Japan Metropolitan Fund Investment (TSE:8953) has been on the radar for many investors recently, especially as its share price has quietly crept up without a major headline event to point to. For those weighing their next move, this subtle uptick can feel like a silent signal, inviting questions about what the market might be seeing or if something deeper is at play beneath the surface.

Looking back, the company has built momentum over the past year. Shares have gained 22% over the period, and growth in the past 3 months has picked up with a 14% climb. Even on shorter timeframes like the past week, performance continues trending upward. These positive moves follow a steady record of revenue and net income growth, underscoring gradual increases in both confidence and expectations.

With all these factors in mind, it’s only natural to ask if the current price tag for Japan Metropolitan Fund Investment is a bargain, or if the market has already accounted for the fund’s future prospects.

Price-to-Earnings of 23.3x: Is it justified?

Japan Metropolitan Fund Investment is currently valued at a price-to-earnings (P/E) ratio of 23.3x. This multiple is higher than the broader Asian Retail REITs industry average of 15.9x, suggesting a notable premium.

The price-to-earnings ratio reflects how much investors are willing to pay for each yen of the company’s earnings. In the context of real estate investment trusts, a higher P/E may signal expectations for future earnings growth, stable income, or a strong operating track record relative to peers.

With the company trading at a substantial premium to the industry average, the market appears to be pricing in a higher level of growth or superior earnings quality. However, investors should consider whether this optimism is justified given Japan Metropolitan Fund Investment’s earnings outlook and competitive position.

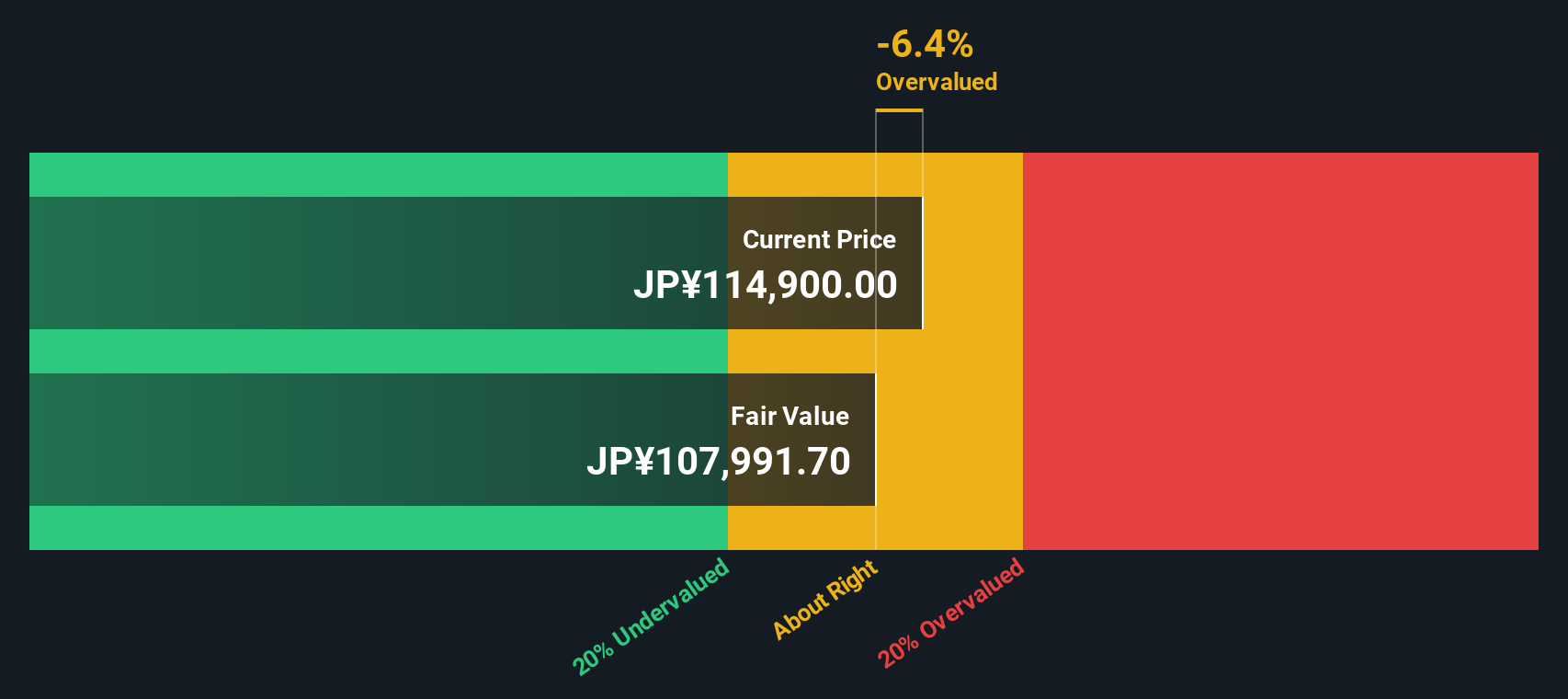

Result: Fair Value of ¥107,991.7 (OVERVALUED)

See our latest analysis for Japan Metropolitan Fund Investment.

However, slowing revenue growth or a shift in investor sentiment could quickly challenge the optimism that is currently priced into Japan Metropolitan Fund Investment shares.

Find out about the key risks to this Japan Metropolitan Fund Investment narrative. Another View: What Does the SWS DCF Model Say?

Looking at Japan Metropolitan Fund Investment through the lens of our DCF model, the story challenges the earlier valuation. This approach suggests the shares may be overvalued based on future cash flows. Could the market be pricing in more optimism than these projections support?

Look into how the SWS DCF model arrives at its fair value.  8953 Discounted Cash Flow as at Sep 2025 Stay updated when valuation signals shift by adding Japan Metropolitan Fund Investment to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

8953 Discounted Cash Flow as at Sep 2025 Stay updated when valuation signals shift by adding Japan Metropolitan Fund Investment to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Japan Metropolitan Fund Investment Narrative

If you have a different perspective or would rather dig into the figures on your own, you can easily craft your own view in just a few minutes, so Do it your way.

A great starting point for your Japan Metropolitan Fund Investment research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let valuable opportunities slip by. Supercharge your portfolio with strategies tailored to your interests and goals, using these powerful stock idea engines:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com