workout preferences are driving demand.

In Japan, demand for fitness apps is increasing as consumers place greater value on maintaining health, fitness and wellness especially amid an ageing population and busy urban lifestyles. Smartphones and wearables are widely adopted, enabling fitness apps to integrate activity tracking, heart rate monitoring and workout guidance seamlessly. The convenience of digital workouts at home or on the go appeals to users who may have limited time or prefer flexible routines rather than gym membership alone. App developers offering Japanese-language content, culturally relevant exercise programmes and integration with local wearables further support uptake across demographics.

User engagement challenges, privacy concerns and competition from offline services restrain growth.

Even when downloads are high, many fitness apps struggle with sustained user engagement; users may download an app but discontinue active use within weeks. Data privacy and security are important considerations in the Japanese industry, and concerns about tracking personal health data can hinder full adoption. Traditional offline fitness services, such as gyms, boutique studios and corporate wellness programmes continue to compete strongly, which may limit shift to purely digital formats.

Personalisation via AI, hybrid home/onsite workout models, and gamified/social features define key trends.

Fitness apps in Japan are evolving to include AI-driven personalization, tailoring workouts, tracking progress and offering adaptive plans based on user behaviour and sensor data. Hybrid models that combine app-based training with occasional in-studio or group sessions are gaining popularity, blending digital convenience with social motivation. Gamification, social sharing, challenges and community features are becoming stronger, supporting user retention and motivation. Despite maturation in core industries, there remains opportunity in addressing older age segments, specialised wellness (mobility, rehabilitation) and multilingual tourism-related fitness offerings.

Analysis of the Demand for Fitness Apps in Japan by Region

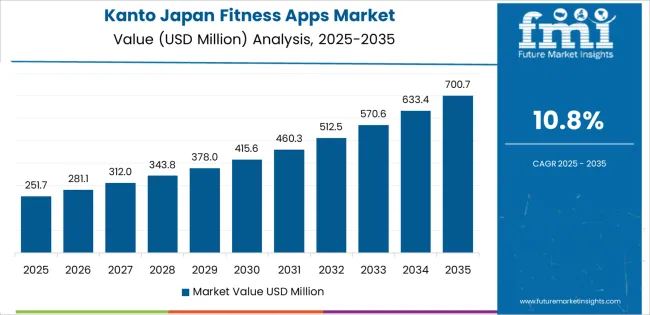

Demand for fitness apps in Japan is rising through 2035 as consumers adopt digital tools for exercise tracking, guided workouts, weight management, and wellness monitoring. Growth is influenced by expanded smartphone penetration, increased use of wearables, and stronger interest in hybrid fitness models combining online coaching with in-person activity. Localized app features, such as diet tracking aligned with Japanese eating patterns, stress-monitoring functions, and home-workout programssupport adoption across diverse age groups. Corporate-wellness participation and regional health campaigns also strengthen usage. Kyushu & Okinawa leads with 11.7%, followed by Kanto (10.8%), Kinki (9.5%), Chubu (8.3%), Tohoku (7.3%), and the Rest of Japan (6.9%).

Region

CAGR (2025-2035)

Kyushu & Okinawa

11.7%

Kanto

10.8%

Kinki

9.5%

Chubu

8.3%

Tohoku

7.3%

Rest of Japan

6.9%

How are Kyushu & Okinawa driving demand for fitness apps?

Kyushu & Okinawa grow at 11.7% CAGR, supported by strong consumer interest in accessible digital wellness tools, increasing participation in outdoor activities, and expanding smartphone usage across urban and regional communities. Fitness apps offering guided walking, bodyweight routines, and beginner-friendly programs see rapid adoption due to the region’s diverse user base. Local gyms and wellness centers integrate app-based scheduling, progress tracking, and remote-training modules that encourage consistent engagement. Tourism areas with active lifestyles contribute to demand for step-tracking and activity-monitoring applications. Regional health programs promoting preventive care also encourage residents to adopt digital fitness solutions for daily monitoring and goal setting.

Strong adoption among beginners and casual exercisers

Gym integration supporting hybrid fitness participation

Outdoor activity culture enhancing app-based tracking usage

Preventive-health programs driving broader digital engagement

How is Kanto advancing demand for fitness apps?

Kanto grows at 10.8% CAGR, driven by dense urban populations, high smartphone penetration, and strong engagement with digital wellness platforms across Tokyo, Kanagawa, and Saitama. Busy professionals rely on app-based exercise routines that fit into short schedules, including HIIT, mobility, and stretching programs. Gyms and boutique studios integrate app features for class booking, performance tracking, and virtual coaching. Wearable-device adoption is high, supporting synchronization with fitness apps for heart-rate monitoring and daily-activity analysis. Urban consumers show strong interest in diet-logging, step-tracking, and sleep-analysis tools. Corporations in metropolitan areas expand wellness initiatives that include app-based participation incentives.

High wearable-device usage enhancing app integration

Strong urban demand for flexible, time-efficient workouts

Gym partnerships supporting virtual and hybrid fitness formats

Corporate-wellness adoption reinforcing consistent engagement

How is Kinki shaping demand for fitness apps?

Kinki grows at 9.5% CAGR, supported by active urban lifestyles and steady adoption of digital health technologies across Osaka, Kyoto, and Hyogo. Fitness apps offering structured workout plans, calorie-tracking tools, and personalized suggestions appeal to diverse users balancing work and wellness. Gyms use app-based systems to support class scheduling and individualized progress management. Wearables linked to fitness apps help users monitor training intensity and recovery. Cultural interest in walking, running, and light fitness routines aligns with app-based tracking and coaching features. Universities and corporate campuses broaden engagement by promoting app-based health-improvement initiatives.

