Demand for Medical Tourism in Japan Forecast and Outlook 2025 to 2035

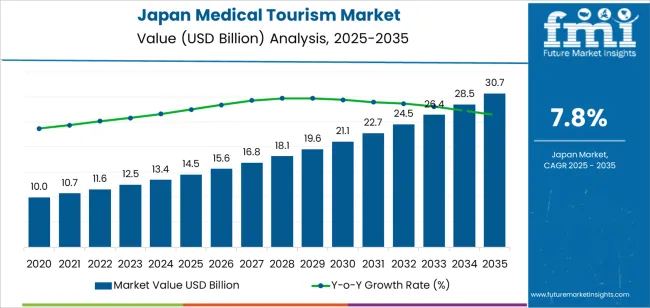

The demand for medical tourism in Japan is expected to grow significantly from USD 14.5 billion in 2025 to USD 30.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 7.8%. Japan’s advanced healthcare system, coupled with its world-class medical technologies and high-quality care, continues to make it an attractive destination for international patients. The increasing trend of global mobility, combined with rising healthcare costs in other countries, is driving more patients to seek affordable and effective treatment options in Japan

The country’s medical tourism sector is further supported by its well-established reputation for specialized medical services, particularly in fields such as advanced cancer treatments, fertility procedures, and cardiovascular care. With Japan’s emphasis on cutting-edge technology and highly skilled healthcare professionals, it continues to draw a diverse range of international patients seeking top-tier medical procedures at competitive costs. Japan’s combination of traditional and modern medicine, including wellness treatments like acupuncture and holistic therapies, is appealing to patients who value comprehensive care.

Quick Stats of the Demand for Medical Tourism in Japan

Demand for Medical Tourism in Japan Value (2025): USD 14.5 billion

Demand for Medical Tourism in Japan Forecast Value (2035): USD 30.7 billion

Demand for Medical Tourism in Japan Forecast CAGR (2025 to 2035): 7.8%

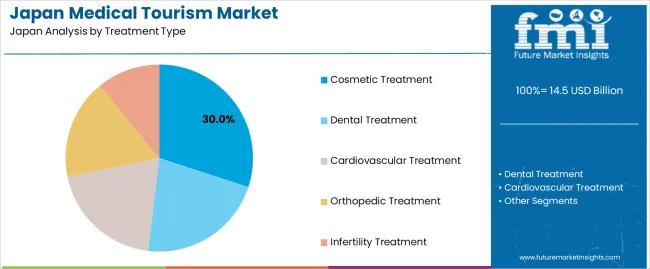

Demand for Medical Tourism in Japan Leading Treatment Type: Cosmetic Treatment (32%)

Demand for Medical Tourism in Japan Key Growth Regions: Kanto, Kinki, Chubu, Tohoku, Rest of Japan

Demand for Medical Tourism in Japan Top Players: MedRetreat, Healthbase, ApolloHospitals, KPJHealthcareBerhad, KlinikumMedicalLink

Government support and an increasingly welcoming approach towards medical tourists are also important factors in the growth of this sector. Japan’s efforts to streamline visa processes, improve language accessibility, and establish services specifically for foreign patients are helping to make the country a more attractive destination for medical tourism. As a result, more healthcare facilities are offering medical tourism packages tailored to international patients, focusing on a seamless experience from consultation to recovery.

What is the Growth Forecast for the Demand for Medical Tourism in Japan through 2035?

Between 2025 and 2030, the demand for medical tourism in Japan will increase from USD 14.5 billion to USD 19.6 billion, adding USD 5.1 billion. This growth phase will be driven by rising global demand for high-quality medical treatments, Japan’s affordability of care compared to other developed countries, and the country’s continued efforts to improve services for international patients. The demand will primarily come from patients seeking advanced surgical procedures, fertility treatments, and specialized therapies that are not as widely available in their home countries.

From 2030 to 2035, the demand is expected to accelerate, growing from USD 19.6 billion to USD 30.7 billion, adding USD 11.1 billion. This later phase will see a significant rise in medical tourism demand, driven by continued innovation in medical technologies, expanding international awareness of Japan’s medical capabilities, and the growing demand for wellness and preventive treatments. Japan’s medical tourism industry will continue to grow as more international patients travel for specialized treatments and benefit from Japan’s excellent healthcare infrastructure and government-backed incentives to make healthcare more accessible to visitors.

