Yen recovered modestly in Asian session as Tokyo officials reissued verbal warnings against excessive moves in the currency market. After the week’s accelerated selling following Sanae Takaichi’s election as LDP leader, the latest remarks from Finance Minister Katsunobu Kato suggest Japan may be nearing an intervention threshold, at least rhetorically. For now, traders appear to be scaling back short positions, hinting that Yen’s near-term selling climax could be behind it.

Kato said authorities were closely watching “one-sided, rapid moves on the foreign exchange market,” reiterating that exchange rates should reflect economic fundamentals and move in an orderly manner. “The government will thoroughly monitor for excessive fluctuations and disorderly movements,” he emphasized. Still, he struck a balanced note on the impact of the weaker Yen, acknowledging that “the extent and nature of these effects vary depending on the domestic and global environment”, suggesting that actual intervention is not imminent.

Former BoJ board member Atsushi Takeuchi also weighed in, telling Reuters that authorities would likely tolerate gradual declines but intervene if speculation about the Yen sliding to 160–170 per Dollar gains traction. “If the Yen falls that much, authorities could and must step in,” he said. While intervention “can’t change the broad market trend”, it can “put a pause to sharp Yen declines.”

Meanwhile, Prime Minister-designate Sanae Takaichi is trying to walk a fine line. On one hand, she said she does not want to trigger excessive depreciation. On the other, she stressed that the BoJ’s policy decisions must align with government priorities, hinting at a preference for demand-driven inflation and cautioning against premature rate hikes. That stance could delay further BoJ tightening and leave Yen vulnerable in a risk-on environment.

Elsewhere, attention turns to Canada’s employment report due later today, a key input for the BoC’s October 29 rate decision. The BoC resumed rate cuts in September after a soft patch in the labor market and cited export weakness—linked to U.S. tariff policy—as a major uncertainty. A steady employment reading could justify a pause, but another downbeat print—particularly in manufacturing and export-heavy sectors—could tilt the balance toward more easing. USD/CAD is now pressing key resistance level at 1.4, and the next move is decisive for the near-term trend.

In the broader currency markets, Dollar is currently the week’s strongest performer, followed by Loonie and Aussie. Yen still sits at the bottom, trailed by Euro and Swiss Franc, while Sterling and the Kiwi hover in the middle of the pack.

In Asia, at the time of writing, Nikkei is down -0.98%. Hong Kong HSI is down -1.14%. China Shanghai SSE is down -0.51%. Singapore Strait Times is down -0.08%. Japan 10-year JGB yield is up 0.02 at 1.699. Overnight, DOW fell -0.52%. S&P 500 fell -0.28%. NASDAQ fell -0.08%. 10-year yield rose 0.019 to 4.148.

Fed’s Barr sees need for caution, notes stronger spending and sticky inflation

Fed Governor Michael Barr said in a speech overnight that monetary policy remains “modestly restrictive”, and supported the decision to lower the federal funds rate by 25 bps at the September meeting. He said the move brought the stance “a bit closer toward neutral,” but emphasized that further adjustments should depend on new data and the evolving balance of risks.

Barr noted that since the September meeting, consumer spending has surprised to the upside, with data showing activity on a “notably stronger trajectory” than previously thought. That, he said, prompted most observers to revise up forecasts for GDP growth through the remainder of the year. Inflation, meanwhile, “moved up as expected,” with core PCE remaining well above the 2% target.

The Fed governor cautioned that “considerable uncertainty” continues to cloud the outlook. Slower payroll growth could be a “harbinger of worse to come,” he said, though it might also stabilize given the low unemployment rate and solid growth backdrop. On inflation, he warned that tariffs could have only a modest effect on prices—or, conversely, trigger renewed price pressures if expectations begin to rise.

Barr concluded that the FOMC should remain “cautious” about adjusting policy until more evidence clarifies the direction of the economy. “If we see inflation moving further away from our target, it may be necessary to keep policy at least modestly restrictive for longer,” he said. “If we see heightened risks in the labor market, we may need to move more quickly to ease policy.”

Fed’s Williams sees lower rates this year, tariff impact on inflation as limited

New York Fed President John Williams said in an interview with The New York Times that he still expects interest rates to be lower by year-end, but emphasized that the pace and extent of easing will depend on incoming data.

When asked about the possibility of two additional 25bps reductions, Williams said that would depend on whether inflation and employment evolve broadly in line with his outlook. He expects inflation to “move up a bit to around near 3%” and unemployment to edge slightly higher, in which case “policy should evolve the way we expect.”

But he warned against complacency, noting that it would be “very damaging to the economy and the Fed’s credibility” if inflation were allowed to rise well above 2% without action.

Williams downplayed fears that President Donald Trump’s tariffs were fueling persistent inflation. He estimated the measures have lifted the price level by only 0.25 to 0.5 percentage point, adding that “underlying inflation seems to be moving gradually lower toward 2%.” He also said there were no signs of second-round effects, suggesting tariffs are having limited spillovers on broader price dynamics.

At the same time, Williams pointed to rising downside risks to employment, which he said were offsetting some of the upside risk to inflation.

Japan producer prices hold at 2.7% as import declines ease in September

Japan’s corporate goods price index rose 2.7% yoy in September, unchanged from August and slightly above expectations of 2.5%. The data suggest that while upstream cost pressures remain contained, they have yet to fade meaningfully.

