The Asia ex-Japan sustainable fund universe encompasses open-end funds and exchange-traded funds that, through their prospectus or other regulatory filings, claim to focus on sustainability, impact, or environmental, social, and governance factors. This article is adapted from a recent report published by Morningstar Sustainalytics and details regional flows, assets, and launches for the third quarter of 2025.

We used the most recent data available within the past quarter for funds whose full quarterly data were unavailable at the time of publication. Because China’s data were not available, we used second quarter 2025 data as a proxy for third quarter 2025 data in every exhibit of this article. After reversing a six-quarter streak of outflows in the first quarter of 2025, China-domiciled sustainable funds returned to outflows in the second quarter of 2025. The outflows were distributed relatively evenly across locally domiciled sustainable funds. ChinaAMC Energy Innovation Equity recorded the largest single-fund outflow. However, the USD 86 million withdrawn represented a relatively small portion of the fund’s USD 1.1 billion in assets under management, which it had accumulated since its June 2017 launch as ChinaAMC’s first ESG fund.

Flows

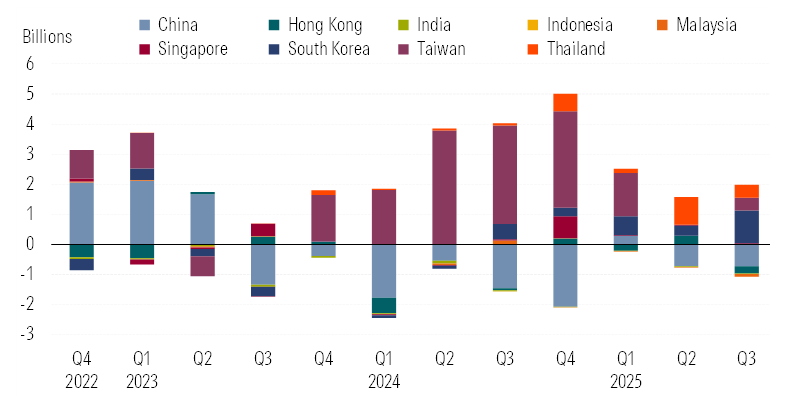

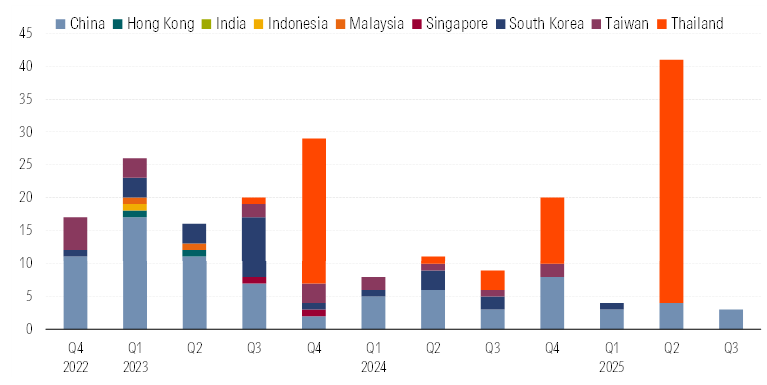

Excluding China, the Asia ex-Japan region experienced USD 1.6 billion in net inflows during the third quarter of 2025, a similar amount to the previous quarter but less than half the level seen in the third quarter of 2024. Inflows were concentrated in South Korea, Thailand, and Taiwan.

South Korea-domiciled sustainable funds saw inflows of USD 1.1 billion. The country’s largest sustainable fund, KIM Credit Focus ESG Feeder Bond 1, continues to dominate inflows, attracting a staggering total of USD 2.0 billion in new subscriptions since the start of 2025.

Meanwhile, Thailand attracted USD 426 million over the third quarter, partly due to ongoing government support, such as special tax deductions for local investors in sustainability-focused funds. For example, the country’s largest sustainable fund, K ESG Sovereign Instruments Fund-ThaiESG, recorded its largest quarterly inflow (USD 187 million) since its July 2024 launch during third quarter 2025.