Demand for Medical Tourism in Japan Key Takeaways

Metric

Value

Demand for Medical Tourism in Japan Value (2025)

USD 14.5 billion

Demand for Medical Tourism in Japan Forecast Value (2035)

USD 30.7 billion

Demand for Medical Tourism in Japan Forecast CAGR (2025 to 2035)

7.8%

Why is the Demand for Medical Tourism in Japan Growing?

The demand for medical tourism in Japan is growing as the country establishes itself as a hub for high-quality, advanced medical care. Japan’s world-renowned healthcare system, combined with cutting-edge technology and highly trained medical professionals, makes it a prime destination for international patients seeking specialized treatments. The increasing availability of medical services tailored to international visitors, such as language support and travel arrangements, is further driving growth in this sector.

Japan’s medical tourism industry is gaining momentum as patients from neighboring countries, especially those in Asia, seek treatments that may not be readily available or affordable in their own countries. Common medical tourism procedures in Japan include advanced cancer treatment, cosmetic surgery, fertility treatments, and orthopedic care. The quality and safety standards of Japanese healthcare attract medical tourists looking for trusted and innovative medical care at competitive prices.

Japan’s emphasis on wellness tourism is boosting demand. The country is promoting medical tourism alongside health and wellness packages that include traditional healing practices, spa treatments, and preventive care. As healthcare standards improve globally and travel becomes easier, Japan’s unique combination of medical expertise and cultural appeal is expected to fuel the continued growth of its medical tourism sector through 2035.

What is the Segment-Wise Analysis of Demand for Medical Tourism in Japan?

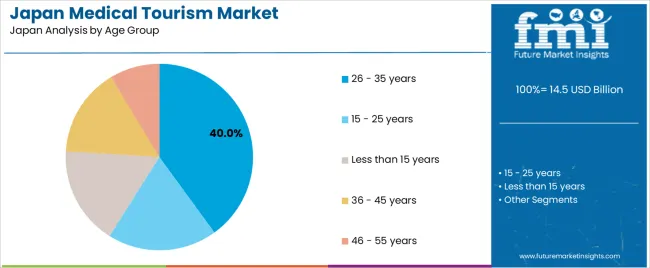

Demand for medical tourism in Japan is segmented by treatment type and age group. By treatment type, demand is divided into cosmetic treatment, dental treatment, cardiovascular treatment, orthopedic treatment, and infertility treatment. The demand is also segmented by age group, including 26 – 35 years, 15 – 25 years, less than 15 years, 36 – 45 years, and 46 – 55 years. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Why Does Cosmetic Treatment Lead the Demand for Medical Tourism in Japan?

Cosmetic treatment accounts for 30% of the demand for medical tourism in Japan. Japan is renowned for its advanced medical technology and high standards of care, particularly in the field of cosmetic surgery and skin treatments. With the rise of global interest in aesthetic procedures such as facelifts, rhinoplasty, and non-surgical treatments, Japan has become a prime destination for individuals seeking high-quality, safe, and effective cosmetic procedures. The demand for cosmetic treatment is driven by factors such as the desire for enhanced appearance, the availability of cutting-edge technology, and highly skilled medical professionals. As more people seek affordable yet world-class cosmetic treatments, Japan’s medical tourism sector is expected to continue to grow, with cosmetic procedures remaining a leading choice.

Why Does the 26 – 35 Years Age Group Lead the Demand for Medical Tourism?

The 26 – 35 years’ age group accounts for 40% of the demand for medical tourism in Japan. This group is often at the peak of their professional and personal lives, with disposable income to invest in elective medical procedures such as cosmetic surgery, dental care, and fertility treatments. Individuals in this age range are increasingly becoming more conscious of their appearance, health, and overall well-being, driving the demand for medical tourism services. Many in this age group are more open to traveling abroad for high-quality and affordable medical care, especially in specialized fields like cosmetic treatment and dental procedures. With the increasing awareness and growing access to international medical options, the 26 – 35 years demographic will continue to be a dominant driver of medical tourism demand in Japan.

What are the Key Trends, Drivers, and Restraints in the Demand for Medical Tourism in Japan?

Japan’s strengths include top‑tier healthcare infrastructure, world‑class medical technology and growing multilingual services tailored for foreign patients. Key drivers include the government’s strategic push to attract inbound medical‑tourism, increases in visas and hospital accreditation for overseas patients, rising interest in advanced specialties like oncology, cardiovascular care, aesthetic procedures and regenerative medicine, and the integration of healthcare with tourism (e.g., wellness + treatment). Restraints include relatively high cost of care compared to some regional competitors, language and cultural barriers in some facilities, logistical/visa complexit.

Why is Demand for Medical Tourism in Japan Growing?

