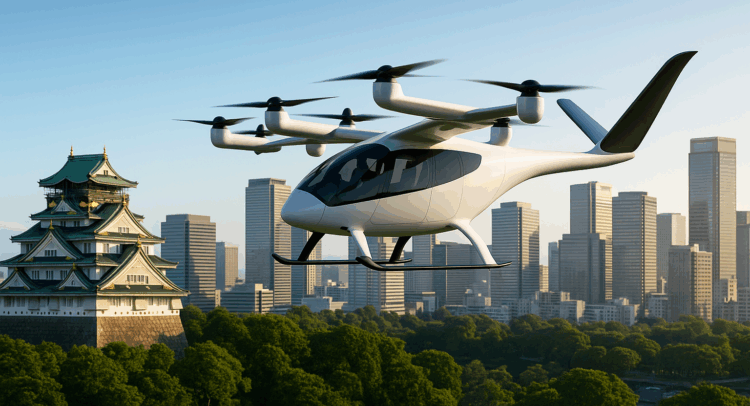

Archer Aviation (ACHR) officially stated that its partner, Soracle, a joint venture between Japan Airlines (JPNRF) and Sumitomo Corporation (SSUMF), has been chosen to lead air taxi services in Osaka Prefecture. This step makes Archer the only U.S. electric air taxi maker tied to the launch of service in the region. For Archer, the move opens a path into a large new market and could help strengthen its position with global partners.

Elevate Your Investing Strategy: Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The plan centers on Archer’s Midnight aircraft, which Soracle intends to use as the main part of its fleet. Agreements with Osaka Prefecture and Osaka City cover the start of work on rules, community plans, and service designs that would connect Osaka with the broader Kansai area. In recent months, Archer and Soracle also showcased the Midnight aircraft at the Osaka Kansai World Expo, which helped draw public attention to the project.

Big in Japan

Archer’s Chief Executive, Adam Goldstein, met with Japan’s Minister of Land, Infrastructure, Transport, and Tourism, Hiromasa Nakano, to discuss how to build a path for air taxi use in the country. A group from the Japan Civil Aviation Bureau and the Consul General of Japan in San Francisco also visited Archer’s main site in California. These visits signaled growing ties between the company and Japan’s leaders.

Soracle Chief Executive Yukihiro Ota said the new step with Osaka is meant to bring a real service to the region. He pointed to Archer’s role in helping to shape the work and said both sides are confident in the plan. Japan, which has a long record of adopting new travel systems such as high-speed rail, is seen as an early market for the next stage of air travel.

For Archer, the Osaka deal highlights progress beyond the U.S. market. The agreement with Soracle is still subject to final contracts, but it adds weight to Archer’s case with investors who follow the growth of electric air taxis. If the project advances as planned, Archer could benefit from being the first U.S. company with a role in Japan’s launch of air taxi services, which may support its global growth outlook.

Is Archer Aviation Stock a Good Buy?

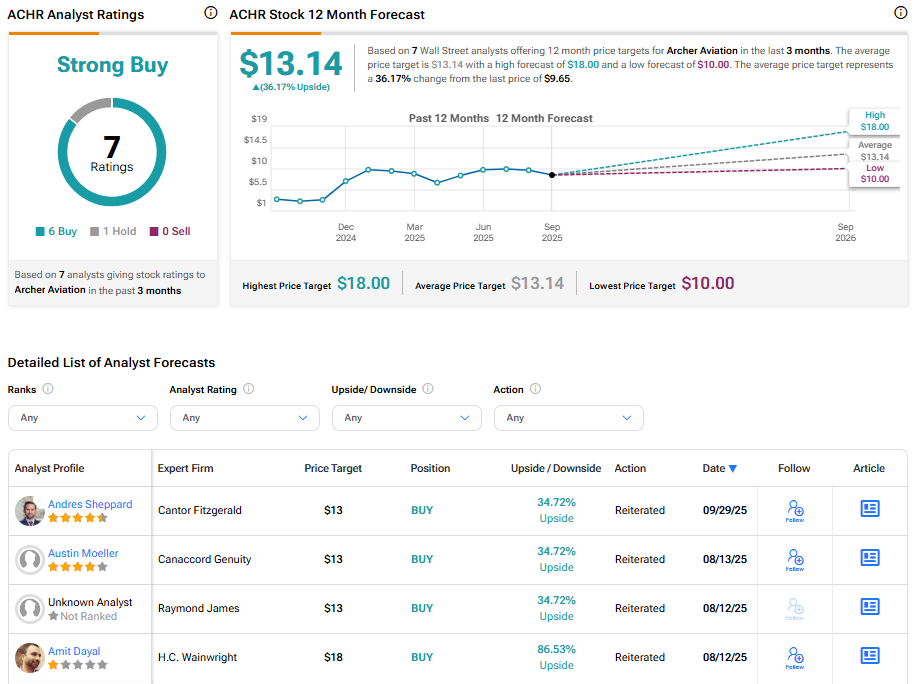

On Wall Street, analysts remain optimistic about the company’s prospects. Based on seven recent ratings, Archer Aviation boasts a “Strong Buy” consensus with an average 12-month price target of $13.14. This implies a 36.17% upside from the current price.

See more ACHR analyst ratings

Disclaimer & DisclosureReport an Issue

AloJapan.com