Soracle, the joint venture between Japan Airlines and Sumitomo Corporation, recently announced it will lead the launch of air taxi services in Osaka Prefecture, with Archer Aviation’s Midnight aircraft as the core of its planned fleet. This collaboration marks Archer as the only U.S. eVTOL manufacturer at the center of developing airborne mobility across the Kansai region through a major local partnership. We’ll explore how Archer’s partnership with Japanese industry leaders could reshape its path to commercial readiness and global expansion.

Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

What Is Archer Aviation’s Investment Narrative?

To own a stake in Archer Aviation is to buy into the future of urban air mobility, with bold ambitions riding on commercializing electric vertical takeoff and landing (eVTOL) aircraft globally. The recent Osaka announcement, which puts Archer’s Midnight aircraft at the heart of Japan’s air taxi rollout via Soracle, is a headline win for international credibility and brand visibility. However, its primary catalysts, certification progress, revenue generation, and capital sufficiency, remain as critical as ever and likely unchanged in the immediate term. While the Osaka deal strengthens Archer’s strategic narrative and could ease regulatory and market entry risks abroad, the business continues to face steep losses, dilution pressures, and the challenge of delivering on its production and certification goals before the cash runway runs out. The stock’s strong rally this year underscores an appetite for potential, but not necessarily an immediate shift in outlook from this news alone, given the scale and complexity of execution ahead.

Yet, capital needs and dilution risk remain front of mind for anyone following the story.

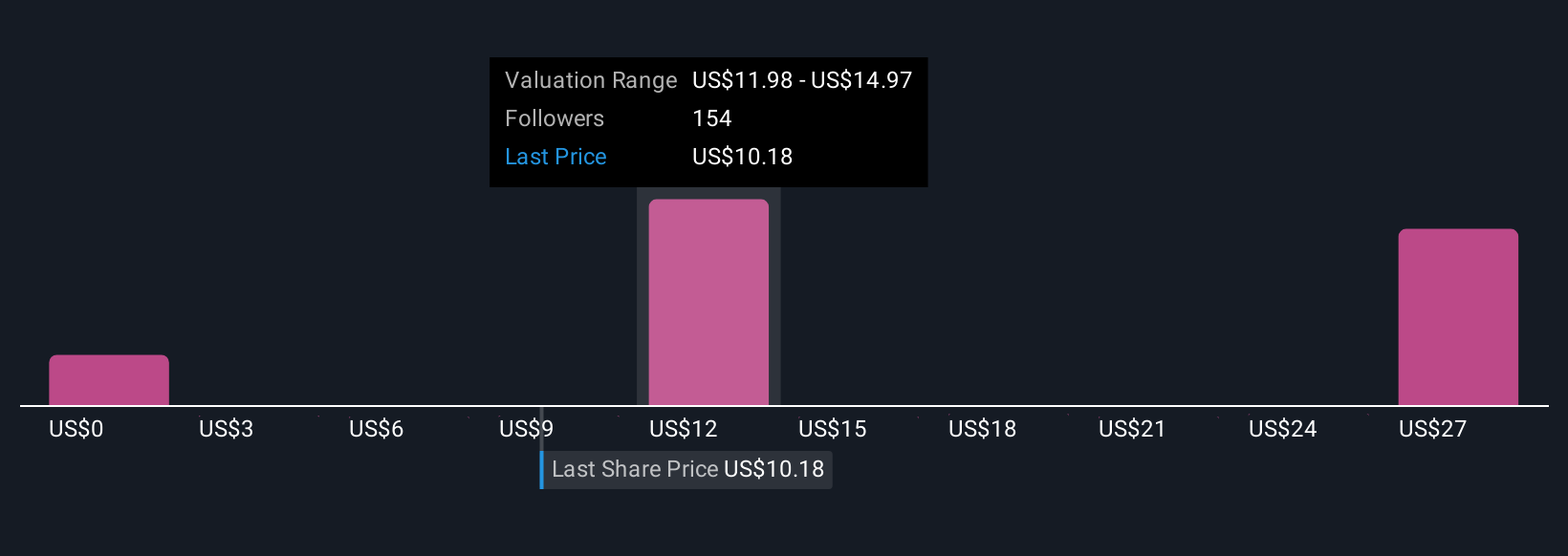

Archer Aviation’s shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives ACHR Community Fair Values as at Oct 2025 Fair value estimates from 45 Simply Wall St Community members range from as low as US$3.00 to as high as nearly US$30.00. With such a wide spread of retail forecasts, it’s clear perceptions may shift dramatically as Archer Aviation’s global expansion plans and capital requirements continue to develop. Take the time to compare several alternative viewpoints before making up your mind.

ACHR Community Fair Values as at Oct 2025 Fair value estimates from 45 Simply Wall St Community members range from as low as US$3.00 to as high as nearly US$30.00. With such a wide spread of retail forecasts, it’s clear perceptions may shift dramatically as Archer Aviation’s global expansion plans and capital requirements continue to develop. Take the time to compare several alternative viewpoints before making up your mind.

Explore 45 other fair value estimates on Archer Aviation – why the stock might be worth over 2x more than the current price!

Build Your Own Archer Aviation Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don’t miss this chance:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com