Okinawa Cellular Telephone (TSE:9436) posted annual EPS growth of 9.6%, outpacing its five-year average of 3.8% per year. Net profit margins rose to 15%, up from 14.4% last year, while revenue growth is forecast at 3% per year, which is slightly behind the broader Japanese market’s projected 4.4%. Earnings are expected to grow at a modest 2.4% per year, trailing the Japanese market’s anticipated 8% pace. The company remains attractive with high-quality earnings, improving margins, a favorable price-to-earnings ratio, and no material risks flagged in recent filings.

See our full analysis for Okinawa Cellular Telephone.

The next step is seeing how Okinawa Cellular’s latest numbers stand up against the prevailing narratives. It is always telling to see which stories get confirmed and which might need an update.

Curious how numbers become stories that shape markets? Explore Community Narratives

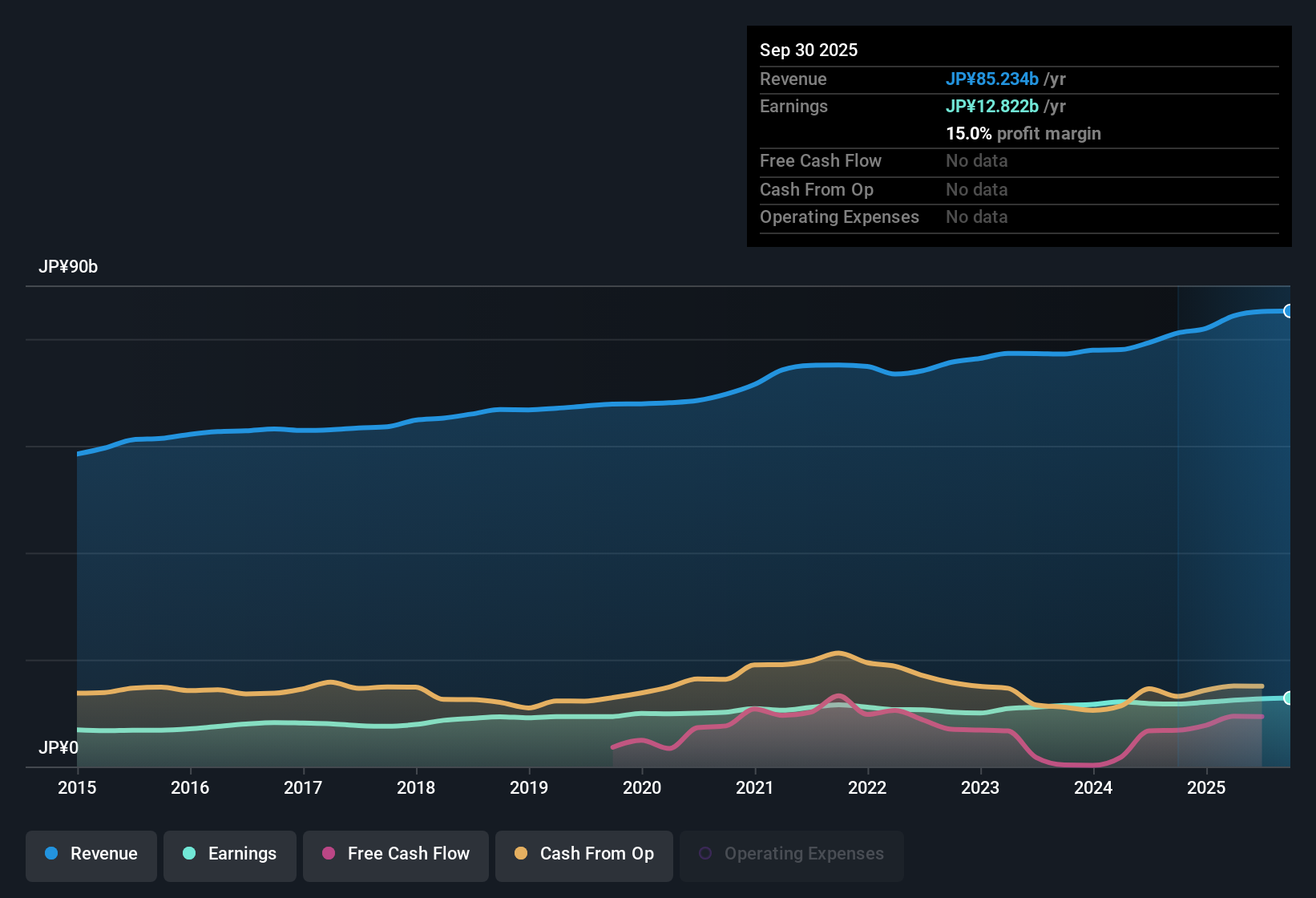

TSE:9436 Earnings & Revenue History as at Oct 2025 Net Profit Margins Edge Higher Net profit margins improved to 15%, rising from 14.4% last year and signaling a gradual move toward greater efficiency. Revenue growth remains modest compared to market peers. High-quality earnings heavily support the bullish case that Okinawa Cellular has become more resilient, supported by its stable profitability and margin improvements.

TSE:9436 Earnings & Revenue History as at Oct 2025 Net Profit Margins Edge Higher Net profit margins improved to 15%, rising from 14.4% last year and signaling a gradual move toward greater efficiency. Revenue growth remains modest compared to market peers. High-quality earnings heavily support the bullish case that Okinawa Cellular has become more resilient, supported by its stable profitability and margin improvements.

Accelerating margins attract investors looking for dependable telecom plays, particularly in regions where growth outpaces the industry average. The company’s consistent margin lift also reinforces confidence in Okinawa Cellular’s ability to maintain dividends if revenue momentum slows further. Modest Growth Guidance Trails Market Earnings are forecast to expand at just 2.4% per year, noticeably below the anticipated 8% pace for the wider Japanese market. This puts Okinawa Cellular’s growth prospects in a more cautious light. Despite management’s steady hand, the main question for cautious investors remains whether subdued future forecasts diminish the appeal of otherwise improving profitability.

Guidance lags broader sector trends, which could limit upward revaluation for the share price if market optimism shifts toward faster-growing competitors. Weighed against the company’s recent margin improvement, this forecast emphasizes the importance of considering present financial stability alongside slower long-term expansion. Valuation Remains Attractive Versus Peers Okinawa Cellular is trading below its estimated DCF fair value at ¥2,653, which is well beneath the ¥3,395.05 DCF fair value figure. This offers investors a visible discount relative to high-quality earnings and a sector with moderate growth expectations. Prevailing market analysis underscores that valuation attractiveness, combined with solid historical profit growth and no flagged risks, reinforces the stock’s appeal as a defensive pick even as market-wide earnings expectations rise.

Trading at a discount to both sector averages and DCF fair value, the stock could attract renewed investor attention if fundamentals remain strong. With no material risks currently identified, Okinawa Cellular’s current price provides a layer of downside protection and helps explain persistent value investor interest. Next Steps

Don’t just look at this quarter; the real story is in the long-term trend. We’ve done an in-depth analysis on Okinawa Cellular Telephone’s growth and its valuation to see if today’s price is a bargain. Add the company to your watchlist or portfolio now so you don’t miss the next big move.

See What Else Is Out There

While Okinawa Cellular’s improving margins and defensive profile are notable, its lackluster earnings growth and below-market forecasts suggest limited long-term upside.

If you’re looking for companies projected to deliver stronger profit expansion ahead, check out high growth potential stocks screener (59 results) to compare opportunities with brighter growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com