Japanese energy firm Jera is in talks to acquire Haynesville natural gas assets from GeoSouthern Energy and Williams Cos.

Jera has emerged as the top bidder for the Louisiana Haynesville assets, according to sources who requested anonymity to discuss a potential transaction.

Jera, GeoSouthern and Williams are discussing a potential valuation of the Haynesville gas assets at around $1.7 billion, Reuters reported.

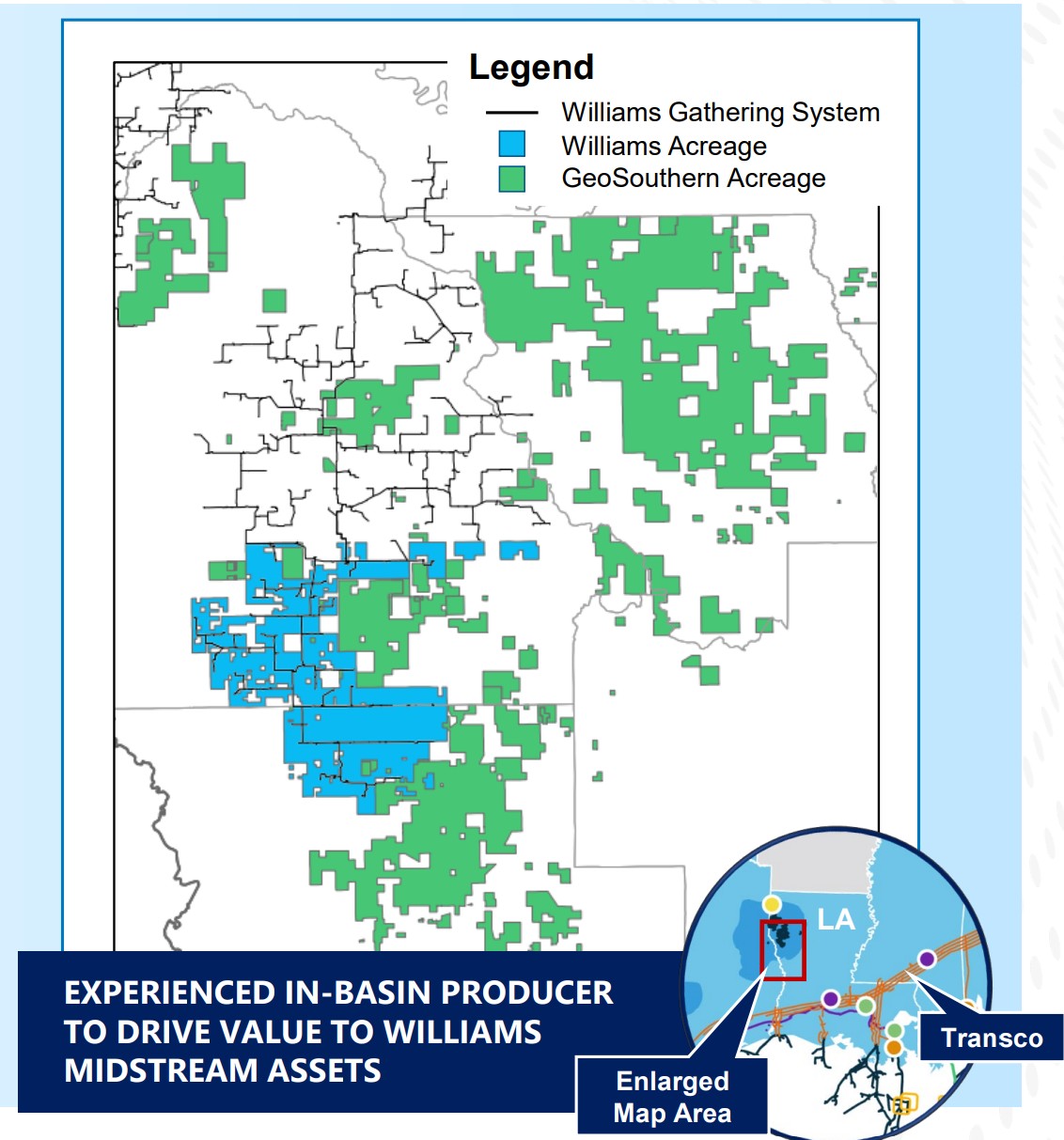

GEP Haynesville II, a joint venture (JV) between operator GeoSouthern and midstream firm Williams, is one of the top gas producers in the basin. Williams owns a non-operated minority stake in the JV.

In July, Hart Energy was first to report that GeoSouthern and Williams were working with bankers to market the Haynesville assets.

GEP Haynesville II operates around 50,000 net acres in Louisiana. The company is producing around 600 MMcf/d of gas, Williams CEO Chad Zamarin noted at an industry conference last month.

GEP holds around 200 gross operated locations, the third-most for a private Haynesville E&P behind Aethon Energy and TG Natural Resources, according to Enverus data.

GeoSouthern, Williams and Jera did not respond to Hart Energy’s request for comment at the time of publication.

RELATED

Exclusive: GeoSouthern, Williams Market Haynesville Gas Assets

International interest in U.S. gas

An acquisition by Jera, Japan’s largest power generator, would represent the company’s entrance into the U.S. shale space. But the Japanese firm has been expanding its footprint in other parts of the U.S. gas value chain.

This summer, Jera signed agreements for approximately 5.5 million tonnes per annum (mtpa) of LNG offtake from U.S. Gulf Coast producers, including Cheniere and Sempra Infrastructure.

Earlier this month, Jera announced signing a letter of intent with Glenfarne LLC to explore potential LNG offtake from the Alaska LNG project.

International buyers, particularly buyers from Asia, are interested in owning U.S. gas assets to hedge their exposure to LNG offtake agreements.