Japan is increasingly drawing medical tourists because its healthcare system is highly rated globally for safety, innovation and patient outcomes. With advanced options available in major centres such as Tokyo and Osaka, patients from abroad are choosing Japan for complex treatments, wellness check‑ups and aesthetic services that may be less accessible elsewhere. The government has made inbound medical tourism a pillar of its growth strategy, streamlining visa procedures and promoting Japanese hospitals internationally. The combination of medical care with the touristic appeal of Japan such as culture, hospitality, nature and wellness‑oriented stays—enhances appeal, turning healthcare travel into a broader “health‑and‑wellness destination” experience.

How are Technological Innovations Driving Growth of Medical Tourism in Japan?

Technological innovations are boosting Japan’s attractiveness as a medical‑tourism destination by enabling cutting‑edge diagnostics, minimally invasive treatments, regenerative medicine and digital health solutions. Japanese hospitals use advanced imaging, robotics, precision oncology, stem‑cell therapies and telehealth follow‑up models, which appeal to patients seeking best‑in‑class care. Adoption of multilingual digital platforms, AI‑supported patient navigation and international‑patient centres makes the journey simpler for foreign visitors. These innovations elevate Japan’s reputation globally and enable hospitals to compete on quality, not just price, thus driving inbound demand for medical tourism.

What are the Key Challenges Limiting Adoption of Medical Tourism in Japan?

Despite momentum, several challenges limit broader growth of medical tourism in Japan. Cost remains a barrier: treatments in Japan tend to be more expensive compared with other countries in Asia, making price‑sensitive patients look elsewhere. Language, cultural adaptation and logistical support (translation services, international insurance coordination) are still under‑developed in some institutions. Visa and regulatory processes for foreign patients can be complex and healthcare insurance systems are designed primarily for residents, adding administrative friction. Many regional hospitals lack experience handling inbound international patients, limiting capacity outside major cities and hampering nationwide expansion.

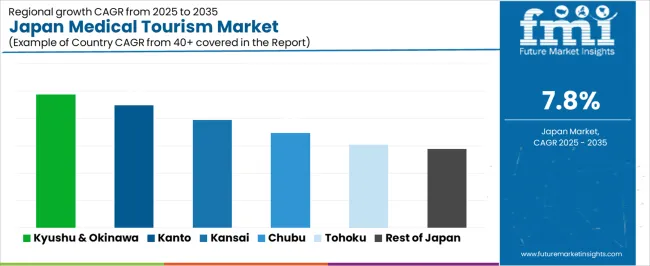

What is the Regional Demand Outlook for Medical Tourism in Japan?

Region

CAGR (%)

Kyushu & Okinawa

9.8%

Kanto

9.0%

Kinki

7.9%

Chubu

6.9%

Tohoku

6.1%

Rest of Japan

5.8%

The demand for medical tourism in Japan is growing across all regions, with Kyushu & Okinawa leading at a 9.8% CAGR. This growth is supported by Japan’s high-quality healthcare system and its increasing appeal to international patients. Kanto follows closely with a 9.0% CAGR, driven by Tokyo’s prominence as a global hub for medical services and innovations. Kinki shows a 7.9% CAGR, influenced by the region’s strong healthcare infrastructure. Chubu experiences a 6.9% CAGR, benefiting from its growing medical tourism offerings. Tohoku and the Rest of Japan show more moderate growth at 6.1% and 5.8%, respectively, driven by regional improvements in medical facilities and services tailored to international patients.

Why is Growth Strongest in Kyushu & Okinawa for Medical Tourism?

Kyushu & Okinawa is seeing the highest demand for medical tourism in Japan, with a 9.8% CAGR. This growth is driven by the region’s increasing focus on promoting its healthcare services to international patients, particularly from neighboring countries in Asia. Kyushu, with its medical tourism initiatives and accessible transport options, is attracting patients seeking affordable, high-quality medical treatments, including cosmetic surgeries, dental work, and wellness therapies.

Okinawa’s popularity as a tourist destination is also contributing to its growth in medical tourism, as visitors increasingly combine leisure and medical treatments, taking advantage of the region’s health resorts and wellness services. Kyushu & Okinawa’s commitment to improving healthcare facilities and promoting international partnerships in the medical sector positions the region as a leading destination for medical tourists. The rising demand for specialized treatments and a broader range of healthcare services will continue to drive growth in the medical tourism sector in this region.

