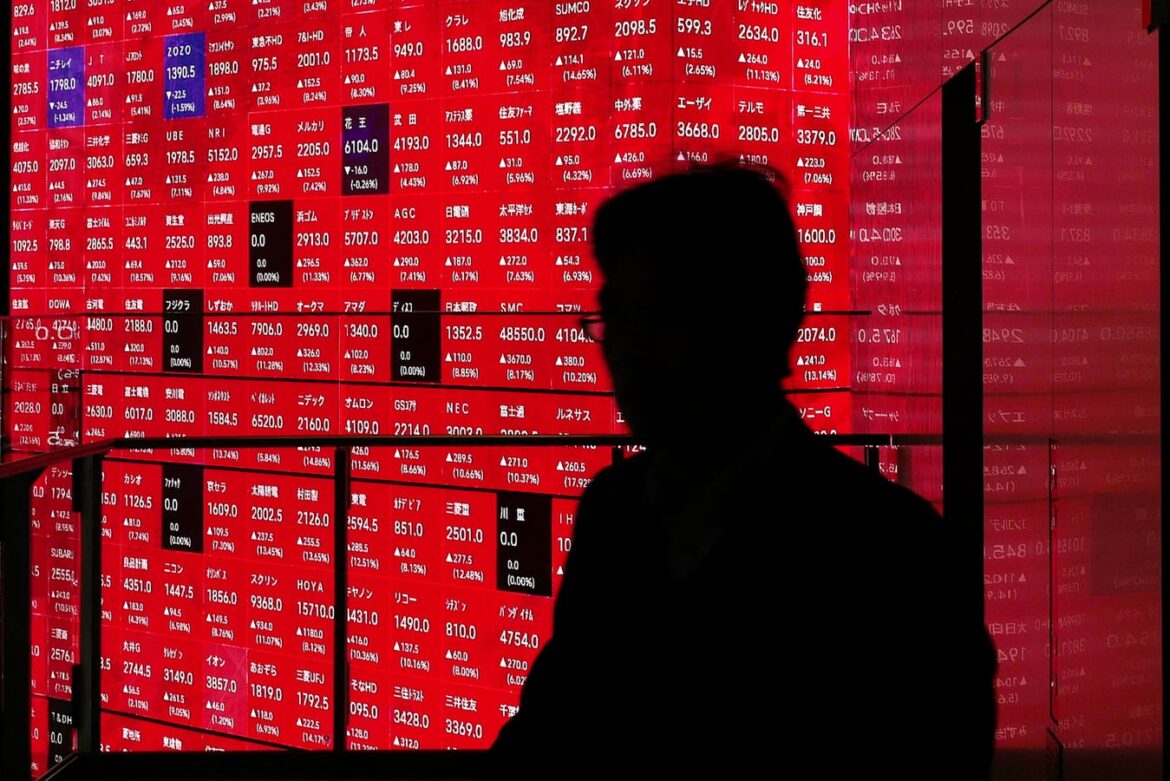

An electronic board shows the Nikkei 225 index on the Tokyo Stock Exchange at an office building in Tokyo.

KAZUHIRO NOGI/AFP via Getty Images

For the last two years, the Bank of Japan has been playing the globe’s most tantalizing game of Jenga.

With every step BOJ Governor Kazuo Ueda makes to remove one financial block — say, reducing government bond holdings — his team risks the whole game coming crashing down. On Friday, Ueda disclosed plans to pull out what may be the riskiest block yet: stocks.

Since 2013, the BOJ has been hoarding government bonds and stocks in unprecedented ways. By 2018, the BOJ’s balance sheet topped the size of Japan’s $4.2 trillion economy — a first for a Group of Seven nation.

That was under Governor Haruhiko Kuroda. In April 2023, Ueda took over with a mission to normalize interest rates. By January 2025, Ueda managed to hike rates to a 17-year high of 0.5%. And to taper bond purchases by 400 billion yen ($2.7 billion) per quarter.

Global market turmoil forced the BOJ to lower that figure to 200 billion yen per quarter. Still, the direction remains clear. Slowly, but surely, the BOJ is withdrawing from the markets.

That now includes stocks via exchange-traded funds. Friday is the first time the BOJ disclosed that it is exiting the stock investment game. By book value, the BOJ’s ETF holdings are worth roughly 37 trillion yen ($251 billion). By market value, the holdings are worth more than double that.

The hope is to pull out the ETF block without the whole market collapsing. That, of course, will be easier said than done after years of the BOJ being the Japanese stock market’s investment “whale.”

As experiments go, this one is quite precarious. This week, the Nikkei 225 Stock Average surged to an all-time high, topping 45,000. Now that the BOJ is throttling back on its support for the market, investors are left wondering if underlying economic fundamentals support such rich stock values.

Investors have every reason to question whether the economy and a critical mass of Japan Inc. companies can thrive amid U.S. President Donald Trump’s tariffs. Though Japan got away with a 15% tariff, it’s still quite the economic headwind.

China, meanwhile, is slowing and exporting deflation at a moment when U.S. growth is flatlining. There’s an open question, it follows, whether Japan can navigate such a challenging environment amid soft domestic demand and waning confidence.

Investors also have valid reasons to wonder why they should have confidence in the economic outlook when the BOJ seems to lack it. The idea that Team Ueda will be able to hike rates anytime soon is becoming more fanciful with each passing week.

Adding to the drama is complete uncertainty about who will replace Prime Minister Shigeru Ishiba, who resigned earlier this month.

Stefan Angrick, Japan economist at Moody’s Analytics, notes that “the outlook for Japan’s economy appears daunting. Exports and industrial production are slipping as higher U.S. tariffs bite manufacturers. And with inflation still running ahead of wages and the government dragging its feet on big-ticket investment items, domestic demand won’t save the day.”

Political uncertainty adds to the mix, Angrick adds. In general, he says, “we believe expectations for major policy shifts under his successor are premature. Whoever takes the helm will need to tackle voter frustration with cost-of-living issues and the rise of right-wing populism. And even candidates pushing for fiscal expansion will need to contend with the reality that Japan’s economy needs more than broad demand-side stimulus.”

Yet this uncertainty comes as the global outlook darkens — both in economic and geopolitical terms. Add in the fact that the stock game’s main investment whale is stepping back from the market.

How all this plays out is anyone’s guess. But at least one thing is clear: the BOJ will have to be very careful not to destabilize the financial system as it removes the most precarious Jenga piece yet.

AloJapan.com