Strong use of structured digital workout programs

Integration of wearables for training and recovery insights

Gym and studio systems using app-based scheduling

University and corporate participation boosting adoption

How is Chubu influencing demand for fitness apps?

Chubu grows at 8.3% CAGR, shaped by rising interest in home-based exercise, growing online-coaching availability, and steady smartphone adoption across Aichi, Shizuoka, and Gifu. Fitness apps supporting low-equipment routines, step-tracking, and weight-management tools appeal to users seeking convenience outside traditional gym settings. Manufacturers and large employers in the region integrate wellness apps into employee-health programs. Wearable devices linked to fitness platforms help users track daily activity during commutes and workplace routines. Younger populations show interest in app-based training challenges and community features that encourage consistent engagement.

Rising use of home-based and low-equipment workout apps

Employer wellness programs integrating fitness applications

Wearable-device adoption supporting daily-activity tracking

Strong engagement among younger users through challenge features

How is Tohoku supporting demand for fitness apps?

Tohoku grows at 7.3% CAGR, supported by increasing awareness of digital wellness benefits, interest in preventive healthcare, and growing engagement with mobile fitness tools across Miyagi, Fukushima, and Akita. Users adopt fitness apps for structured walking programs, stretching routines, and personalized health tracking suited to regional lifestyle patterns. Local employers and community organizations incorporate digital fitness initiatives that encourage regular activity. Wearable devices are becoming more common, enabling integration with exercise-tracking apps. Although overall digital adoption is slower than in metropolitan regions, steady interest in health-improvement tools maintains consistent growth.

Strong adoption of walking and stretching-focused apps

Community and employer-supported fitness engagement

Gradual rise in wearable-device integration

Stable interest in preventive health and lifestyle tracking

How is the Rest of Japan contributing to demand for fitness apps?

The Rest of Japan grows at 6.9% CAGR, supported by moderate smartphone adoption, gradual interest in home-based exercise, and expanding participation in digital wellness programs. Users rely on fitness apps for simple routines including mobility sessions, guided walking, and goal-tracking features. Gyms in smaller cities introduce app-based tools for membership management and class scheduling. Regional health agencies promote digital wellness campaigns that encourage daily activity tracking. Adoption remains slower due to population dispersion, but sustained interest in accessible, low-cost fitness tools ensures ongoing demand.

Adoption of basic exercise and activity-tracking apps

Gym usage of app-based scheduling and engagement tools

Regional health programs promoting digital activity monitoring

Steady demand driven by accessible, low-barrier fitness formats

What is the competitive landscape of the demand for fitness apps in Japan?

Demand for fitness apps in Japan is shaped by a group of digital-wellness developers serving users seeking structured workouts, activity tracking, and guided training across mobile and connected devices. Aaptiv holds the leading position with an estimated 35.0% share, supported by its library of audio- and video-based training sessions, consistent user-interface stability, and long-standing adoption among individuals seeking structured home and gym workouts. Its position is reinforced by dependable content updates and predictable performance across iOS and Android platforms.

Adidas and Azumio, Inc. follow as significant participants. Adidas provides app-based training programmes with controlled progression structures and steady engagement tools suited to cardio, strength, and conditioning routines. Azumio contributes validated tracking features, nutritional logging, and activity-monitoring functions aligned with health-management patterns common among Japanese users. Appinventiv and Applico maintain roles as technology partners that support custom fitness-app development for wellness brands and gym networks, supplying stable backend architectures and consistent UX frameworks. Appster adds capability through design-driven fitness-app builds suited to niche training categories and wellness platforms.

Competition across this segment centres on content quality, tracking accuracy, user-engagement consistency, integration with wearables, and app stability under daily use. Demand continues to grow as Japanese consumers prioritise guided home workouts, personalised training paths, and mobile health tools that deliver reliable performance and straightforward progression monitoring across diverse fitness levels.

Key Players in Japan Fitness Apps Demand

Aaptiv

Adidas

Appinventiv

Applico

Appster

Azumio, Inc.

Scope of the Report

Items

Values

Quantitative Units

USD million

Type

Exercise & Weight Loss, Diet & Nutrition, Activity Tracking

Platform

iOS, Android, Others

Device Type

Smartphones, Tablets, Wearable Devices

Regions Covered

Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan

Key Companies Profiled

Aaptiv, Adidas, Appinventiv, Applico, Appster, Azumio, Inc.

Additional Attributes

Dollar sales by app type, platform, and device category; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of fitness and wellness app developers; advancements in AI-driven workout plans, nutrition tracking, and wearable device integration; integration with gyms, home fitness routines, corporate wellness programs, and personalised health monitoring across Japan.

Japan Fitness Apps Demand by Segments Type:

Exercise & Weight Loss

Diet & Nutrition

Activity Tracking

Platform:

Device Type:

Smartphones

Tablets

Wearable Devices

Region:

Kyushu & Okinawa

Kanto

Kinki

Chubu

Tohoku

Rest of Japan

Frequently Asked Questions

How big is the demand for fitness apps in Japan in 2025?

The demand for fitness apps in Japan is estimated to be valued at USD 373.6 million in 2025.

What will be the size of fitness apps in Japan in 2035?

The market size for the fitness apps in Japan is projected to reach USD 915.3 million by 2035.

How much will be the demand for fitness apps in Japan growth between 2025 and 2035?

The demand for fitness apps in Japan is expected to grow at a 9.4% CAGR between 2025 and 2035.

What are the key product types in the fitness apps in japan?

The key product types in fitness apps in Japan are exercise & weight loss, diet & nutrition and activity tracking.

Which platform segment is expected to contribute significant share in the fitness apps in Japan in 2025?

In terms of platform, ios segment is expected to command 48.8% share in the fitness apps in Japan in 2025.

AloJapan.com