Source: Morningstar Direct. Data as of September 2025.

Source: Morningstar Direct. Data as of September 2025.

In Taiwan, sustainable fund inflows were driven mainly by the market’s largest sustainable ETFs, including Capital ICE ESG 20+ Year BBB US Corporate ETF and Cathay Sustainability High Dividend ETF, with subscriptions of USD 374 million and USD 152 million, respectively. Additionally, Franklin Templeton SinoAm Taiwan ESG High Dividend ETF had a particularly strong quarter, with inflows of USD 139 million. This ETF tracks the ICE NYSE Taiwan ESG High Dividend Recovery Target Index, which includes dividend-paying companies with positive return on equity growth rates, while excluding securities with high ESG risks.

Source: Morningstar Direct. Data as of September 2025.

Source: Morningstar Direct. Data as of September 2025.

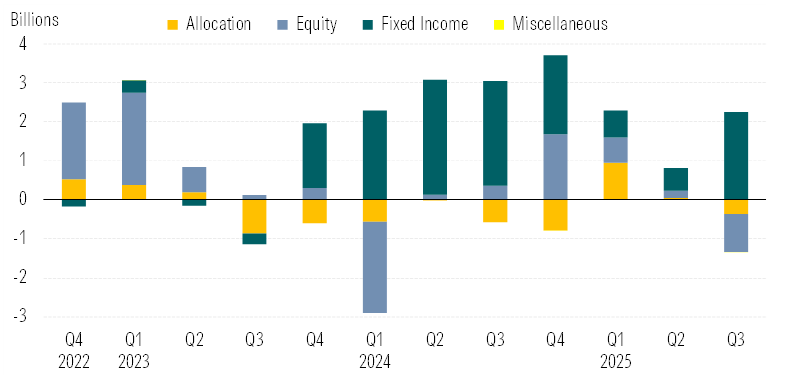

Sustainable fixed income funds continued to attract strong inflows of USD 2.3 billion in third quarter 2025 as investors sought resilient returns aligned with rising ESG standards. The consistent inflows into sustainable bond funds have also reflected supportive policy regimes for these types of products, such as in Thailand, and robust and growing issuance in the region.

Source: Morningstar Direct. Data as of September 2025.

Source: Morningstar Direct. Data as of September 2025.

Assets

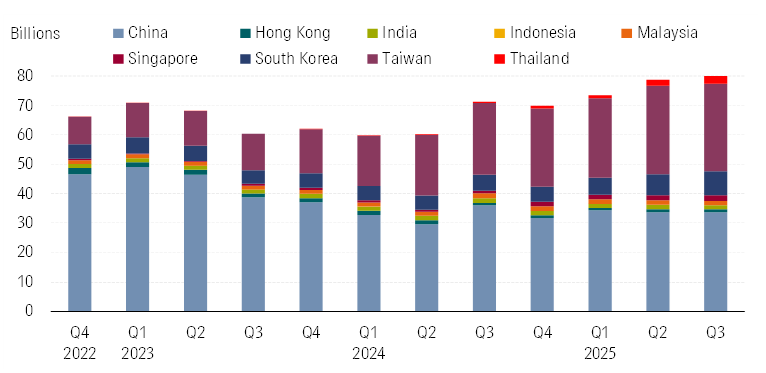

Total sustainable fund assets in Asia ex-Japan (including China) rose modestly by 2% during the third quarter of 2025, reaching USD 80 billion. China remained the largest fund market in the region, holding a 42% share, followed by Taiwan at 37% and South Korea at 10%. South Korea’s market share increased by more than 1% over the quarter, supported by both inflows and strong equity market performance. For context, the Morningstar Korea Target Market Exposure Index gained 13% over the period.

Source: Morningstar Direct. Data as of September 2025.

