Tokyo Electron (TSE:8035) shares moved after US lawmakers called for expanded export restrictions on advanced chipmaking tools to China, urging Japan and others to coordinate these measures. The potential for stricter regulations has put future sales and earnings under increased scrutiny.

See our latest analysis for Tokyo Electron.

Tokyo Electron’s share price has shown remarkable resilience, posting a 29.6% gain over the past month and delivering a 17.1% total shareholder return for the year. This performance comes despite ongoing policy risks and a recent downward revision to earnings guidance. While regulatory uncertainty is adding short-term volatility, momentum remains strong as investors continue to look beyond near-term challenges and focus on the company’s broader growth potential.

If market shifts around chipmakers have you curious about other tech leaders on the rise, now is a great time to explore the See the full list for free..

With the stock’s robust run despite policy headwinds, investors are now weighing whether Tokyo Electron still trades at an attractive valuation or if the recent surge means the market is already factoring in its long-term growth. The question is whether there is a real buying opportunity or if everything is already priced in.

Most Popular Narrative: 6.5% Overvalued

Tokyo Electron’s latest fair value estimate stands below the current share price, raising questions about whether the recent rally has pushed the stock into overvalued territory. The narrative’s assumptions about future chip demand and company margins set the stage for contentious debates on just how far the upside can go.

The imminent launch of next-generation AI servers by 2027, which will require much denser, more advanced chips (e.g., 3nm nodes, 2.5x transistor counts, 4x memory/HBM stack), is set to drive a significant and sustained increase in customer capital expenditures for advanced semiconductor equipment beginning in the second half of 2026. This development positions Tokyo Electron to benefit from renewed order growth and top-line acceleration.

Read the complete narrative.

This narrative hides a bold set of forecasts: one future catalyst, ambitious margin bets, and an industry P/E multiple that is anything but typical. Can Tokyo Electron truly live up to the optimism? Uncover the numbers behind the valuation and see what’s fueling these price targets.

Result: Fair Value of ¥27,499 (OVERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, prolonged customer investment delays or greater vulnerability to China-related export restrictions could quickly challenge even this bullish long-term outlook.

Find out about the key risks to this Tokyo Electron narrative.

Another View: Multiples Tell a Complicated Story

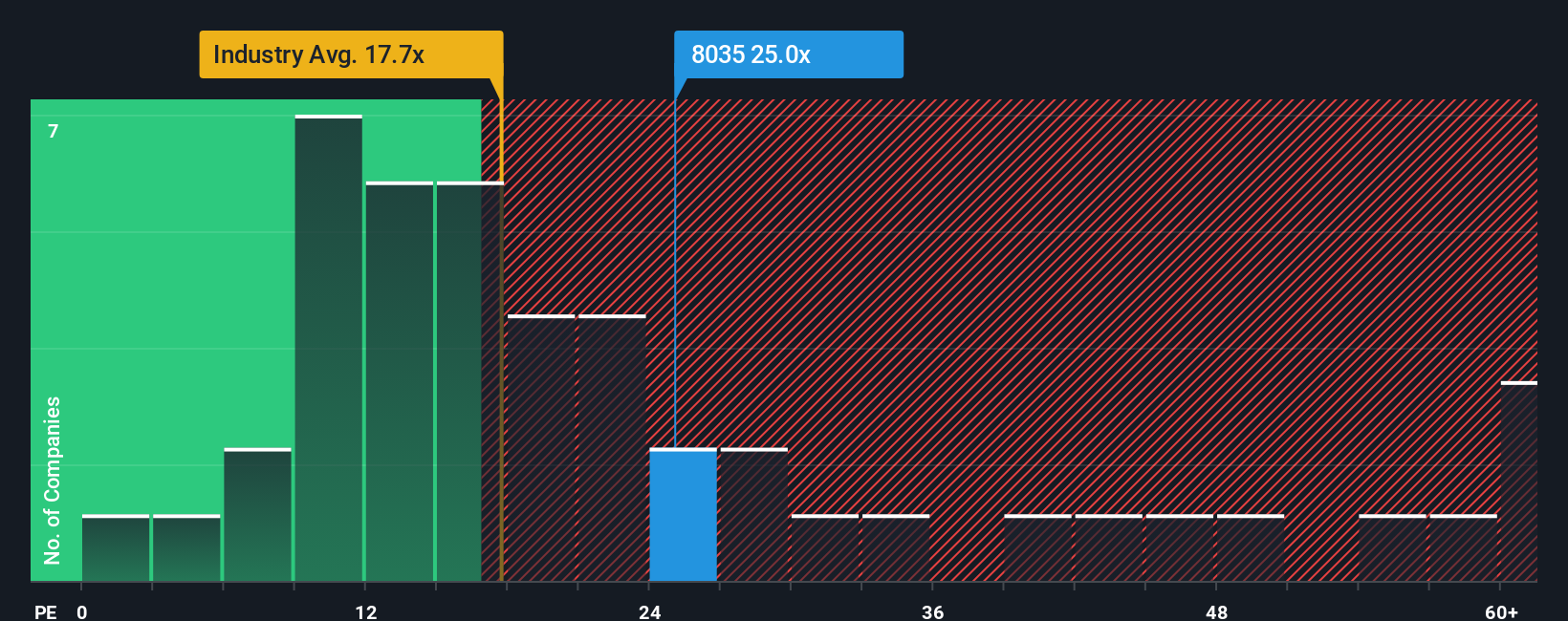

Looking at Tokyo Electron through the lens of its price-to-earnings ratio, the stock trades at 25x, which is more expensive than the Japanese semiconductor industry’s 17.7x average. However, it remains below what our fair ratio analysis suggests should be 27.4x. This means that while Tokyo Electron appears pricey relative to its peers, the market might still see further room for upside, or the risk could be growing if industry multiples fall back.

See what the numbers say about this price — find out in our valuation breakdown.

TSE:8035 PE Ratio as at Oct 2025 Build Your Own Tokyo Electron Narrative

TSE:8035 PE Ratio as at Oct 2025 Build Your Own Tokyo Electron Narrative

If you have a different take on Tokyo Electron’s story or want to dig into the details yourself, it has never been easier to analyze the numbers and shape your perspective in just a few minutes. Do it your way.

A great starting point for your Tokyo Electron research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep their eyes open for the next hidden gem. Don’t let new opportunities pass you by when there are fresh ideas worth your attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Tokyo Electron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com