Foreign investors extended their heavy buying of Japanese stocks for a second consecutive week, as optimism grew that Liberal Democratic Party (LDP) leader Sanae Takaichi could become Japan’s next prime minister a move expected to usher in fiscally loose, pro-growth policies.

According to Japan’s Ministry of Finance, overseas investors poured a net 1.89 trillion yen ($12.59 billion) into Japanese equities in the week ending October 11. This follows a record 2.48 trillion yen in net purchases the previous week, highlighting renewed confidence in Japan’s markets.

Takaichi, a long-time LDP figure known for her dovish fiscal stance, had appeared poised to become Japan’s first female prime minister after winning the party leadership race. Her prospects brightened this week after the Japan Innovation Party emerged as a potential coalition partner, following the Komeito party’s exit from its 26-year alliance with the LDP.

Market Reaction:

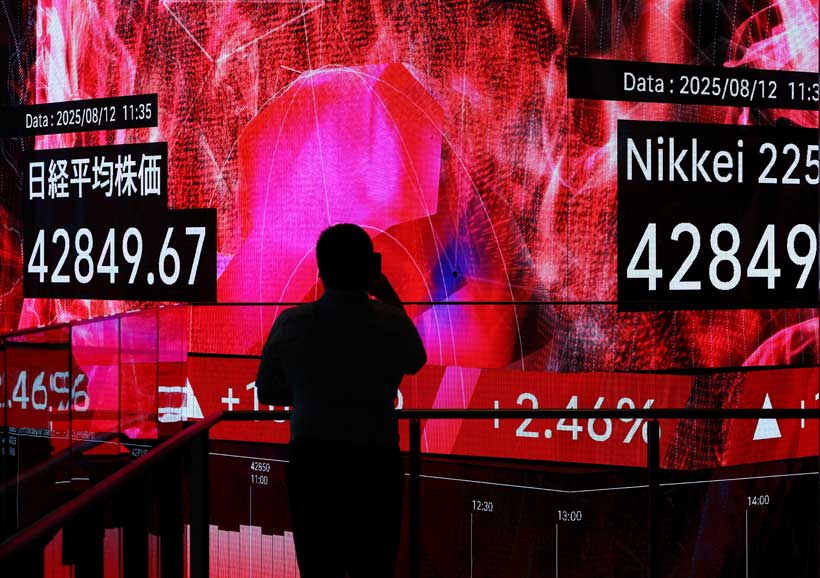

The Nikkei 225 (.N225) and Topix (.TOPX) indexes have slipped about 0.8% this week, giving back part of last week’s 5.07% and 2.19% gains respectively as investors reassess political dynamics.

Bond and Capital Flows:

Foreign investors also snapped up 199.4 billion yen in long-term Japanese bonds for a second week in a row and 1.52 trillion yen in short-term bills, marking the largest weekly bond inflow since July 19.

Japanese investors, meanwhile, reversed their selling streak buying 59.3 billion yen in foreign stocks, along with 596.4 billion yen in long-term foreign bonds and 77.6 billion yen in short-term bills.

Why It Matters:

Takaichi’s potential leadership is seen as market-friendly, with expectations of continued fiscal stimulus and looser monetary coordination. Sustained foreign inflows reflect renewed confidence in Japan’s economic outlook provided political uncertainty stabilizes.

Future Outlook:

Analysts say foreign inflows could remain strong if Takaichi formally secures the premiership next week and signals continuity in pro-growth policies. However, market sentiment may fluctuate depending on coalition negotiations and global risk trends, including U.S. interest rate movements and China’s economic slowdown. Sustained political stability will be key to keeping investor confidence intact.

With information from Reuters.

AloJapan.com