Source: Morningstar Direct. Data as of September 2025.

By asset class, sustainable fixed income funds continued to gain ground, with assets increasing by 8% during the quarter. Asia ex-Japan sustainable fixed income fund assets have grown nearly fivefold since the third quarter of 2023, while equity fund assets have only increased by about 10% over the same period.

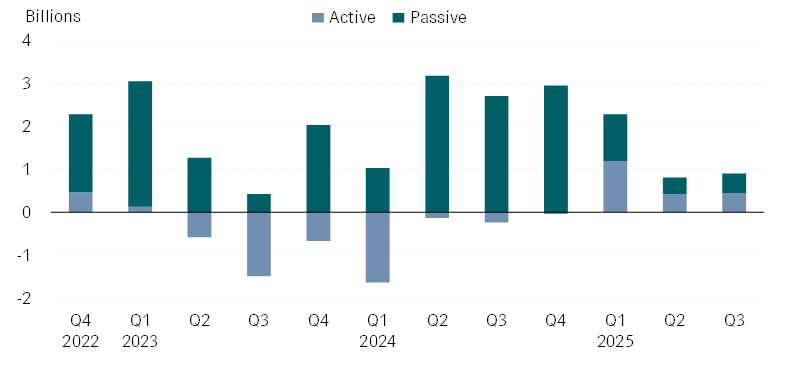

Passive Asia ex-Japan sustainable fund assets stagnated in the third quarter of 2025, while active fund assets posted moderate growth. Year-to-date through September 2025, active sustainable funds slightly regained market share from passive funds, with their share of total Asia ex-Japan sustainable fund assets rising from 42% at the end of 2024 to 44% as of third quarter 2025.

Launches

Following a record quarter for sustainable fund launches, only three sustainable funds were launched in the Asia ex-Japan region in the third quarter of 2025, the lowest number since we started collecting this data in 2021. All three launches were China-domiciled passive offerings. Two were open-ended fixed income funds tracking ChinaBond indices – BlackRock ChinaBond Preferred Green Bond Index Fund (with a custom benchmark of 95% ChinaBond-Investment Preferred Green Bond Index and 5% fixed deposit rate) and China Resources Yuanta ChinaBond Green Inclusive Theme Financial Bond Preferred Index Fund (with a custom benchmark of 95% ChinaBond Green Inclusive Theme Financial Bond Preferred Index and 5% fixed deposit rate).

The remaining launch was E Fund SSE STAR Market New Energy ETF, which tracks an index comprised of the 50 largest new energy stocks listed on the STAR Market, including those involved in new energy power generation and new energy vehicles.

Source: Morningstar Direct. Data as of September 2025.

Source: Morningstar Direct. Data as of September 2025.

Regulatory Update

In the third quarter of 2025, regulatory and governmental bodies advanced ESG-related initiatives relevant to asset managers in the Asia ex-Japan region.

In July, South Korea’s Financial Services Commission expanded the universe of firms required to disclose corporate governance information from 541 companies with assets greater than KRW 500 billion (USD 352 million) to all 842 constituents of the KOSPI starting in 2026. In the same month, a lawmaker proposed a bill to increase disclosure requirements for private equity funds, including quarterly asset management reports. These proposals are part of a broader effort to improve corporate governance standards and bolster international investor confidence.

In August, China’s State Administration of Foreign Exchange launched a new pilot program to encourage green foreign debt financing, allowing non-financial firms to raise overseas funds for investment in qualified green and low-carbon projects. In September, President Xi Jinping announced climate pledges that include cutting emissions by 7–10% by 2035, and expanding wind and solar power capacity to more than six times 2020 levels. These commitments may drive further sustainability-related regulatory initiatives in China in the years ahead.

For the full report, please visit: Global Sustainable Fund Flows: Q3 2025 in Review

The author or authors do not own shares in any securities mentioned in this article. Find out about

Morningstar’s editorial policies.

AloJapan.com