Japan Petroleum Exploration recently updated its corporate guidance, projecting higher profits for the fiscal year ending March 2026 amid an evolving global economic landscape. This revision is particularly significant given the company’s history of volatile dividend payouts, suggesting strengthened confidence in future performance. We’ll explore how the improved profit outlook supports Japan Petroleum Exploration’s investment narrative, especially in light of its dividend past.

Trump’s oil boom is here – pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Japan Petroleum Exploration’s Investment Narrative?

To be comfortable owning shares of Japan Petroleum Exploration, you have to believe in the durability of its profit outlook despite a sector prone to swings in energy prices and ongoing boardroom changes. The recent uplift in corporate guidance for fiscal 2026, paired with efforts to stabilize dividends, signals a meaningful attempt to reshape its reputation for erratic payouts and keep investor trust after a year punctuated by a substantial one-off gain. Short term, the profit revision puts a spotlight on earnings releases as the most important catalyst, with improved confidence possibly supporting near-term sentiment and price strength. Still, there is no escaping that analyst forecasts continue to anticipate a sharp earnings and revenue decline, which means macro demand shocks or lower commodity prices could rekindle volatility. The updated guidance offers some optimism but doesn’t erase those underlying risks.

However, with earnings expected to decline sharply, there’s a risk some investors might miss.

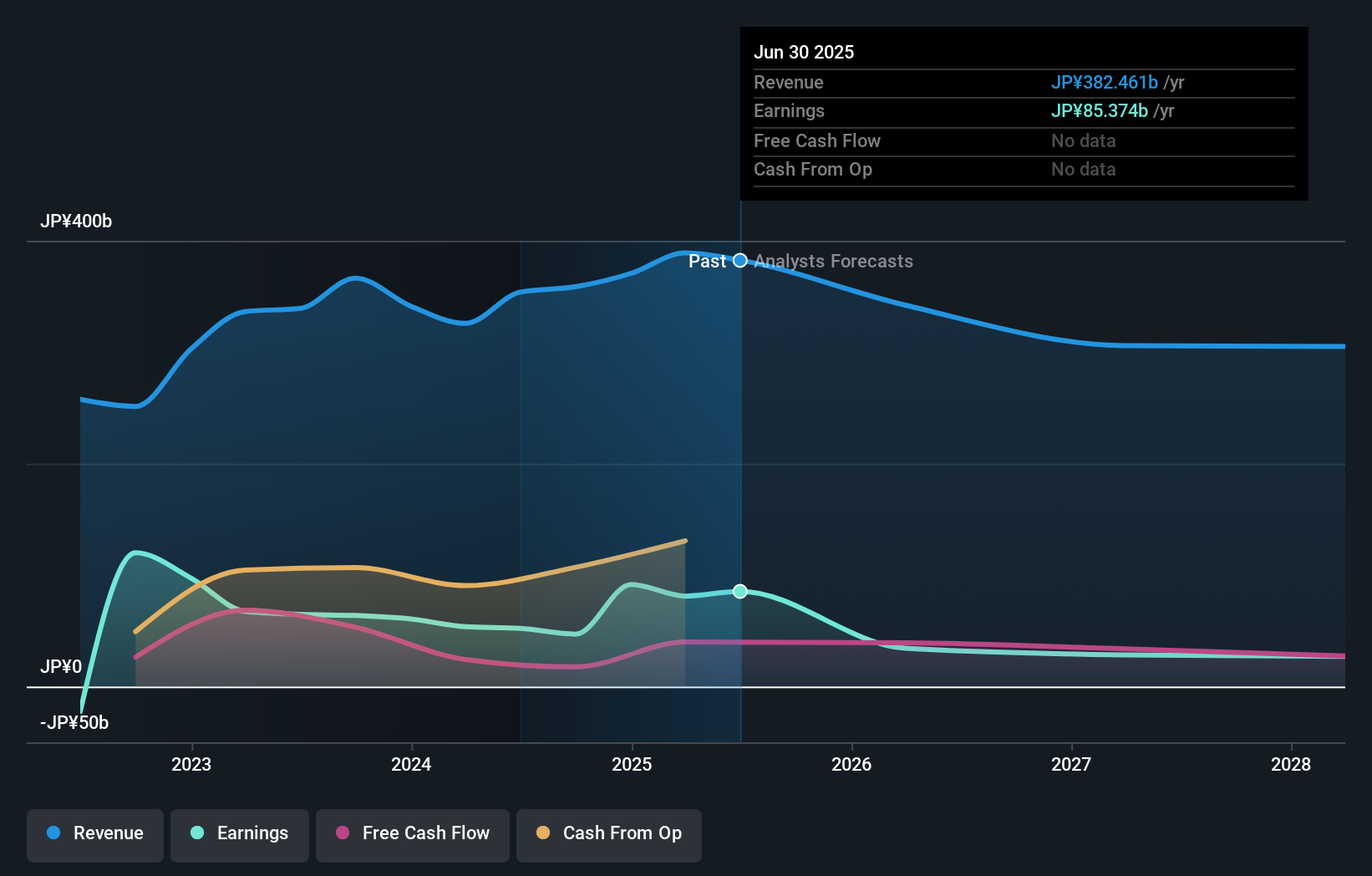

Japan Petroleum Exploration’s shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives TSE:1662 Earnings & Revenue Growth as at Sep 2025 With three individual valuations from the Simply Wall St Community ranging from ¥1,521 to an exceptionally large ¥53,459 per share, opinions vary widely. While some expect the company’s updated profit guidance to support recent momentum, others remain cautious about looming earnings declines. Explore this broad spectrum of market views before drawing your own conclusions.

TSE:1662 Earnings & Revenue Growth as at Sep 2025 With three individual valuations from the Simply Wall St Community ranging from ¥1,521 to an exceptionally large ¥53,459 per share, opinions vary widely. While some expect the company’s updated profit guidance to support recent momentum, others remain cautious about looming earnings declines. Explore this broad spectrum of market views before drawing your own conclusions.

Explore 3 other fair value estimates on Japan Petroleum Exploration – why the stock might be a potential multi-bagger!

Build Your Own Japan Petroleum Exploration Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com