Foreign investors pulled out of Japanese government bonds (JGBs) in the week through September 27, marking the biggest such selloff in a year, driven by growing expectations of potential Bank of Japan rate hikes.

Foreigners sold a net 2 trillion yen ($13.60 billion) worth of Japanese long-term bonds, the most for a week since September 21, 2024, as well as a net 3.22 trillion yen worth of short-term bills, data from Japan’s Ministry of Finance showed on Thursday.

Thomson ReutersForeign flows into Japanese debt securities

Thomson ReutersForeign flows into Japanese debt securities

Yield on Japanese 10-year government bonds hit a 17-year high of 1.665% last week on fears of a rate hike as soon as October 30 after a hawkish split among board members at the BOJ’s meeting on September 18-19.

The need for an interest rate hike was increasing “more than ever”, dovish BOJ board member Asahi Noguchi said on Monday.

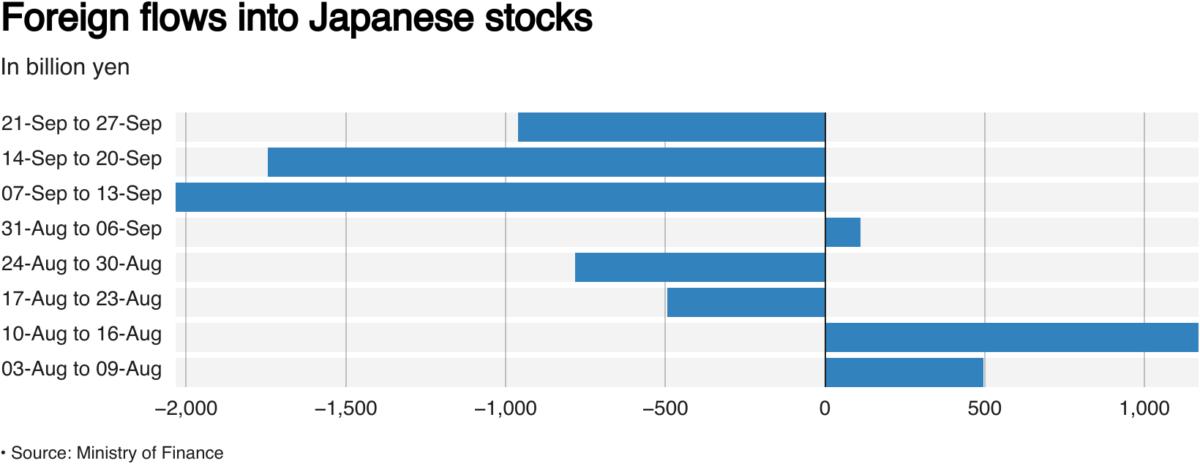

Meanwhile, foreign investors sold Japanese stocks for a third straight week on a net basis last week, to the tune of 963.3 billion yen.

Thomson ReutersForeign flows into Japanese stocks

Thomson ReutersForeign flows into Japanese stocks

Including the most recent week’s net selling, the aggregate outflows for September reached roughly 4.63 trillion yen. This is third-largest net sales figure for the month in 11 years.

Japanese investors, meanwhile, withdrew nearly 162 billion yen from foreign long-term bonds as they ended a four-week trend of net purchases.

Thomson ReutersJapanese investments in overseas debt securities

Thomson ReutersJapanese investments in overseas debt securities

They also pulled out a marginal 11.6 billion yen from foreign equities, posting a second successive week of net sales.

Thomson ReutersJapanese investments in stocks abroad

Thomson ReutersJapanese investments in stocks abroad

($1 = 147.0900 yen)

AloJapan.com