Nvidia’s (NVDA) explosive Q3 earnings report has unleashed a tidal wave of optimism across world markets, and nowhere was the impact more dramatic than in Japan. In Thursday’s trading, the Nikkei was briefly up as much as 4%, breaching the key 50,000 level — albeit only briefly — as semiconductor-related names surged alongside other risk-on stocks.

TipRanks Black Friday Sale

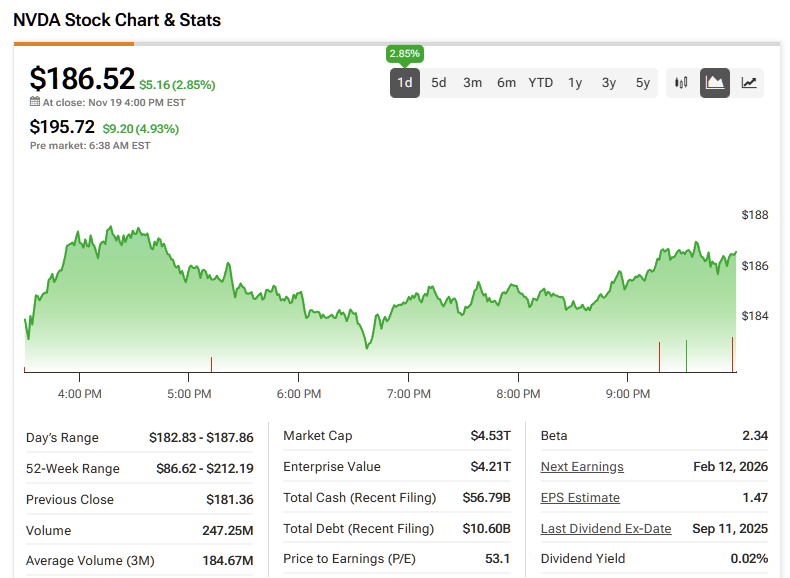

NVDA stock is expected to open ~5% higher when trading resumes in the U.S. later today, with the all-important $200 level likely to be a volatile battleground in the coming weeks.

Japanese semiconductor powerhouses include Tokyo Electron (TOELY), Advantest Corporation (ATEYY), and Renesas Electronics (RNECF). Although their business models differ from Nvidia’s, these Japanese peers benefit from the same macro-tailwinds that NVDA is currently enjoying, including rising demand for advanced semiconductors, worldwide supply-chain integration, and a technology transition from legacy systems towards autonomous, AI-driven, and Internet of Things (IoT) systems.

Nvidia’s powerful Q3 results—and its confident guidance—helped silence concerns that the AI boom was nearing exhaustion, reversing a string of profit-taking sessions in Tokyo over the past few weeks. By the close of trading, the Nikkei was up 2.7%, closing just below the psychologically important 50,000 level.

Nikkei’s Top Gainers

Momentum quickly spilled beyond tech, lifting a diverse range of Japanese stocks. Digital-content platform Amazia, known for its popular manga and e-book services, saw strong buying as investors bet that improving market sentiment would boost online media consumption. In risk-on environments, high-engagement digital companies like Amazia often attract capital as traders seek scalable growth stories aligned with Japan’s expanding digital economy. The stock ended the day 23% higher.

Investment firm Kitahama Capital Partners also drew significant attention, ending the day 23% higher. With markets snapping back into rally mode, traders rotated into financial and asset-management names poised to benefit from renewed risk appetite. Kitahama’s focus on emerging and growth-oriented investments made it a natural beneficiary of the broader revival sparked by Nvidia’s surge.

Meanwhile, health-food producer Fruta Fruta, known for its Amazonian superfruits and wellness-oriented products, rode the wave of optimism as investors returned to smaller consumer-focused names. With the yen weakening and expectations rising for improved domestic demand, traders flocked to companies positioned to capture niche but fast-growing segments of Japan’s food and lifestyle market.

Macroeconomic Impact of NVDA’s Results

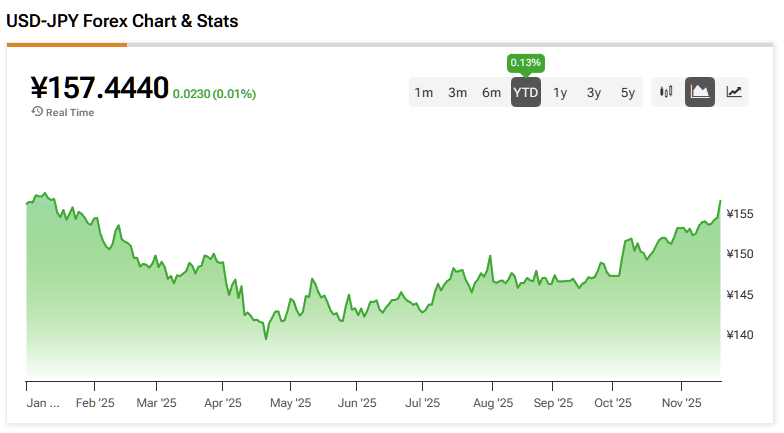

The macro backdrop was also partially affected by NVDA’s results. The yen fell to the mid-157 range against the U.S. dollar—its lowest level in several months—boosting exporter sentiment and strengthening expectations that Japanese exports will rise amid a weaker yen. At the same time, Japan’s 10-year government bond yield hit 1.8% for the first time in over 17 years as investors priced in more bond issuance tied to forthcoming fiscal stimulus.

And in a standout move, Bitcoin Japan also surged more than 20% today, benefiting from both the global risk-on mood and rising crypto enthusiasm tied indirectly to AI-driven tech optimism. Its gains underscore just how far Nvidia’s effect ripples across markets, nations, and asset classes.

As Nomura strategist Maki Sawada noted, the market had been primed for a rebound after several days of steep declines. Nvidia’s blockbuster results delivered the spark—driving a broad surge across the Nikkei and pushing companies like Amazia, Kitahama Capital Partners, and Fruta Fruta to fresh highs. Still, even a stellar quarter from an AI semiconductor bellwether isn’t enough to erase lingering concerns about overheating and the broader inflation outlook. Whether the current wave of AI-driven enthusiasm can endure remains an open question.

Disclaimer & DisclosureReport an Issue

AloJapan.com