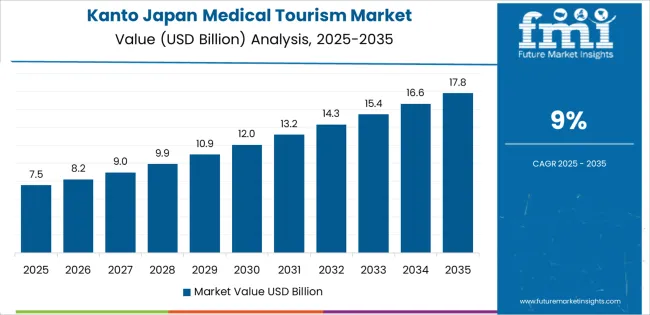

How is Growth in Kanto Influenced for Medical Tourism?

Kanto is experiencing strong growth in medical tourism, with a 9.0% CAGR. The region’s growth is largely driven by Tokyo, which is renowned for its advanced medical technology, world-class healthcare facilities, and the high quality of care provided. As Japan’s capital, Tokyo is a global medical hub, attracting international patients who seek a range of medical treatments, including specialized surgeries, cosmetic procedures, and fertility treatments.

Kanto’s medical tourism sector benefits from its excellent international connectivity, with major airports like Narita and Haneda making it easily accessible for patients from around the world. The region’s established reputation for cutting-edge healthcare technology and well-trained professionals in fields such as robotics, oncology, and plastic surgery continues to draw international visitors seeking high-quality medical services. As the demand for Japan’s advanced medical services increases, Kanto is expected to continue to lead in the medical tourism sector.

What is Driving Growth in Kinki for Medical Tourism?

Kinki is experiencing steady growth in medical tourism, with a 7.9% CAGR. The region, including cities like Osaka and Kyoto, is known for its strong healthcare infrastructure, world-class medical institutions, and cutting-edge medical technology. Osaka, as a major commercial center, has seen a rise in international patients seeking various treatments such as dental care, cosmetic surgery, and cancer therapies.

Kinki’s cultural and historical significance also plays a role in attracting medical tourists who combine healthcare treatments with travel experiences. The region’s healthcare providers are increasingly focusing on offering specialized services tailored to foreign patients, and the expansion of medical tourism facilities is further driving demand. With growing recognition of its medical expertise and expanding medical tourism services, Kinki is becoming an increasingly important destination for international patients seeking affordable and high-quality healthcare options.

How is Growth in Chubu Being Influenced for Medical Tourism?

Chubu is seeing moderate growth in medical tourism, with a 6.9% CAGR. The region’s growing healthcare infrastructure, particularly in cities like Nagoya, is contributing to its rising appeal for international patients. As more hospitals and clinics in Chubu adopt international patient services and focus on offering specialized medical treatments, the region is seeing a steady rise in medical tourism demand.

Chubu’s strong presence in industrial sectors, including automotive and manufacturing, is helping to drive awareness of its medical facilities, especially in high-demand areas like orthopedic surgeries, dental care, and cosmetic procedures. The region’s accessible location and continuous improvements in healthcare services for foreign patients are expected to contribute to further growth in medical tourism. As more patients seek affordable, high-quality medical care in Chubu, the demand for medical tourism services will continue to expand.

What is Driving Growth in Tohoku for Medical Tourism?

Tohoku is experiencing moderate growth in medical tourism, with a 6.1% CAGR. The region’s healthcare sector is becoming increasingly focused on attracting international patients, especially as it improves its medical facilities and develops specialized services. Tohoku’s scenic beauty and lower cost of living also make it an attractive destination for medical tourists seeking affordable treatments, including general healthcare services and wellness therapies.

As Tohoku continues to invest in medical infrastructure and expand its medical tourism services, the demand for healthcare-related travel is expected to grow steadily. The region’s focus on offering tailored services to international patients, along with government initiatives to promote medical tourism, ensures that Tohoku will continue to attract a growing number of foreign patients looking for high-quality care in a more peaceful and less urbanized setting.

How is Growth in the Rest of Japan Being Supported for Medical Tourism?

The Rest of Japan is experiencing steady growth in medical tourism, with a 5.8% CAGR. While the growth rate is slower than in more developed regions like Kyushu & Okinawa and Kanto, the Rest of Japan is gradually becoming a more popular destination for medical tourists seeking affordable and high-quality healthcare services. The region’s ongoing efforts to develop its healthcare infrastructure and promote medical tourism are contributing to this growth.

The Rest of Japan’s appeal lies in its more rural and tranquil settings, providing patients with an opportunity to combine medical treatments with wellness tourism. As more hospitals and clinics expand their international services and offer specialized treatments, the region’s medical tourism sector is expected to continue growing. With increasing recognition of Japan’s high standards of care and growing interest in health-focused travel, the Rest of Japan remains a promising, albeit moderate, player in the medical tourism market.

