JAPAN POST BANK (TSE:7182) has just been added to several major S&P indices, including the S&P Global 1200, S&P Japan 500, S&P TOPIX, and S&P International 700. This change is likely to draw new attention from institutional investors and index funds, which may influence trading volumes and price movements in the coming weeks.

See our latest analysis for JAPAN POST BANK.

JAPAN POST BANK’s addition to major S&P indices has put it on more investors’ radar. While the recent share price return has been fairly steady, its five-year total shareholder return of 1.66% reflects modest but persistent long-term gains. The momentum may be building as more index funds adjust their positions and the market reassesses the bank’s future prospects.

If you’re interested in uncovering other trends that are catching institutional attention, consider broadening your investing horizons and discover fast growing stocks with high insider ownership

Given the bank’s steady long-term returns but discounted share price relative to analyst targets, is JAPAN POST BANK an overlooked bargain at today’s levels, or has the market already factored in its future growth?

Price-to-Earnings of 14.9x: Is it justified?

JAPAN POST BANK is trading at a price-to-earnings ratio of 14.9x, suggesting that investors are willing to pay a moderate premium for each yen of its earnings. With a last close of ¥1,765, this positions the bank as attractively valued compared to some listed peers.

The price-to-earnings (P/E) ratio helps investors determine whether the stock price reflects solid earnings prospects or is factoring in too much optimism. For banks, this metric is widely followed because stable, mature earnings are the norm, and a lower P/E often appeals to value-focused buyers.

At 14.9x earnings, JAPAN POST BANK appears reasonably valued. The company’s P/E is below the peer average of 20.4x, which points to a relative discount versus similar institutions. However, it does sit higher than the broader JP Banks industry average of just 11.2x. This signals that the market is pricing in either greater stability, unique business strengths, or higher expectations for future cash flows. The fair P/E ratio is estimated at 16x, suggesting there is room for the valuation to move closer to what underlying fundamentals support.

Explore the SWS fair ratio for JAPAN POST BANK

Result: Price-to-Earnings of 14.9x (UNDERVALUED)

However, slowing revenue growth or an unexpectedly weak profit report could quickly shift sentiment and put pressure on shares in the near term.

Find out about the key risks to this JAPAN POST BANK narrative.

Another View: Discounted Cash Flow Perspective

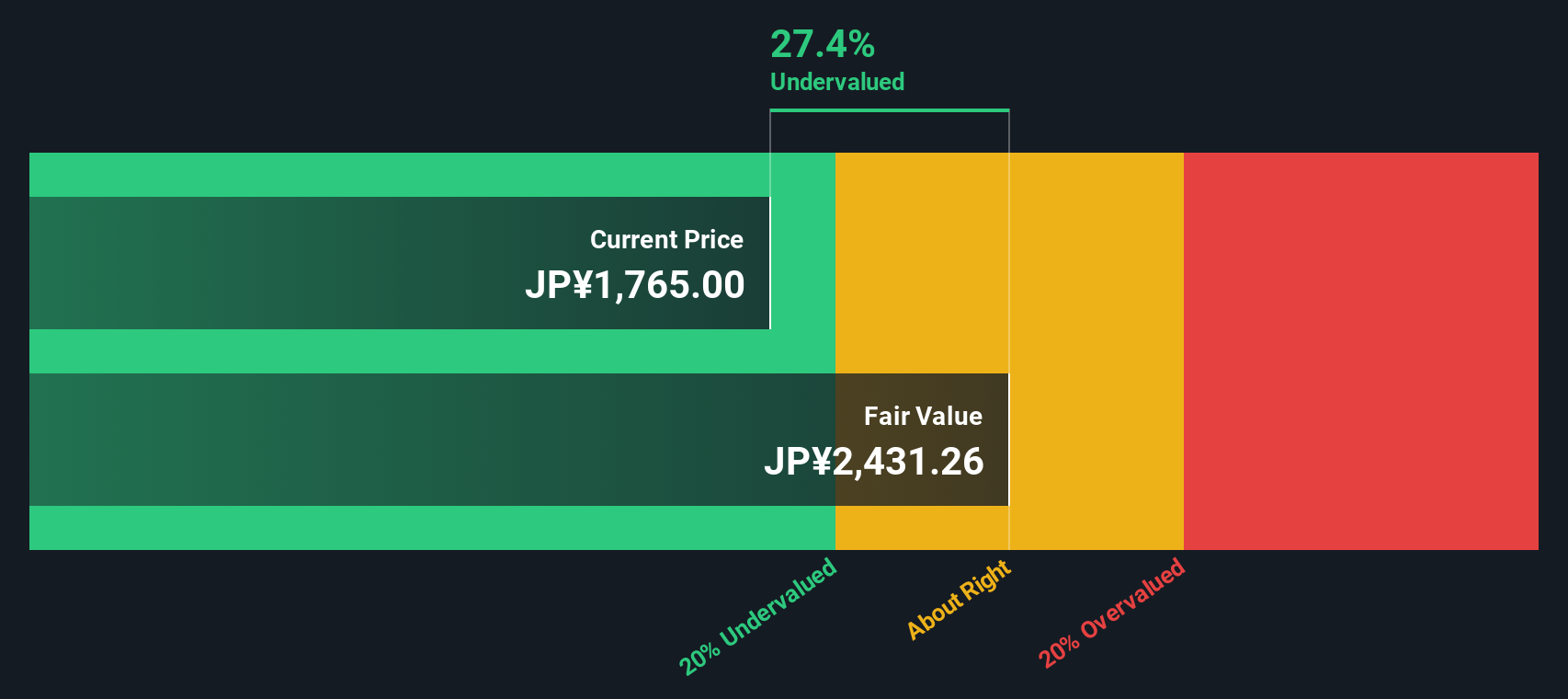

While the price-to-earnings ratio suggests JAPAN POST BANK is undervalued compared to its fair ratio and certain peers, our SWS DCF model presents an even starker picture. The model estimates fair value far above the current price, which implies a significant discount. Could the market be missing something fundamental, or is cautious sentiment warranted?

Look into how the SWS DCF model arrives at its fair value.

7182 Discounted Cash Flow as at Oct 2025

7182 Discounted Cash Flow as at Oct 2025

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out JAPAN POST BANK for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own JAPAN POST BANK Narrative

If you have a different perspective or are inclined to dig deeper into the numbers yourself, you can easily develop your own view in just a few minutes, and Do it your way

A great starting point for your JAPAN POST BANK research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Want to uncover where the smart money is heading next? Don’t settle for a shortlist. There are dynamic opportunities just waiting to be found with the right strategies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com