As the world’s fourth-largest automotive market, Japan’s electrification transformation follows a unique path: hybrid vehicles dominate the market with an overwhelming advantage, while the development of pure electric vehicles faces bottlenecks, and their market share has long hovered at a low level.

Recently, a study by JATO Dynamics, an automotive industry data and consulting service provider, on the Japanese electric vehicle market shows that despite the Japanese government’s multi-pronged measures, such as subsidies, tax incentives, and the expansion of charging infrastructure, to support the popularization of electric vehicles, consumers’ choices clearly indicate that at this stage, hybrid technology remains a more practical and more in line with the national conditions solution in the minds of Japanese consumers. Meanwhile, although the options for pure electric models are becoming increasingly diverse, their market performance is still constrained by real challenges such as price polarization, range anxiety, and insufficient infrastructure. Especially in the mainstream price range, there are few options for pure electric vehicles, making it difficult to compete with the rich lineup of hybrid models.

This pattern of “hybrid leading, pure electric lagging” not only reflects the unique preferences of the Japanese automotive market but also reflects the complex reality faced by the global electric vehicle wave in the process of local adaptation in different markets.

Hybrids Replace Fuel Vehicles as the Dominant Force, with Significant Cost Advantages

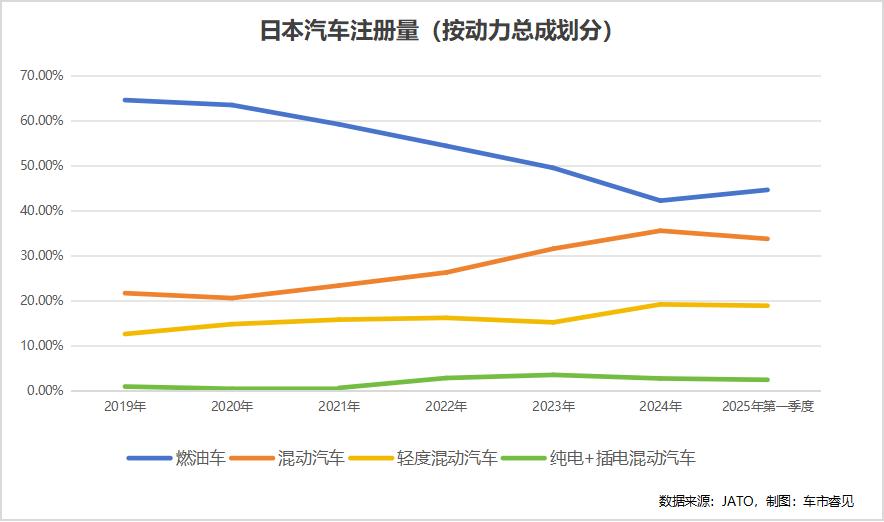

The Japanese passenger car market is undergoing profound changes, and the share of internal combustion engine models continues to shrink. In 2023, the share of internal combustion engine models in the total registration volume of passenger cars fell below 50% for the first time, further dropping to 42.3% in 2024. Although it rebounded slightly to 44.7% in the first half of 2025, the market is now mainly occupied by electrified powertrains.

The electrified powertrains in the Japanese market include hybrid vehicles, mild hybrid vehicles, plug-in hybrid vehicles, and pure electric vehicles. Data shows that the market share of hybrid models increased from 21.7% in 2019 to 35.6% in 2024 and remained stable at 33.8% in the first half of 2025, showing a steady growth trend. Japanese manufacturers, with their technological advantages and competitive pricing strategies, have promoted the continuous growth of hybrid vehicles. In the first half of 2025, hybrid models accounted for 21% of the overall market sales, with Toyota contributing 6% and Nissan accounting for 4.5%.

For most Japanese consumers, hybrids are currently considered the most realistic choice. In the first half of 2025, the weighted average price of new passenger cars in Japan was about 3.29 million yen (about 157,000 yuan), and about 80% of the models had a manufacturer’s suggested retail price of less than 4.09 million yen (about 196,000 yuan), and 90% of the models were priced below 5.8 million yen (about 281,000 yuan).

However, in this mainstream price range, there are very few options for pure electric models. Only 6 models are priced below 4.09 million yen, including 2 kei cars and 3 imported models (Hyundai Kona/Inster, BYD Dolphin). In contrast, there are 34 hybrid models to choose from, mainly from local brands such as Toyota, Honda, and Nissan.

Although the sticker price of hybrid models is usually higher than that of fuel vehicles in the same class, considering fuel efficiency, improved configuration, and tax incentives, their cost-effectiveness is considered very prominent. With a wide range of product lineups and consumers’ long-term trust in local brands, hybrids remain the most familiar and easily accessible electrification option for Japanese consumers.

