Japan Excellent, Inc. recently announced it had acquired an additional co-ownership interest in BIZCORE JIMBOCHO, a high-grade office building located in Tokyo. This addition highlights the company’s focus on enhancing portfolio quality and asset management efficiency through assets with advanced facilities and prominent locations. We will explore how expanding ownership in this prime Tokyo office property could influence Japan Excellent’s broader investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

What Is Japan Excellent’s Investment Narrative?

Owning a piece of Japan Excellent means believing in the resilience and long-term value of high-quality, centrally located office real estate in Tokyo. The acquisition of additional interest in BIZCORE JIMBOCHO aligns well with this theme, underscoring the company’s intent to enhance asset quality and pursue stable cash flow. Previously, the main catalyst had been incremental dividend increases, as seen with recent distribution raises tied to tenant activity, while a key risk remained the stagnant earnings growth and relatively high debt burden. With this deal, there’s now extra focus on the ability to translate property enhancements into stronger performance metrics, though for now, the impact on short-term profit and risk may not be immediately material unless the property quickly drives higher cash flows or helps offset margin pressure.

But rapid expansion also brings its own risks, especially if debt levels are already high.

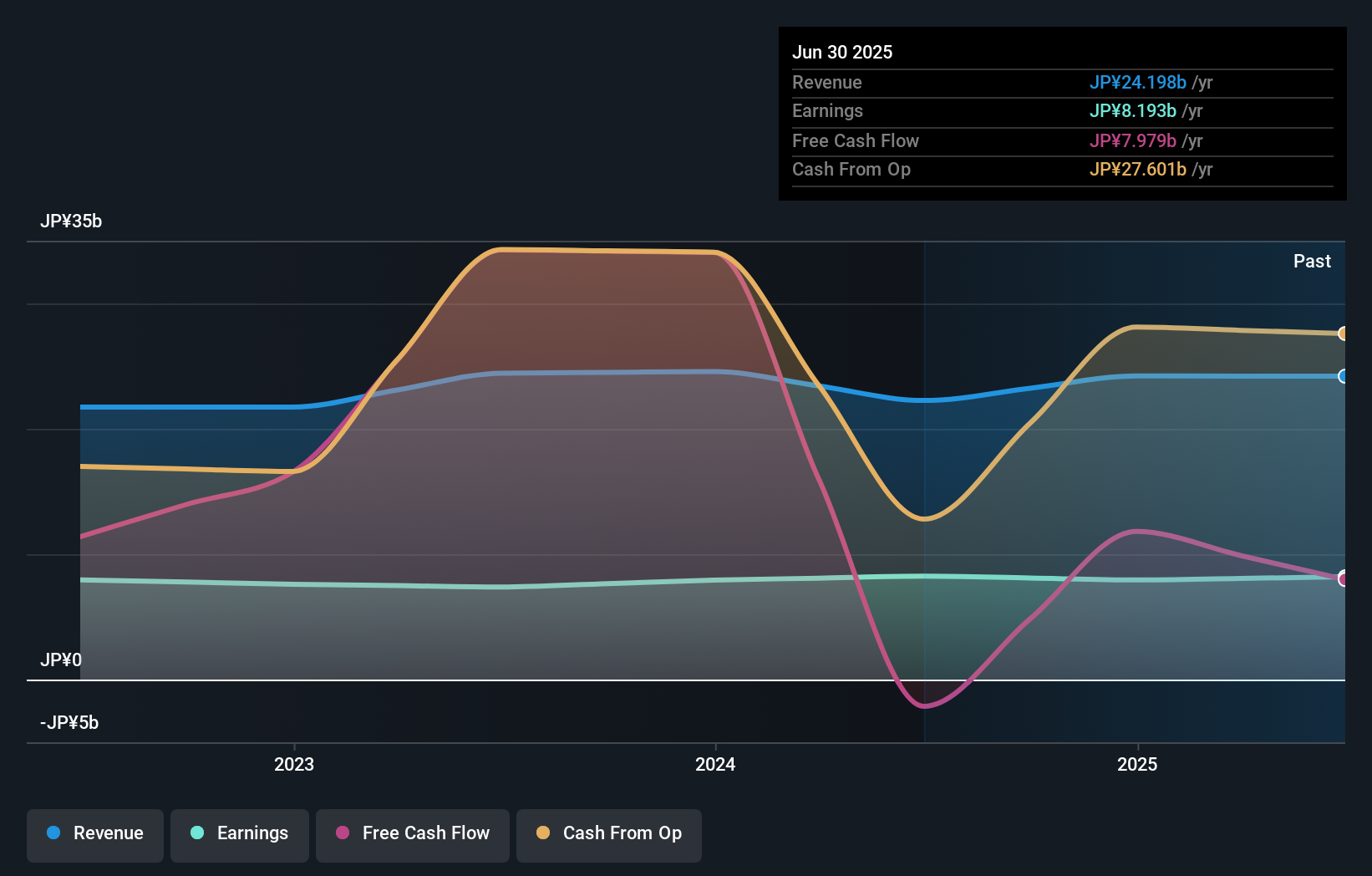

Japan Excellent’s shares are on the way up, but they could be overextended by 41%. Uncover the fair value now.Exploring Other Perspectives TSE:8987 Earnings & Revenue Growth as at Sep 2025 The Simply Wall St Community offers two fair value estimates for Japan Excellent, from ¥125,727 to ¥170,770 per share. While these views vary widely, be aware the earnings trend has lagged in recent years, a theme that may challenge bullish outlooks for the near term. Discover how these differences can shape your own perspective.

TSE:8987 Earnings & Revenue Growth as at Sep 2025 The Simply Wall St Community offers two fair value estimates for Japan Excellent, from ¥125,727 to ¥170,770 per share. While these views vary widely, be aware the earnings trend has lagged in recent years, a theme that may challenge bullish outlooks for the near term. Discover how these differences can shape your own perspective.

Explore 2 other fair value estimates on Japan Excellent – why the stock might be worth 15% less than the current price!

Build Your Own Japan Excellent Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

A great starting point for your Japan Excellent research is our analysis highlighting 3 important warning signs that could impact your investment decision.Our free Japan Excellent research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Japan Excellent’s overall financial health at a glance.Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com