TG Natural Resources (TGNR), the U.S. subsidiary of Tokyo Gas, has been another active acquirer of U.S. gas assets.

TGNR acquired a 70% stake in Chevron’s East Texas Haynesville properties for $525 million in March, including $75 million in cash and $450 million in capital carry.

In late 2023, TGNR acquired private East Texas producer Rockcliff Energy II for $2.7 billion.

Meanwhile, Japan’s Mitsui & Co. has quietly built up a U.S. shale footprint spanning from South Texas to the emerging Western Haynesville play.

RELATED

Japan’s Mitsui Testing Western Haynesville Alongside Comstock, Aethon

Can GeoSouthern strike gold again?

GEP Haynesville II is GeoSouthern Energy’s second foray into the Haynesville Shale. And before entering the Haynesville in 2015, GeoSouthern was a trailblazer in the South Texas Eagle Ford play.

Led by billionaire founder and CEO George Bishop, GeoSouthern sold its Eagle Ford acreage to Devon Energy in 2014 for $6 billion in cash.

GeoSouthern went on to partner with Blackstone’s credit arm, GSO Capital Partners, to acquire and develop the Haynesville and Middle Bossier formations in Louisiana.

The first iteration of the company, GEP Haynesville, was acquired by Southwestern Energy for $1.85 billion in cash and equity in late 2021. GEP Haynesville was producing around 700 MMcf/d by the time of the Southwestern deal.

A few months before selling GEP Haynesville I, GeoSouthern and Williams formed the JV to develop a second Haynesville tract. The largely undeveloped properties were initially transferred to Williams as part of Chesapeake Energy’s bankruptcy and restructuring process.

Williams formed a JV with GeoSouthern Energy in 2021 to develop a block of Haynesville acreage near GeoSouthern’s existing acreage. (Source: Williams Cos. investor relations)

Williams formed a JV with GeoSouthern Energy in 2021 to develop a block of Haynesville acreage near GeoSouthern’s existing acreage. (Source: Williams Cos. investor relations)

AloJapan.com