Slow Development of Pure Electric Models, Kei Cars as a Breakthrough

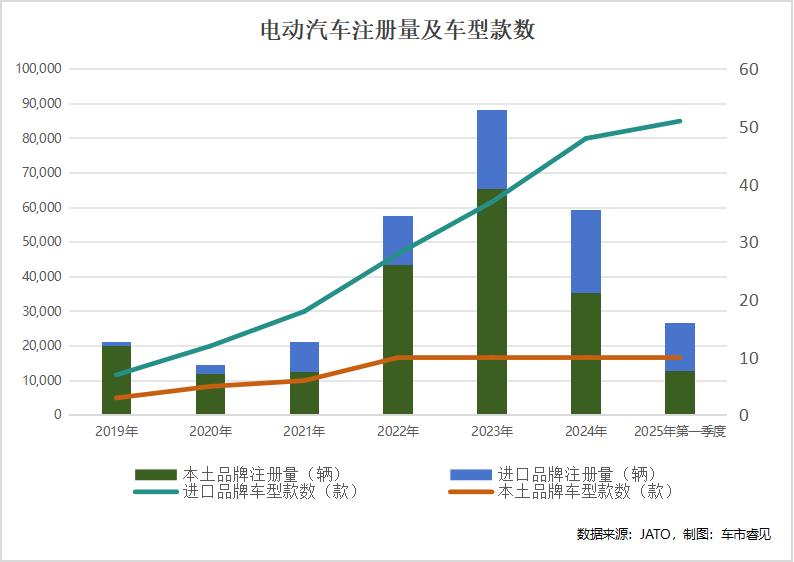

The development of pure electric vehicles in Japan has been slow. Their market share was only 0.5% in 2019, climbed to 2.2% in 2023, and then dropped back to 1.3% in the first half of 2025. The market penetration rate is still limited. The number of models on sale has increased significantly from 10 in 2019 to 61 in 2025. However, only 10 of them are from Japanese brands, and the remaining 51 are foreign brands, highlighting the strong influence of imported cars in the Japanese pure electric vehicle market. In terms of sales, the kei pure electric models launched by Nissan and Mitsubishi in 2022 have gradually increased the market share of Japanese brand pure electric models. Kei pure electric vehicles are affordable and compact in size, which are very popular locally and can attract local consumers. They have become a practical starting point for the adoption of pure electric vehicles in recent years.

A comparison of the prices of local and imported pure electric models in the Japanese market reveals a huge difference. In the first half of 2025, the average price of local pure electric models was 3.53 million yen (about 171,000 yuan), emphasizing practicality and economy, with economy kei cars dominating. The average price of imported pure electric models was 7.37 million yen (about 357,000 yuan), targeting high performance, advanced features, and a luxury positioning.

The Japanese government provides subsidies for clean energy vehicles (pure electric and plug-in hybrid models), and the maximum subsidy has gradually increased from 400,000 yen (about 18,000 yuan) in 2020 to 900,000 yen (about 42,000 yuan) in 2025. For kei pure electric vehicles, the maximum subsidy can reach 574,000 yen (about 27,000 yuan).

Taking the Nissan Sakura (with an entry-level price of 2.54 million yen) as an example, it can receive a subsidy of about 574,000 yen, accounting for about 22% of the vehicle price. Coupled with local subsidies and tax incentives, the price gap between electric vehicles and internal combustion engine vehicles is effectively narrowed. In addition, Japan also has an “eco-friendly vehicle tax reduction” policy, which reduces environmental taxes and tonnage taxes based on the vehicle’s environmental performance, reducing the cost of purchasing and owning a vehicle. Nevertheless, the direct driving effect of subsidies on the popularization of pure electric vehicles as a whole is still limited. Fundamental challenges such as consumer preferences and the lag in infrastructure construction continue to hinder the wide acceptance of pure electric vehicles.

Currently, hybrid electric vehicles remain the most stable and widely accepted electrification solution in the Japanese market. Emerging market segments such as kei pure electric vehicles are expected to become an important breakthrough for the future expansion of pure electric vehicles.

Looking ahead, the growth of pure electric vehicles in Japan not only depends on the continuous improvement of external conditions such as incentive policies and infrastructure but also, more crucially, on providing more diversified products that cover different price ranges and suit the actual lifestyles of Japanese consumers. Only by solving these core issues can the pure electric transformation in the Japanese market truly gain momentum.

Source: JATO Dynamics

This article is from the WeChat official account “Automotive Market Insights”, author: Zheng Li. Republished by 36Kr with permission.

AloJapan.com