Following the recent election of Sanae Takaichi as leader of Japan’s ruling party, investors reacted positively to her reputation for pro-growth economic policies and anticipated fiscal stimulus measures. This leadership shift has focused attention on export-oriented and infrastructure-linked companies, highlighting the potential impact of continued monetary easing and increased government investment in sectors such as defense and technology. We’ll explore how expectations for higher government spending under Takaichi’s leadership could shape Japan Steel Works’ investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer’s.

What Is Japan Steel Works’ Investment Narrative?

If you want to be a shareholder of Japan Steel Works right now, you need to see a future in which government-led investment and loose monetary policy can offset premium valuations and justify elevated expectations for growth. The election of Sanae Takaichi and her expansionist economic stance could prove to be a significant short-term catalyst, especially for companies with strong links to defense, technology, or infrastructure, segments where Japan Steel Works already plays a role. With the recent surge in the Nikkei and the company’s share price, investor sentiment is clearly being driven by hopes of new stimulus and a supportive policy backdrop. Yet, the share price now trades well above most fair value estimates and the company remains expensive versus peers, adding to concerns about sustainability if anticipated spending or monetary support doesn’t arrive as hoped. The biggest risks now may be less about operational execution and more about shifts in policy momentum or rising expectations for profit and revenue growth that could be tough to meet if the macro environment changes. For now, the news has clearly sharpened both the catalysts and the debates around valuation and risk.

But expectations for continued stimulus could fade quickly if political momentum shifts, something investors should not overlook.

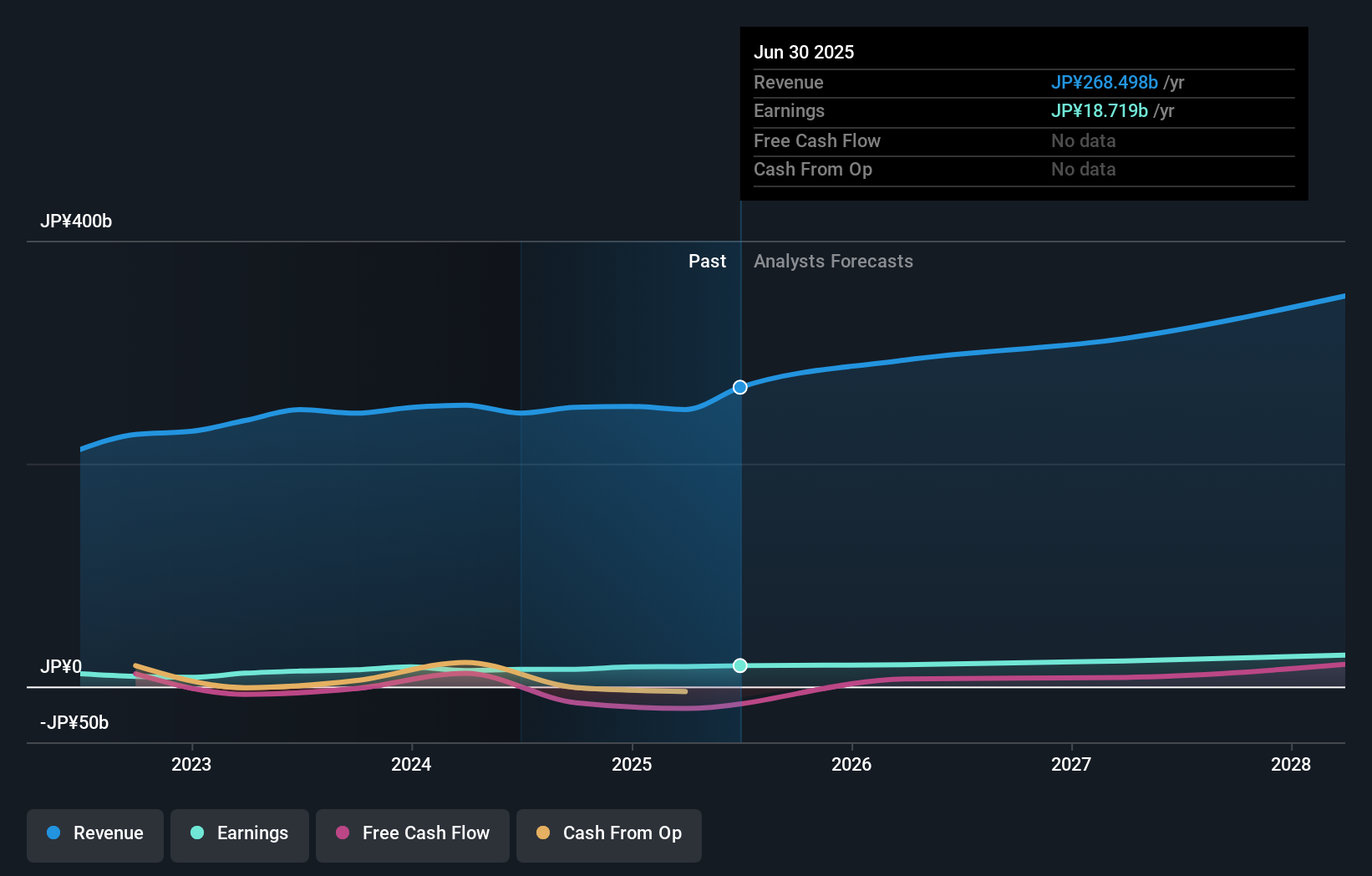

Japan Steel Works’ shares are on the way up, but they could be overextended by 35%. Uncover the fair value now.Exploring Other Perspectives TSE:5631 Earnings & Revenue Growth as at Oct 2025 Fair value estimates from a single Simply Wall St Community member cluster tightly around ¥7,556, but prevailing optimism after recent leadership changes may test those projections. Many market participants are weighing how policy could affect growth and risk, plenty of potential for diverging views on future performance. Explore other community perspectives for more insight into where fellow investors see value and risk.

TSE:5631 Earnings & Revenue Growth as at Oct 2025 Fair value estimates from a single Simply Wall St Community member cluster tightly around ¥7,556, but prevailing optimism after recent leadership changes may test those projections. Many market participants are weighing how policy could affect growth and risk, plenty of potential for diverging views on future performance. Explore other community perspectives for more insight into where fellow investors see value and risk.

Explore another fair value estimate on Japan Steel Works – why the stock might be worth 26% less than the current price!

Build Your Own Japan Steel Works Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don’t delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com