This article first appeared on GuruFocus.

T. Rowe Price Japan Fund (Trades, Portfolio) recently submitted its N-PORT filing for the third quarter of 2025, shedding light on its strategic investment decisions during this period. The T. Rowe Price Japan Fund (Trades, Portfolio) is known for its focus on Japanese companies, investing at least 80% of its net assets in a diverse range of industries within Japan. The fund’s strategy is to identify companies with the potential for above-average, long-term earnings growth, employing a growth-oriented investment style. The fund’s approach is supported by a global team of investment analysts dedicated to conducting in-depth fundamental research. T. Rowe Price aims to acquire stocks of companies with promising earnings, cash flow, or book value at reasonable prices.

T. Rowe Price Japan Fund Exits Tokio Marine Holdings Inc, Impacting Portfolio by -3.51%

T. Rowe Price Japan Fund (Trades, Portfolio) added a total of seven stocks to its portfolio, with the most significant addition being MS&AD Insurance Group Holdings Inc (TSE:8725). The fund acquired 310,400 shares, which now account for 2.35% of the portfolio, with a total value of 7,053,540 million. The second largest addition was Sumitomo Corp (TSE:8053), consisting of 219,000 shares, representing approximately 2.12% of the portfolio, with a total value of 6,358,620 million. The third largest addition was Tsuruha Holdings Inc (TSE:3391), with 195,500 shares, accounting for 1.05% of the portfolio and a total value of 3,134,010 million.

T. Rowe Price Japan Fund (Trades, Portfolio) also increased its stakes in a total of ten stocks. The most notable increase was in Nippon Steel Corp (TSE:5401), with an additional 373,500 shares, bringing the total to 1,181,000 shares. This adjustment represents a significant 46.25% increase in share count, impacting the portfolio by 0.52%, with a total value of 4,874,020 million. The second largest increase was in Relo Group Inc (TSE:8876), with an additional 124,100 shares, bringing the total to 214,800. This adjustment represents a significant 136.82% increase in share count, with a total value of 2,595,460 million.

T. Rowe Price Japan Fund (Trades, Portfolio) completely exited seven holdings in the third quarter of 2025. Notably, the fund sold all 236,500 shares of Tokio Marine Holdings Inc (TSE:8766), resulting in a -3.51% impact on the portfolio. Additionally, the fund liquidated all 447,500 shares of Inpex Corp (TSE:1605), causing a -2.2% impact on the portfolio.

T. Rowe Price Japan Fund (Trades, Portfolio) also reduced its position in eight stocks. The most significant changes include a reduction in Sony Group Corp (TSE:6758) by 108,000 shares, resulting in a -16.29% decrease in shares and a -0.98% impact on the portfolio. The stock traded at an average price of 3,810.27 during the quarter and has returned 27.14% over the past three months and 34.94% year-to-date. Additionally, the fund reduced its position in Seven & i Holdings Co Ltd (TSE:3382) by 107,100 shares, resulting in a -17.04% reduction in shares and a -0.6% impact on the portfolio. The stock traded at an average price of 2,030.8 during the quarter and has returned -8.89% over the past three months and -18.78% year-to-date.

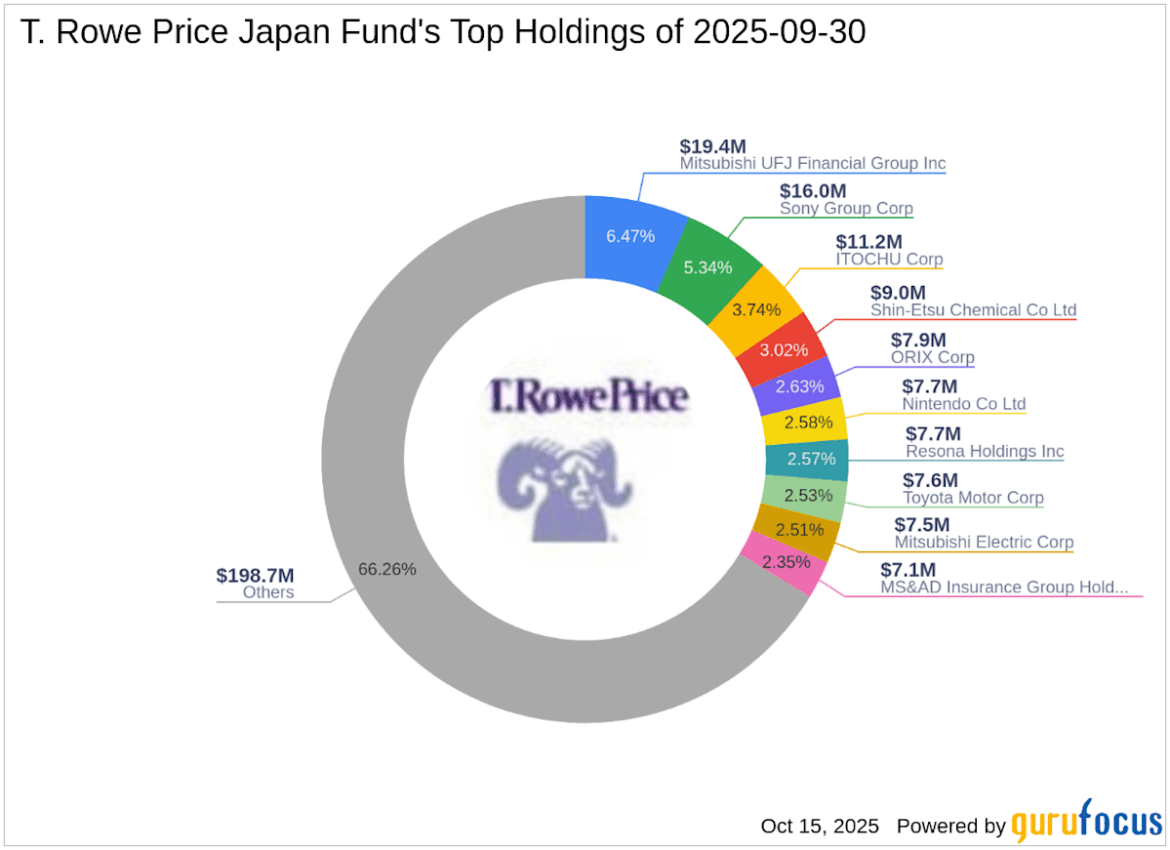

As of the third quarter of 2025, T. Rowe Price Japan Fund (Trades, Portfolio)’s portfolio included 76 stocks. The top holdings included 6.47% in Mitsubishi UFJ Financial Group Inc (TSE:8306), 5.34% in Sony Group Corp (TSE:6758), 3.74% in ITOCHU Corp (TSE:8001), 3.02% in Shin-Etsu Chemical Co Ltd (TSE:4063), and 2.63% in ORIX Corp (TSE:8591).

T. Rowe Price Japan Fund Exits Tokio Marine Holdings Inc, Impacting Portfolio by -3.51%

The holdings are mainly concentrated in ten of the eleven industries: Industrials, Financial Services, Consumer Cyclical, Technology, Basic Materials, Healthcare, Communication Services, Consumer Defensive, Real Estate, and Energy.

T. Rowe Price Japan Fund Exits Tokio Marine Holdings Inc, Impacting Portfolio by -3.51%

AloJapan.com