Aflac Incorporated recently participated in ITC Vegas 2025 at Mandalay Bay, where VP Matt Keane discussed enterprise data, AI, and platform innovation initiatives. A key driver behind Aflac’s strong recent performance has been the successful rollout of its new cancer insurance product, Miraito, in the Japanese market. We’ll examine how Miraito’s impressive sales momentum in Japan could shape Aflac’s investment narrative and future growth outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Aflac Investment Narrative Recap

To be a shareholder of Aflac today, you need confidence in the company’s ability to leverage innovation and product rollout success, such as the Miraito cancer product in Japan, despite headwinds like declining net premiums and rising costs in its largest market. The ITC Vegas 2025 presentation showcased Aflac’s focus on data and AI, but this event does not materially change the central catalyst: sustained growth in Miraito’s Japanese sales, nor does it offset the immediate risk from ongoing premium contraction and margin pressures.

Aflac’s ongoing share buyback is perhaps the most relevant recent announcement, reflecting continued efforts to return capital to shareholders while navigating profitability challenges in Japan. This approach fits into the narrative that, while digital initiatives and product innovation are promising for the future, near-term results will still be shaped by performance in the Japanese supplemental insurance market.

However, investors should also be aware of ongoing yen weakness and economic volatility in Japan, as these factors can…

Read the full narrative on Aflac (it’s free!)

Aflac’s narrative projects $18.5 billion in revenue and $3.8 billion in earnings by 2028. This requires 5.1% yearly revenue growth and a $1.4 billion increase in earnings from the current $2.4 billion.

Uncover how Aflac’s forecasts yield a $108.31 fair value, in line with its current price.

Exploring Other Perspectives AFL Community Fair Values as at Oct 2025

AFL Community Fair Values as at Oct 2025

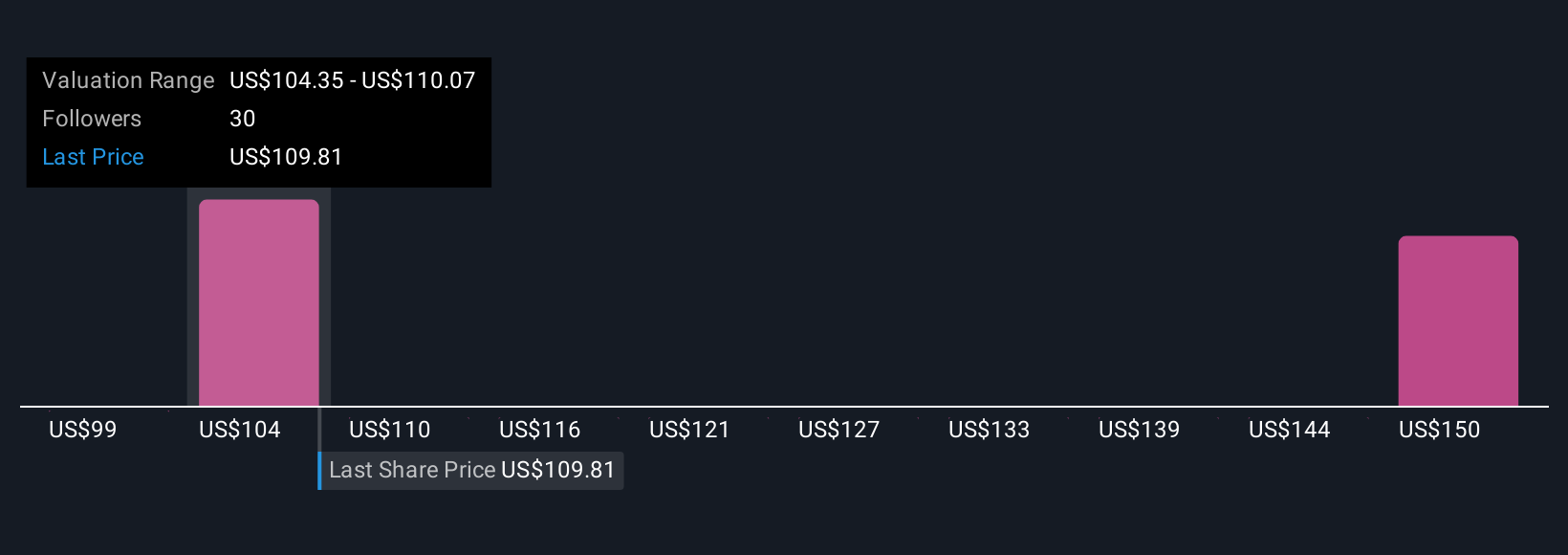

Fair value estimates for Aflac from the Simply Wall St Community span a wide range, from US$98.64 to US$155.79, across three independent analyses. With contracting net premiums in Japan still the main risk, you will see just how sharply these opinions can differ.

Explore 3 other fair value estimates on Aflac – why the stock might be worth 10% less than the current price!

Build Your Own Aflac Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com