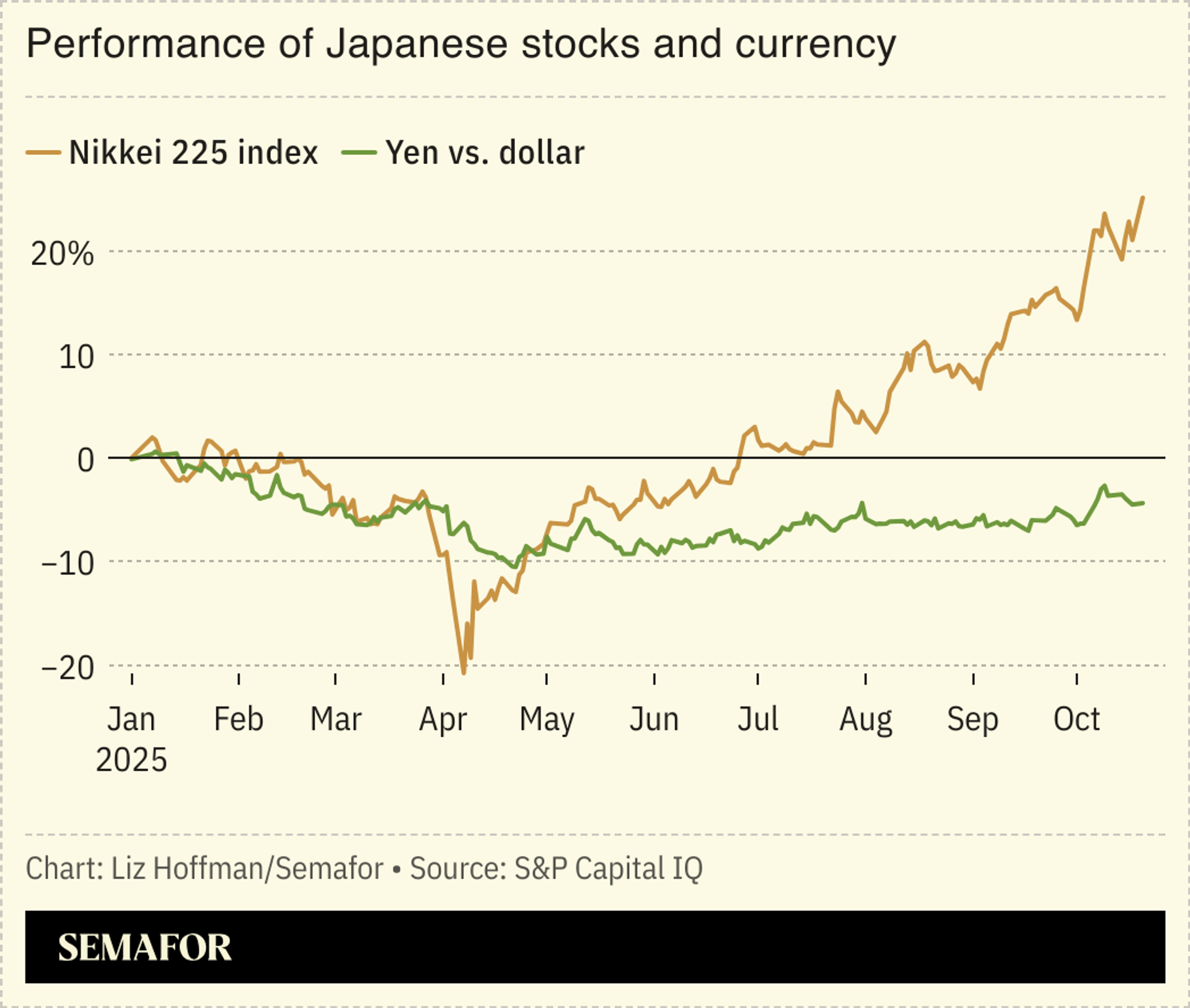

Japanese stocks climbed on Tuesday after lawmakers elected a new prime minister, with foreign investors betting on Sanae Takaichi’s reflationist ambitions.

A hardline conservative, Takaichi is expected to push for higher spending, tax cuts, and lower interest rates, in line with the philosophy of her mentor, the late Shinzo Abe.

Foreign investors now see Japan as a way to diversify from Europe and the US, overcoming “the ‘lost decades’ of Japanese stocks,” one analyst said. While markets are cheering “Sanaenomics,” political realities could hinder Takaichi’s spending agenda: Her coalition with a party that favors a smaller government could mean more targeted industry-focused spending, instead of a massive stimulus, ING analysts wrote.

AloJapan.com