Japan Airport Terminal (TSE:9706) has attracted attention from many investors recently, even without a major headline or notable event. Sometimes, the absence of news itself can make a stock movement interesting and worth a closer look. When there is no clear catalyst, price movements may tell their own story and leave investors wondering if there is a hidden signal about where this company is headed.

Looking at the bigger picture, Japan Airport Terminal’s stock has slipped around 2% over the past year, despite a rebound of 13% in the past three months. The longer-term perspective is mixed: the stock is up about 6% in five years, but down nearly 19% over the last three. Revenue has grown annually, even as net income has dipped, suggesting shifting conditions beneath the surface. Momentum appears to be building for now after a tougher run earlier in the year.

With the stock trending upward in recent months, investors may be considering whether the market is overlooking value here or already factoring future growth into the price.

Price-to-Earnings of 16.2x: Is it justified?

Japan Airport Terminal currently trades at a price-to-earnings (P/E) ratio of 16.2, slightly above the average for its peers in the infrastructure sector and the broader Asian market. Compared to the peer average of 16.1x and the Asian Infrastructure industry average of 13.5x, this valuation suggests a premium relative to similar companies in the region.

The price-to-earnings ratio looks at how much investors are willing to pay today for a unit of the company’s recent earnings. In sectors such as infrastructure, this multiple is important because it reflects current profitability and investor expectations for future earnings stability or growth.

This modestly elevated multiple may indicate that investors are expecting steadier or stronger earnings going forward, but it also raises the possibility that the stock could be overvalued based on current and forecast profitability.

Result: Fair Value of ¥5,986 (OVERVALUED)

See our latest analysis for Japan Airport Terminal.

However, external shocks to travel demand or ongoing declines in net income could quickly reverse recent momentum for Japan Airport Terminal shares.

Find out about the key risks to this Japan Airport Terminal narrative. Another View: The SWS DCF Model

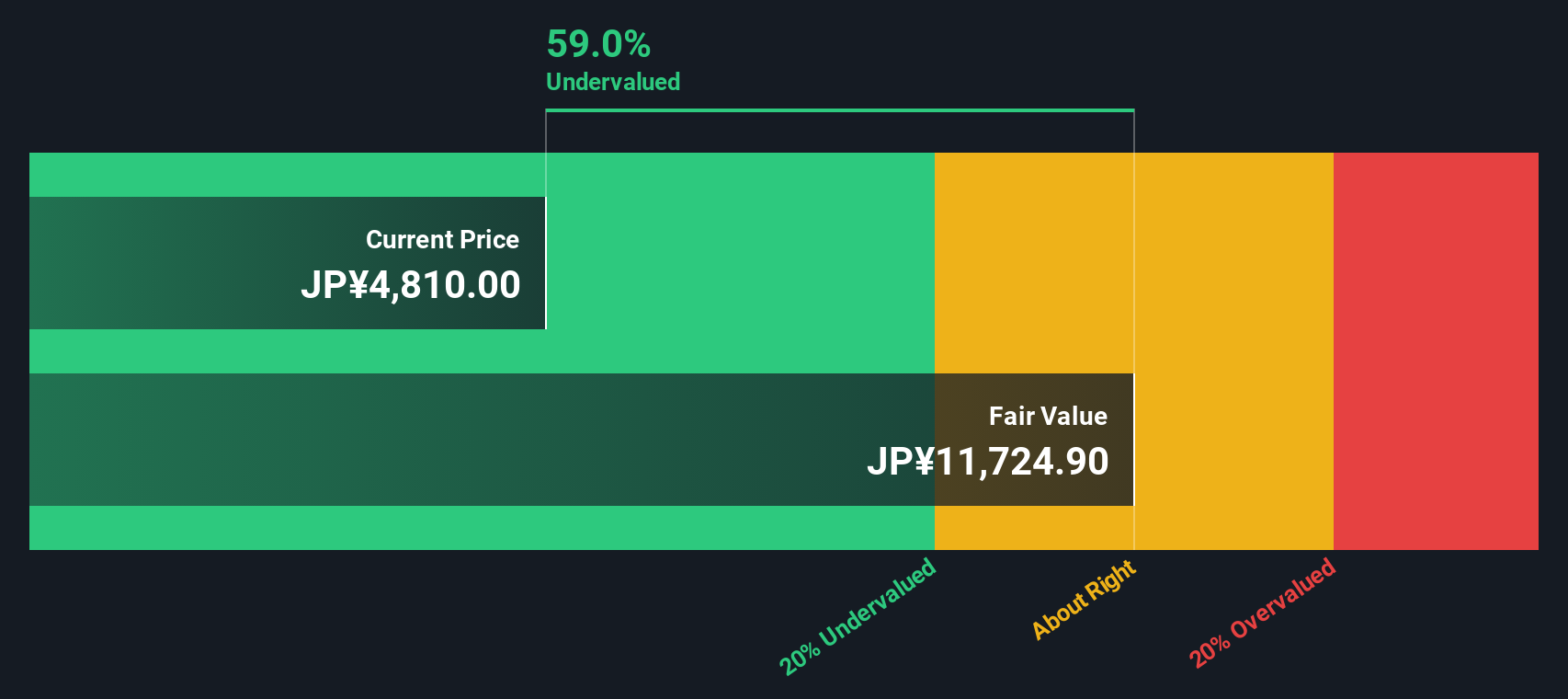

While market multiples suggest Japan Airport Terminal is overvalued compared to industry standards, our SWS DCF model offers a more optimistic perspective and indicates the stock may actually be undervalued. Which method tells the true story?

Look into how the SWS DCF model arrives at its fair value.

9706 Discounted Cash Flow as at Sep 2025

9706 Discounted Cash Flow as at Sep 2025

Stay updated when valuation signals shift by adding Japan Airport Terminal to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Japan Airport Terminal Narrative

Readers who wish to dig deeper or reach their own conclusions can quickly explore the available data and put together a personal analysis of the story: Do it your way.

A great starting point for your Japan Airport Terminal research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Great investing happens when you act ahead of the crowd. The Simply Wall Street Screener shines a spotlight on unique opportunities you might otherwise miss. Give yourself an edge by checking out these standout ideas today:

Boost your search for undervalued stocks with strong upside by using our undervalued stocks based on cash flows, a tool designed to highlight companies whose prices may not reflect their true earning potential. Start building a portfolio of companies that are part of the AI wave by taking advantage of our AI penny stocks, which helps you spot businesses driving the future of artificial intelligence. Maximize your income with stocks offering impressive yields over 3 percent, all easily found through our dividend stocks with yields > 3% that puts high-performing dividend payers front and center.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com