Yen-based import price index declined -0.8% yoy, a much smaller drop than August’s -3.9%, pointing to easing import deflation as Yen’s weakness and rising global input costs filter through.

In terms of components, food and beverage prices climbed 4.7% yoy, following a 4.9% in August. Agricultural goods prices, including rice, jumped 30.5%, moderating from August’s 41% surge.

RBA’s Bullock: Inflation back in band but services still sticky, jobs market tight

RBA Governor Michele Bullock told lawmakers today that the economy is in a “pretty good spot,” with inflation back within the 2–3% target band and the labor market still tight. Speaking before a parliamentary committee in Canberra, she said, “the key now is to make sure it stays there sustainably.”

She said that services inflation remains the main concern, running “a little sticky” at around 3%, even as goods inflation continues to moderate. That offset has kept headline inflation contained for now.

On employment, Bullock said the labor market is in “a pretty good place”, though “possibly a little bit tight” in certain sectors. The RBA expects unemployment to edge higher over the coming months, a move consistent with a gradual rebalancing.

She also highlighted that household consumption is picking up, filling the gap left by weaker public demand—an important transition, she said, to keep growth on track.

NZ BNZ manufacturing flat at 49.9, firms cite soft demand and rising costs

New Zealand’s BNZ Performance of Manufacturing Index held steady at 49.9 in September, marking another month of contraction and remaining below its long-term average of 52.4.

The data highlighted a mixed picture across key components — production edged up from 47.8 to 50.1, barely returning to expansion, while employment dropped from 49.1 to 47.5, weighing on the overall index. New orders also slipped from 54.7 to 50.3, suggesting softening demand momentum.

BusinessNZ Director of Advocacy Catherine Beard said it was encouraging that the PMI did not show deeper contraction, but the sector remained “agonizingly close to returning to expansion mode.” She added weakness in employment prevented the headline figure from crossing the 50 threshold.

Survey respondents continued to highlight muted customer demand and rising cost pressures, with 60% of comments negative, up from August. Manufacturers reported lower order volumes, tight margins, and competitive pricing pressures, reflecting both domestic uncertainty and subdued export demand.

GBP/JPY Daily Outlook

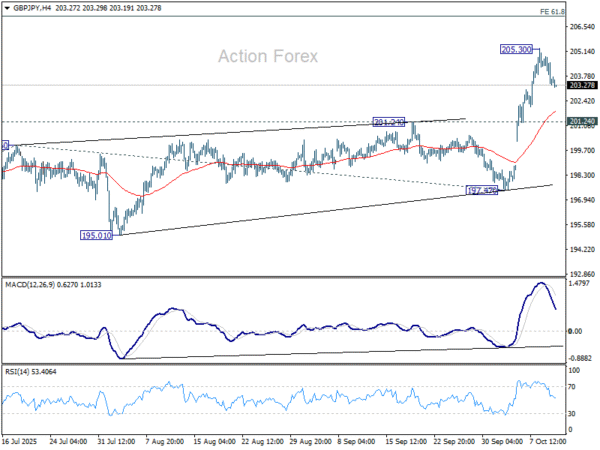

Daily Pivots: (S1) 203.03; (P) 203.96; (R1) 204.61; More…

A temporary top was formed at 205.30 with current retreat, and intraday bias in GBP/JPY is turned neutral for consolidations. Downside should b contained above 201.24 resistance turned support to bring another rally. On the upside, break of 205.30 will resume the rise from 197.47 to 61.8% projection of 184.35 to 199.96 from 197.47 at 207.11.

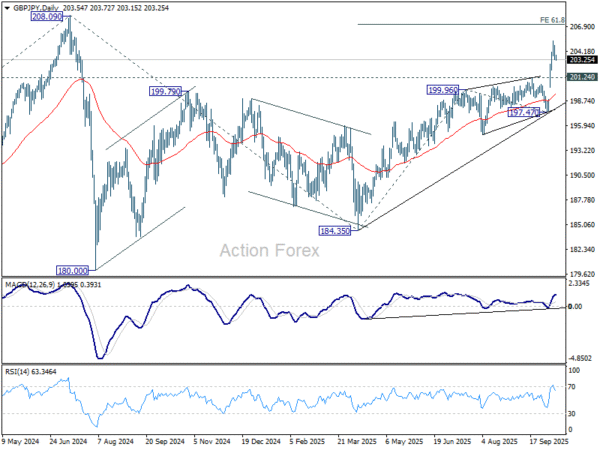

In the bigger picture, price actions from 208.09 (2024 high) are seen as a corrective pattern which might have completed at 184.35. Firm break of 208.09 high will resume the up trend from 123.94 (2020 low). Next target is 61.8% projection of 148.93 to 208.09 from 184.35 at 220.90. This will now remain the favored case long as 197.47 support holds.

Economic Indicators Update

GMT

CCY

EVENTS

ACT

F/C

PP

REV

21:30

NZD

Business NZ PMI Sep

49.9

49.9

23:50

JPY

Bank Lending Y/Y Sep

3.80%

3.70%

3.60%

3.50%

23:50

JPY

PPI Y/Y Sep

2.70%

2.50%

2.70%

12:30

CAD

Net Change in Employment Sep

2.8K

-65.5K

12:30

CAD

Unemployment Rate Sep

7.20%

7.10%

14:00

USD

UoM Consumer Sentiment Oct P

55

55.1

14:00

USD

UoM 1-Yr Inflation Expectations Oct P

4.70%

AloJapan.com