Japan Hotel REIT Investment Corporation has announced an annual dividend of ¥4,830.00 per share, with payments scheduled for March 19, 2026, and an ex-date of December 29, 2025. This dividend increase reflects management’s confidence in the company’s operational outlook and could attract the attention of income-focused investors. With a heightened dividend payout signaling business strength, we’ll explore the broader implications for Japan Hotel REIT’s investment narrative.

Trump’s oil boom is here – pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Japan Hotel REIT Investment’s Investment Narrative?

For investors considering Japan Hotel REIT Investment Corporation, the big picture hinges on stable tourism, consistent hotel performance, and reliable dividend payouts. The recent announcement of a higher annual dividend aligns with earlier guidance, potentially adding momentum to short term catalysts like strong occupancy rates and improved RevPAR figures. This visible commitment from management could help reinforce confidence around business fundamentals and financial flexibility, especially given recent moves to secure long term refinancing and broaden funding through green loans. However, while the dividend news is positive, its market impact might be tempered by the already moderate earnings and revenue growth forecasts, coupled with concerns over low returns on equity and limited dividend history stability. Investors will want to pay close attention to ongoing risks such as relatively high debt levels, low operating cash coverage, and the company’s premium pricing compared to industry peers.

Yet, beyond potential rewards, the large refinancing requirements remain a concern investors should keep in mind.

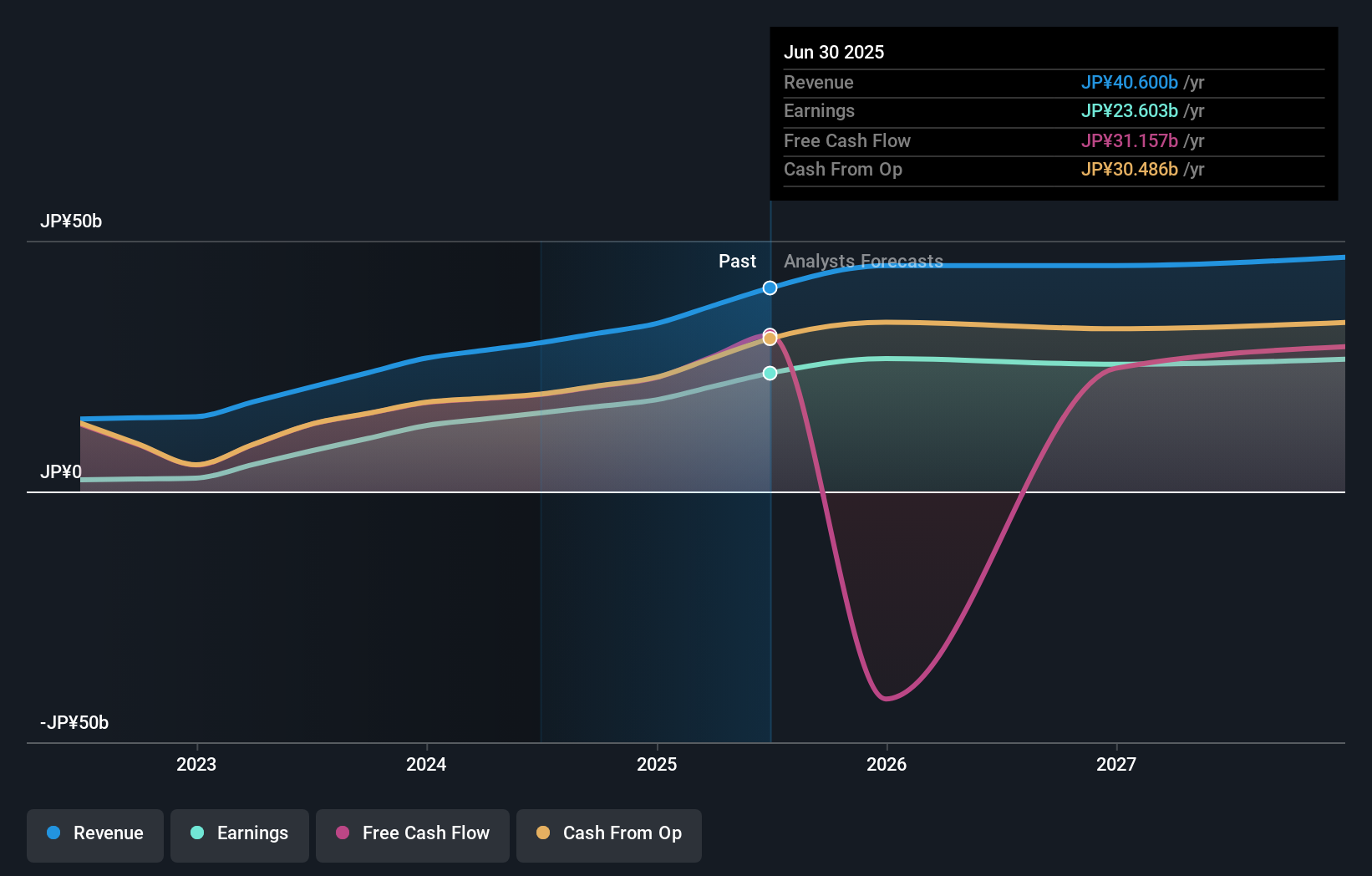

Japan Hotel REIT Investment’s share price has been on the slide but might be dropping deeper into value territory. Find out whether it’s a bargain at this price.Exploring Other Perspectives TSE:8985 Earnings & Revenue Growth as at Oct 2025 Japan Hotel REIT’s fair value estimates from the Simply Wall St Community range from ¥76,000 to ¥95,560 across two views, showing how much retail investor sentiment can differ. With current refinancing challenges at play, it is worth considering how wider market risks could influence future value. Explore several opinions to weigh the outlook for yourself.

TSE:8985 Earnings & Revenue Growth as at Oct 2025 Japan Hotel REIT’s fair value estimates from the Simply Wall St Community range from ¥76,000 to ¥95,560 across two views, showing how much retail investor sentiment can differ. With current refinancing challenges at play, it is worth considering how wider market risks could influence future value. Explore several opinions to weigh the outlook for yourself.

Explore 2 other fair value estimates on Japan Hotel REIT Investment – why the stock might be worth 14% less than the current price!

Build Your Own Japan Hotel REIT Investment Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com