Tokyo Steel Manufacturing (TSE:5423) posted a net profit margin of 6%, down from 7.2% a year earlier, as the company reported negative earnings growth in the most recent year following a strong five-year stretch averaging 13.3% annual growth. Looking ahead, earnings are forecast to decline by 5.4% per year over the next three years while revenue growth is projected at just 0.2% annually, trailing the broader Japanese market’s 4.4%. Despite this margin pressure and cooling growth expectations, investors may note that the stock is trading below both fair value estimates and analyst price targets, with a Price-to-Earnings ratio that remains favorable versus its peers.

See our full analysis for Tokyo Steel Manufacturing.

Next, we will see how these figures measure up against the current narratives shaping Tokyo Steel’s outlook. This offers a clearer picture of what the numbers might mean for investors.

Curious how numbers become stories that shape markets? Explore Community Narratives

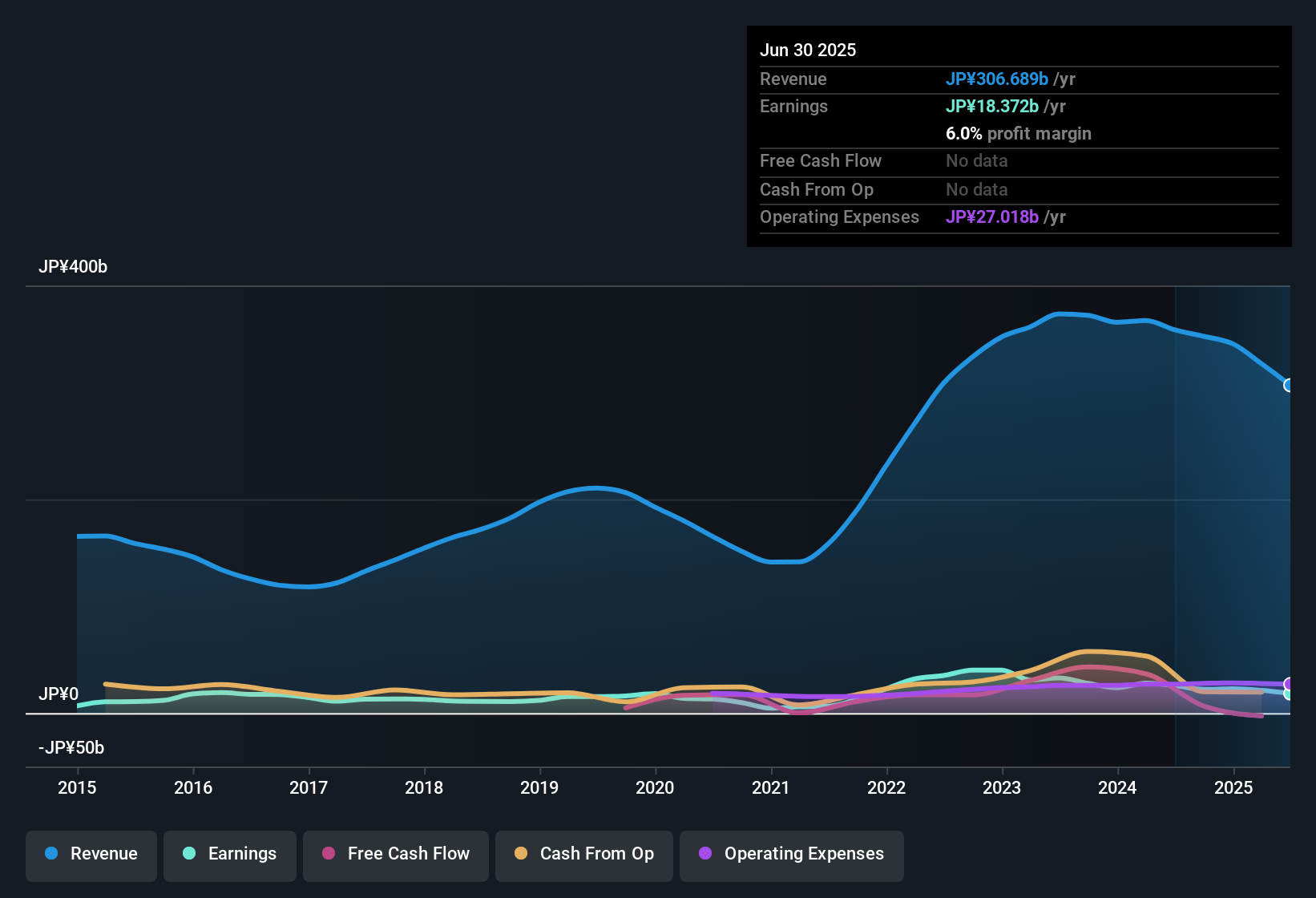

TSE:5423 Earnings & Revenue History as at Oct 2025 Profit Margin Compression Widens Gap with Peers Net profit margin slid to 6% from 7.2% last year, at a time when broader Japanese market revenue is projected to grow 4.4% annually. This far outpaces Tokyo Steel’s 0.2% pace over the same horizon. Recent results highlight a key challenge for management, as declining profitability is flagged as a concern in the prevailing market view, with:

TSE:5423 Earnings & Revenue History as at Oct 2025 Profit Margin Compression Widens Gap with Peers Net profit margin slid to 6% from 7.2% last year, at a time when broader Japanese market revenue is projected to grow 4.4% annually. This far outpaces Tokyo Steel’s 0.2% pace over the same horizon. Recent results highlight a key challenge for management, as declining profitability is flagged as a concern in the prevailing market view, with:

Profit compression emphasized as a headwind for near-term sentiment, since shrinking margins leave less room for error if costs rise or demand weakens further. Despite this, market watchers note the five-year earnings growth trend of 13.3% per year, which still provides a credible longer-term track record versus peers exposed to similar sector cycles. Growth Outlook Trails Sector Momentum Earnings are forecast to decline by 5.4% annually over the next three years, while revenue growth is projected at just 0.2% per year. This is well below sector averages and the Japanese market’s 4.4% benchmark. Bears argue this muted outlook sets up a tough narrative for recovery, as:

The lack of top-line expansion and negative profit trajectory directly challenge hopes for a cyclical upswing, putting the onus on efficiency or cost actions to support future results. What is surprising is that although sector peers are forecast for more robust growth, such divergence has not yet led to a wider valuation gap or loss of analyst backing at the current share price. Valuation Draws Interest Despite Headwinds Tokyo Steel shares trade at 1,359.00 yen, a discount both to the 1,686.67 yen analyst target and DCF fair value of 1,870.09 yen. The company maintains a Price-to-Earnings ratio below sector and peer averages. This undervaluation heavily supports interest even as the prevailing market view warns about weaker growth potential, since:

Investors may be drawn in by a wide margin between share price and valuation metrics, which could provide a buffer if industry trends recover or cost controls take hold. Still, confidence hinges on whether the company can offset lackluster revenue gains with improved operational leverage or sector tailwinds, which are not yet visible in current forecasts. Next Steps

Don’t just look at this quarter; the real story is in the long-term trend. We’ve done an in-depth analysis on Tokyo Steel Manufacturing’s growth and its valuation to see if today’s price is a bargain. Add the company to your watchlist or portfolio now so you don’t miss the next big move.

See What Else Is Out There

Tokyo Steel is facing profit margin compression, sluggish revenue growth, and forecasts that trail both its sector and the broader Japanese market.

If you want to focus on companies delivering stable expansion instead, check out stable growth stocks screener (2084 results) for consistent performers with a track record of reliable growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Tokyo Steel Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com