This article first appeared on GuruFocus.

Hennessy Japan Fund (Trades, Portfolio) recently submitted its N-PORT filing for the third quarter of 2025, shedding light on its strategic investment decisions during this period. Established on October 31, 2003, the Hennessy Japan Fund (Trades, Portfolio) aims for long-term capital appreciation by investing at least 80% of its net assets in equity securities of Japanese companies. The fund employs a consistent and repeatable investment process, combining time-tested, purely quantitative stock selection formulas with a highly disciplined, team-managed approach. The fund’s strategy focuses on identifying good businesses with exceptional management that are trading at attractive prices, based on rigorous, on-site research. The fund seeks arbitrage opportunities between a company’s fundamental value and its market price, maintaining a concentrated portfolio of the managers’ best ideas.

Hennessy Japan Fund’s Strategic Moves: A Closer Look at SoftBank Group Corp

Hennessy Japan Fund (Trades, Portfolio) also increased stakes in a total of five stocks, with the most notable increase being in SoftBank Group Corp (TSE:9984). The fund added 130,100 shares, bringing the total to 284,700 shares. This adjustment represents a significant 84.15% increase in share count, with a 2.61% impact on the current portfolio and a total value of 21,739,400. The second largest increase was in Daiwa House Industry Co Ltd (TSE:1925), with an additional 22,900 shares, bringing the total to 258,900. This adjustment represents a 9.7% increase in share count, with a total value of 8,559,470.

Hennessy Japan Fund (Trades, Portfolio) also reduced its position in 18 stocks. The most significant changes include a reduction in Renesas Electronics Corp (TSE:6723) by 372,200 shares, resulting in a -41.61% decrease in shares and a -1.18% impact on the portfolio. The stock traded at an average price of 1,849.81 during the quarter and has returned 3.43% over the past three months and -12.29% year-to-date. Additionally, the fund reduced its position in Sompo Holdings Inc (TSE:8630) by 39,200 shares, resulting in a -6.68% reduction in shares and a -0.34% impact on the portfolio. The stock traded at an average price of 4,389.4 during the quarter and has returned 8.48% over the past three months and 14.25% year-to-date.

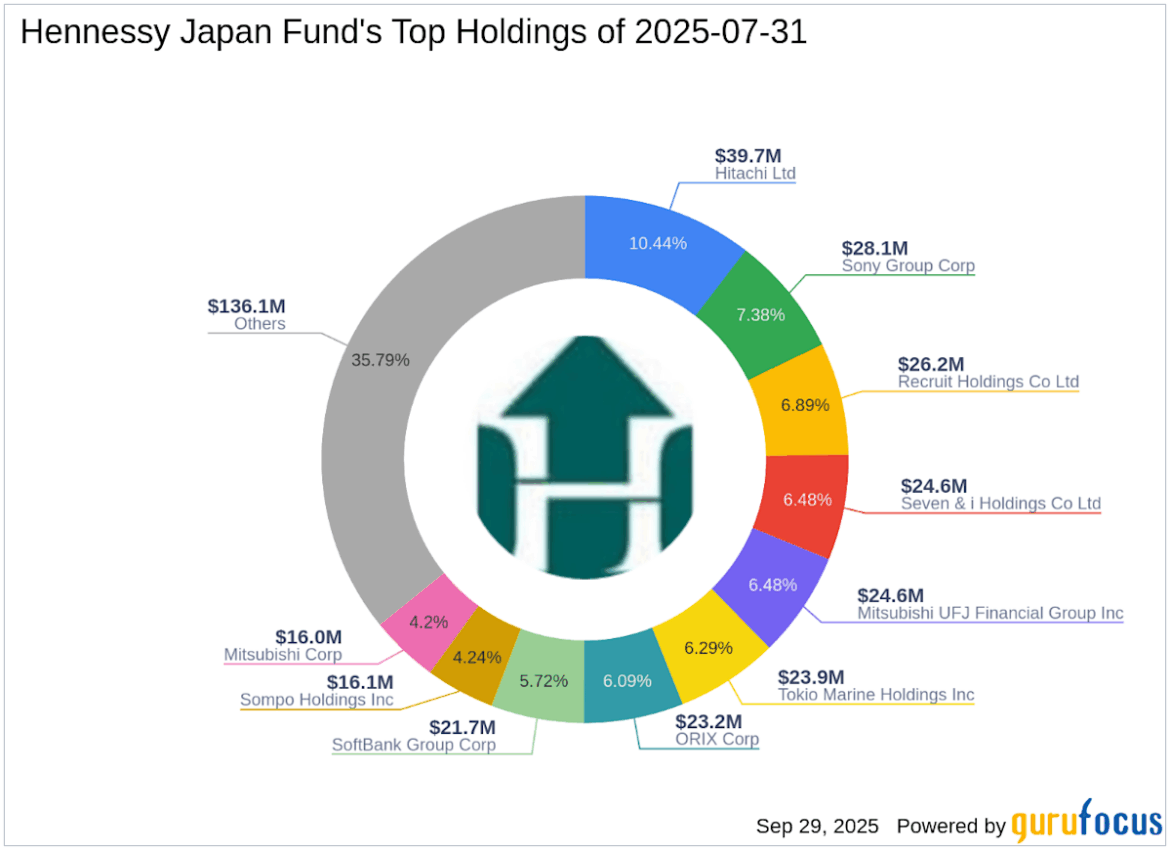

As of the third quarter of 2025, Hennessy Japan Fund (Trades, Portfolio)’s portfolio included 28 stocks. The top holdings comprised 10.44% in Hitachi Ltd (TSE:6501), 7.38% in Sony Group Corp (TSE:6758), 6.89% in Recruit Holdings Co Ltd (TSE:6098), 6.48% in Mitsubishi UFJ Financial Group Inc (TSE:8306), and 6.48% in Seven & i Holdings Co Ltd (TSE:3382). The holdings are mainly concentrated in nine of the 11 industries: Financial Services, Industrials, Technology, Communication Services, Consumer Defensive, Consumer Cyclical, Basic Materials, Real Estate, and Healthcare.

Hennessy Japan Fund’s Strategic Moves: A Closer Look at SoftBank Group Corp

AloJapan.com