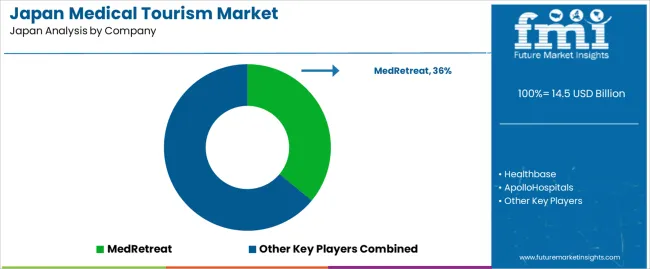

What is the Competitive Landscape of Japan Medical Tourism Demand?

The demand for medical tourism in Japan has been gathering pace as the country intensifies its efforts to attract international patients seeking advanced treatments, wellness care, and high‑quality medical infrastructure. With Japan’s globally renowned hospitals, cutting‑edge healthcare technologies, and growing governmental initiatives to welcome foreign patients, the country is increasingly positioned as a destination for health‑travelers from across Asia and beyond.

In this context, MedRetreat holds an estimated 36.0% share of the inbound medical tourism segment, reflecting its strong role in coordinating treatment packages, facilitating travel arrangements, and connecting patients with Japan’s private healthcare providers. Other notable players involved in catering to these health‑travel flows include Healthbase, ApolloHospitals, KPJ Healthcare Berhad, and Klinikum Medical Link, which help structure cross‑border healthcare journeys and promote Japan’s offerings in the medical‑tourism network.

Key drivers fueling the demand include Japan’s aging population combined with its medical‑tourism push, the growing regional middle‑class seeking treatment in premium overseas facilities, the country’s emphasis on specialties like oncology, regenerative medicine and cosmetic wellness, and streamlined travel‑visa protocols for overseas patients. While challenges such as language/cultural barriers, relatively high cost of care, and competition from more established medical‑tourism destinations persist, the outlook remains positive. With Japan continuing to promote its healthcare ecosystem and align tourism with medical services, demand for medical‑tourism offerings are expected to grow further in the coming years.

Key Players in Japan Medical Tourism Demand

MedRetreat

Healthbase

ApolloHospitals

KPJHealthcareBerhad

KlinikumMedicalLink

Scope of Report

Items

Values

Quantitative Unit

USD billion

Treatment Type

Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopedic Treatment, Infertility Treatment

Age Group

26 – 35 years, 15 – 25 years, Less than 15 years, 36 – 45 years, 46 – 55 years

Tourist Type

Domestic, International

Service Provider

Private, Public

Traveler Type

Independent Traveler, Tour Group, Package Traveler

Key Players Profiled

MedRetreat, Healthbase, ApolloHospitals, KPJHealthcareBerhad, KlinikumMedicalLink

Regions Covered

Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan

Additional Attributes

Dollar sales by treatment type, age group, tourist type, and regional trends with a focus on cosmetic and dental treatments

Japan Medical Tourism Demand by Key Segments Treatment Type

Cosmetic Treatment

Dental Treatment

Cardiovascular Treatment

Orthopedic Treatment

Infertility Treatment

Age Group

26 – 35 years

15 – 25 years

Less than 15 years

36 – 45 years

46 – 55 years

Tourist Type

Service Provider

Traveler Type

Independent Traveler

Tour Group

Package Traveler

Region

Kyushu & Okinawa

Kanto

Kinki

Chubu

Tohoku

Rest of Japan

Frequently Asked Questions

How big is the demand for medical tourism in japan in 2025?

The global demand for medical tourism in japan is estimated to be valued at USD 14.5 billion in 2025.

What will be the size of demand for medical tourism in japan in 2035?

The market size for the demand for medical tourism in japan is projected to reach USD 30.7 billion by 2035.

How much will be the demand for medical tourism in japan growth between 2025 and 2035?

The demand for medical tourism in japan is expected to grow at a 7.8% CAGR between 2025 and 2035.

What are the key product types in the demand for medical tourism in japan?

The key product types in demand for medical tourism in japan are cosmetic treatment, dental treatment, cardiovascular treatment, orthopedic treatment and infertility treatment.

Which age group segment to contribute significant share in the demand for medical tourism in japan in 2025?

In terms of age group, 26 – 35 years segment to command 40.0% share in the demand for medical tourism in japan in 2025.

AloJapan.com