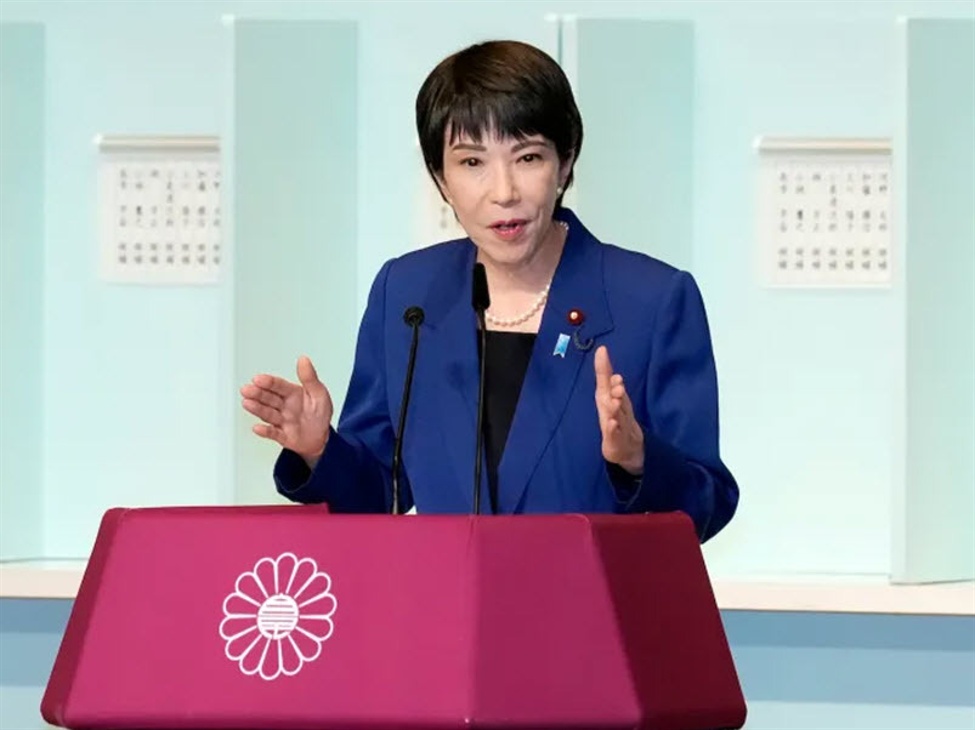

Deutsche Bank says Japan’s new political leadership under Sanae Takaichi is likely to usher in an era of aggressive fiscal stimulus, a stance the bank’s Japan economist Ken Koyama describes as fostering a “high-pressure economy.”

Koyama said Takaichi’s pro-growth agenda, marked by heavy spending, comes as Japan faces chronic labour shortages, sticky inflation, and a weakened yen, all of which could test the sustainability of further stimulus.

Deutsche Bank expects the Bank of Japan (BoJ) to delay its next rate hike

the first move now seen in January 2026followed by additional increases in July 2026 and January 2027taking the policy rate to 1.25%.

The shift in outlook reflects a sharp repricing in market expectations: before the weekend, traders saw a 58% chance of an October rate hike, down from 68% at end-September. That probability has since plunged to just 23% amid expectations of prolonged policy accommodation.

—

Deutsche Bank’s revised BoJ outlook underscores expectations of prolonged policy divergence with the U.S., likely keeping USD/JPY supported near 150. The mix of fiscal expansion and delayed tightening could reinforce yen weakness into early 2026, even as inflation remains above target.

AloJapan.com