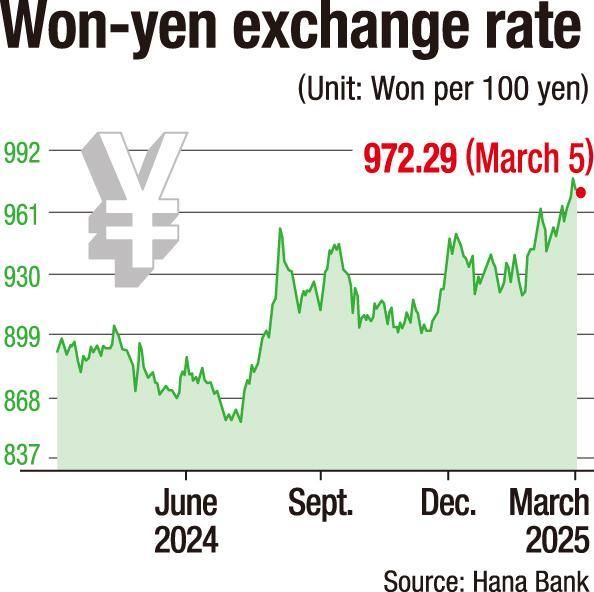

Korean won weakens as yen surges to 21-month high

The won-yen exchange rate is nearing 980 won ($0.67) per 100 yen, marking its highest level in 21 months and making trips to Japan more expensive, experts said Wednesday. A stronger yen also gives Korean exporters an edge over their Japanese rivals in global markets.

According to Hana Bank, the won-yen exchange rate closed at 972.29 per 100 yen on Wednesday, marking a 6.32 won decline from Tuesday. This slight drop follows Tuesday’s peak, the highest since May 16, 2023, when it hit 984.37 won.

The yen’s appreciation is being driven by Japan’s accelerating inflation, which has raised expectations that the Bank of Japan (BOJ) will increase its benchmark interest rate in a monetary policy meeting within the first half of this year. If an additional hike increases the rate to 0.75 percent, it would be its highest level in 30 years.

In February, the yen strengthened by more than 3 percent against the U.S. dollar, whereas the Korean won weakened by 0.45 percent.

“The Japanese currency is relatively less affected by Trump’s tariff policies, whereas the Korean won is more sensitive,” Shinhan Bank economist Paik Seok-hyun said. “Japan has a lower reliance on trade and is not a primary target of U.S. trade measures, whereas Korea has a higher trade dependence.”

The rising yen is expected to put the brakes on Korea’s Japan-bound travel frenzy.

In 2024, a weak yen, combined with pent-up demand from the COVID-19 era, sent Korean tourists flocking to Japan in record numbers.

According to the Korea Tourism Organization, 8.82 million out of 28.69 million outbound Korean travelers last year visited Japan — a 26.7 percent increase from 2023. The number far exceeded those traveling to other destinations such as China, Taiwan, the U.S. and Hong Kong.

But the tide may be turning. “The weak yen has been jet fuel for outbound travel. If the yen continues to strengthen, it could hit the brakes on the trend,” an official at a domestic tourism company said.

This will help shrink Korea’s persistent travel deficit, which has been in the red for 26 consecutive years. In 2024, the travel balance posted a $12.5 billion shortfall.

An employee at Hana Bank fans a handful of Japanese yen at the bank’s headquarters in Seoul, July 2, 2024. Newsis

In addition, the shifting currency dynamics could benefit Korean exporters by enhancing their price competitiveness abroad.

Japan is Korea’s biggest export rival, with nine out of 10 major export items overlapping between the two countries, according to the Korea Trade-Investment Promotion Agency. Key industries affected include semiconductors, automobiles and parts and ships, as well as medical, precision and optical equipment.

“A stronger yen could boost export competitiveness and potentially shift investor interest away from the Japanese stock market, which had benefitted from the prolonged weak yen, toward Korea and other Asian markets,” iM Securities researcher Park Sang-hyun said.

The strong yen will likely continue for some time, with the currency strengthening at a measured pace rather than surging suddenly, experts say.

“The BOJ is expected to curb the yen’s further appreciation by adjusting the timing of rate hikes and the pace of government bond purchases. However, the potential for a strong yen remains throughout the year,” Park said.

While concerns over yen carry trades are resurfacing, experts believe the direct impact will be minimal this time. This is due to the expected gradual monetary policy adjustments by the Federal Reserve and the BOJ, which will lead to only small fluctuations in the U.S.-Japan interest rate gap.

The yen carry trade strategy involves borrowing yen at low interest rates to invest in higher-yielding assets, such as the U.S. dollar. When the BOJ raised interest rates last year, global stock markets experienced a sharp decline in early August as investors rushed to unwind their positions.

Meanwhile, a growing number of Koreans are cashing in on profits from their yen deposits. When the yen hit a record low in 2024, many Koreans seized the opportunity to buy, betting on its eventual rebound.

In February, yen-denominated deposits at Korea’s five major banks — KB Kookmin, Shinhan, Hana, Woori and NH NongHyup — fell by 246.3 billion yen from the previous month, totaling 823 billion yen.

AloJapan.com