Takichi Sanae, who supports stimulus policies, has won the leadership election of the Liberal Democratic Party and is expected to become Japan’s first female prime minister. This outcome has disrupted market expectations, potentially leading to a significant shift in the Bank of Japan’s monetary policy.

The yen opened with a gap lower on Monday, with USD/JPY reaching as high as 149.44, after Sanae Takaichi, a proponent of economic stimulus policies, emerged as the frontrunner to become Japan’s next prime minister following the Liberal Democratic Party (LDP) presidential election.

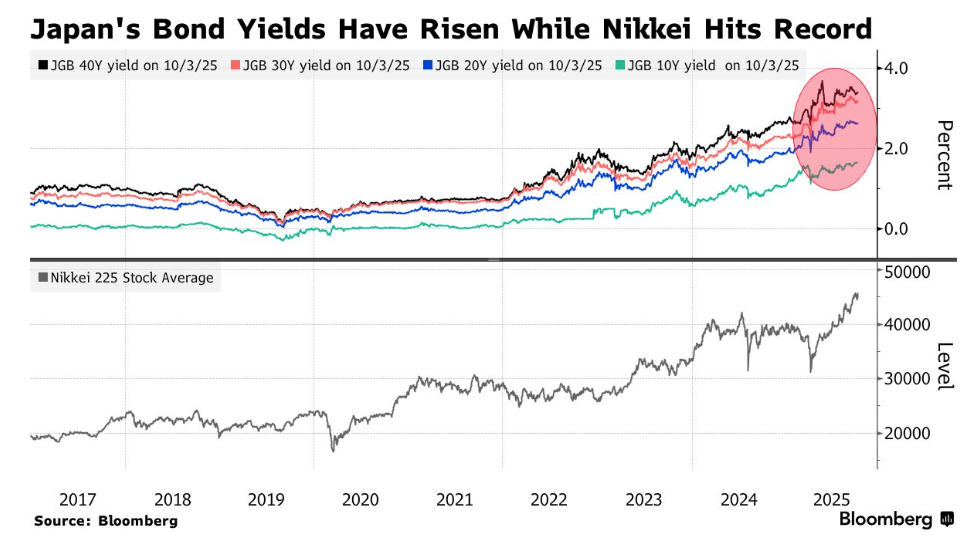

The reaction in the foreign exchange market was in line with strategists’ expectations. As an advocate of loose fiscal and monetary policies, Takaichi is believed to have triggered concerns about increased bond supply while reducing expectations for a Bank of Japan interest rate hike this month. As a result, strategists anticipated that Japan’s stock market and long-term government bond yields might rise at Monday’s opening, while the yen would weaken.

Richard Kaye, co-head of Japanese equity strategy at Comgest Asset Management, noted that domestically oriented stocks and small-cap equities may benefit from growth expectations, whereas bank stocks, which had previously gained due to expectations of a rate hike, could face headwinds.

Richard Kaye, co-head of Japanese equity strategy at Comgest Asset Management, noted that domestically oriented stocks and small-cap equities may benefit from growth expectations, whereas bank stocks, which had previously gained due to expectations of a rate hike, could face headwinds.

Anna Wu, multi-asset investment strategist at VanEck Australia, stated: “This could be more of a positive surprise for the stock market. Considering her overall fiscal policy, I wouldn’t be too surprised if Japanese long-term government bond yields rose slightly on Monday.” She also pointed out that Takaichi is unlikely to overstimulate the economy, which could limit market volatility.

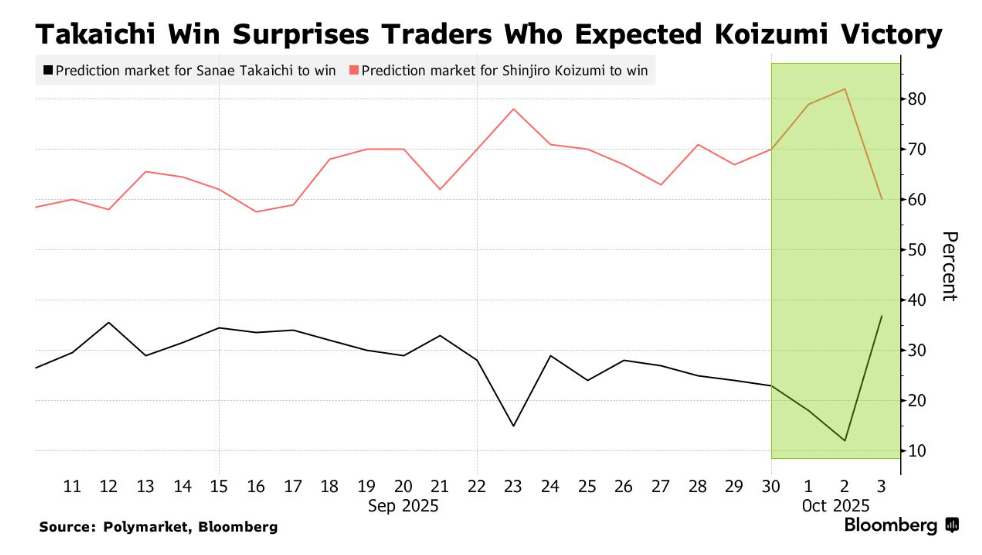

After winning the LDP leadership election on Saturday, Sanae Takaichi is poised to become Japan’s first female prime minister. Investors had previously expected Shinjiro Koizumi, a scion of a political family, to take the position; he is considered more fiscally cautious and likely to push the Bank of Japan toward policy normalization.

Takaichi’s Unexpected Victory Over Koizumi

Takaichi’s Unexpected Victory Over Koizumi

Even before Takaichi’s victory, bond investors were cautious about fiscal spending, and opposition parties had been calling for tax cuts.

Amid speculation about the Bank of Japan raising interest rates, Japan’s 10-year government bond yield has recently hovered near its highest level since 2008. This has driven the yen higher against the US dollar over the past week, while the Nikkei 225 index hit a fresh record high, buoyed by a global rally in technology stocks.

Pelham Smithers, Managing Director of Pelham Smithers Associates, a UK-based Japan equity research firm, stated: ‘The bond market wants to see that Sanae Takagi’s pro-growth strategy will not widen public sector deficits; otherwise, it could further trigger yen selling. However, yen bulls might argue that the Bank of Japan is more likely to offset fiscal stimulus with more aggressive monetary tightening.’

Sanae Takagi, who once called interest rate hikes ‘foolish’ during her campaign for leadership of the Liberal Democratic Party last year, has softened her rhetoric this time. However, in a recent survey by Kyodo News, she still expressed that the Bank of Japan should currently maintain interest rates unchanged.

Speculation about the likelihood of the Bank of Japan raising interest rates at its next policy meeting on October 30 intensified ahead of Saturday’s vote. With her victory, this trend may reverse.

Katsutoshi Inadome, Senior Strategist at Sumitomo Mitsui Trust Asset Management Co., said: ‘Although less pronounced than during last year’s leadership election, the market believes fiscal discipline will loosen, and she will show little understanding of the Bank of Japan’s interest rate hikes. Japanese government bond yields may decline on Monday, particularly for 2-year and 5-year bonds, while ultra-long yields are expected to rise. Expectations priced into an October rate hike may recede somewhat.’

Japanese government bond yields have surged recently, while Japanese stocks reached new historic highs.

Japanese government bond yields have surged recently, while Japanese stocks reached new historic highs.

Anna Wu noted that stocks in sectors such as artificial intelligence, technology, and industry may benefit given Sanae Takagi’s strategic investments in these fields. She added that if Takagi successfully renegotiates terms of the US-Japan trade agreement and secures clearer policies or concessions for the sector, the automotive industry may see a rebound.

Sanae Takagi is expected to be elected Prime Minister in this month’s parliamentary vote. If this happens, she may face her first diplomatic test sooner rather than later, amid reports that US President Trump will visit Japan.

Currently, attention has shifted to the composition of the next cabinet and how the Liberal Democratic Party will cooperate with opposition parties.

Sanae Takai stated that she is willing to incorporate other political parties into the ruling coalition if necessary. Following the recent election, in which the Liberal Democratic Party (LDP) and its coalition partner Komeito lost their majority in both chambers of the Diet, they no longer hold the majority required to pass budgets and other critical bills in the more powerful House of Representatives.

Marito Ueda, Managing Director of SBI FXTrade Co., said, “The market has largely priced in the expectation that fiscal policy will lean toward expansion as long as the incoming Prime Minister can cooperate with opposition parties, regardless of who assumes the role. While there may be an initial impact, it is unlikely to last long.”

AloJapan.com