If you have been following Okinawa Cellular Telephone (TSE:9436), you might have noticed the recent movement in its share price. While no major news headlines have surfaced, the stock’s performance over the past months could still be raising questions for investors. Moves like these can spark curiosity; is there some underlying shift in sentiment, or is it simply part of the regular ebb and flow?

Despite the lack of a specific event, Okinawa Cellular Telephone has quietly delivered a solid year. The stock is up over 32% compared to a year ago and has gained nearly 22% since the start of the year. Shorter-term momentum has picked up too, with shares rising more than 7% over the past three months, even though the previous month saw a slight pullback. With annual revenue and net income both showing growth, the company continues to build on its long-term track record.

After this steady performance, and in the absence of obvious catalysts, should investors see Okinawa Cellular Telephone as overlooked value or has the market already priced in future growth?

Price-to-Earnings of 19.4x: Is it justified?

Based on its price-to-earnings (P/E) ratio, Okinawa Cellular Telephone appears attractively valued compared to its peers. The company’s P/E ratio of 19.4x is considerably lower than the sector average of 59.6x. This suggests it is trading at a more moderate valuation than other companies in the industry.

The P/E ratio measures how much investors are willing to pay for each yen of current earnings. It is especially relevant for telecom firms like Okinawa Cellular Telephone, which often enjoy steady profit streams but experience slower growth compared to other industries. A lower P/E can signal that the market has modest expectations or may have overlooked the company’s consistent earnings growth.

This valuation implies that investors may be cautious about future growth prospects, or it could mean the company offers an opportunity for value-oriented investors if performance continues to improve.

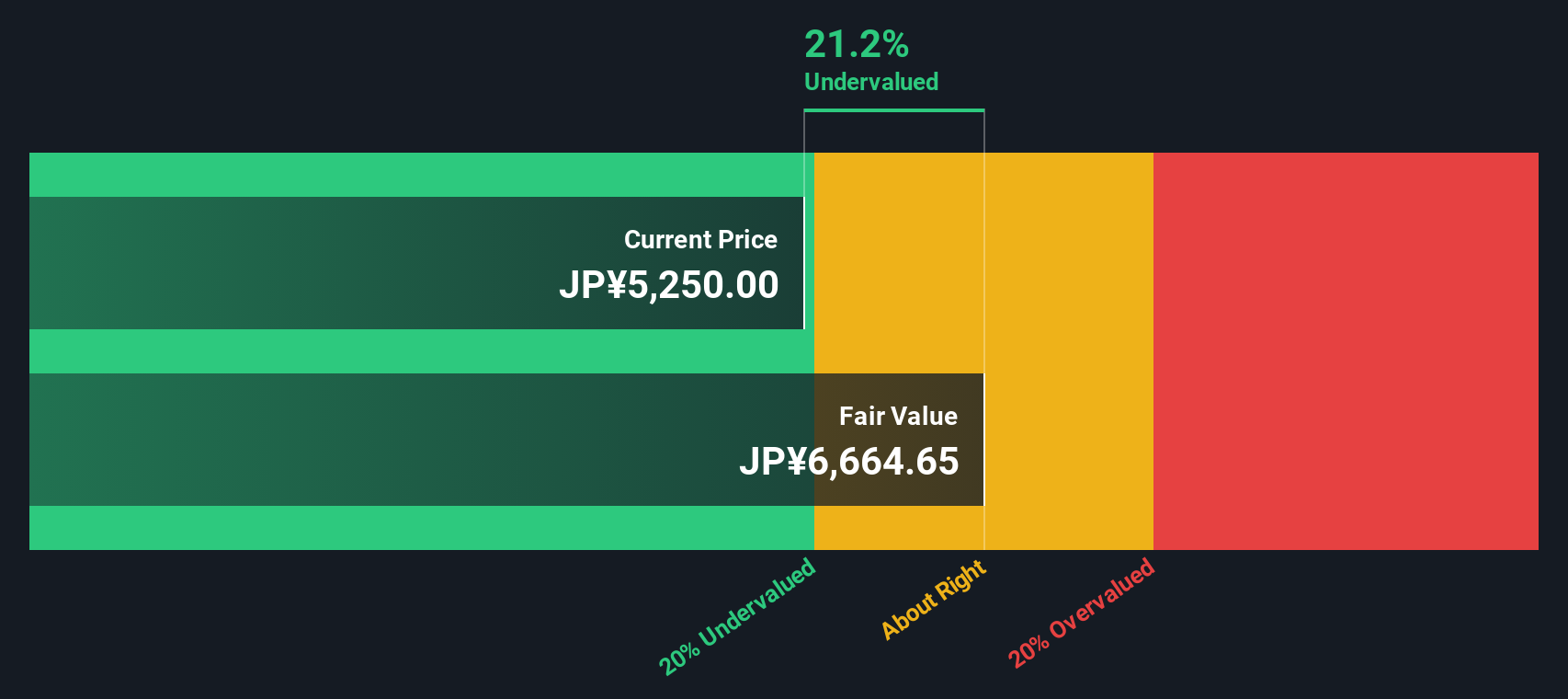

Result: Fair Value of ¥6,664.65 (UNDERVALUED)

See our latest analysis for Okinawa Cellular Telephone.

However, risks remain if revenue growth slows or if market sentiment shifts. This could result in renewed pressure on Okinawa Cellular Telephone’s share price.

Find out about the key risks to this Okinawa Cellular Telephone narrative. Another View: What Does the SWS DCF Model Suggest?

Looking at Okinawa Cellular Telephone through the lens of our DCF model, a different picture starts to emerge. This approach also points to the shares being undervalued, but does it back up what the multiples say, or challenge it? The answer could depend on how much weight you put on each method. Where would you lean?

Look into how the SWS DCF model arrives at its fair value.  9436 Discounted Cash Flow as at Sep 2025 Stay updated when valuation signals shift by adding Okinawa Cellular Telephone to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

9436 Discounted Cash Flow as at Sep 2025 Stay updated when valuation signals shift by adding Okinawa Cellular Telephone to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Okinawa Cellular Telephone Narrative

If you have your own perspective or wish to dig deeper into the numbers, you can easily put together your own view in just a few minutes using the available tools. This allows you to shape your personal investment story. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Okinawa Cellular Telephone.

Looking for More Smart Investment Opportunities?

Don’t stop with just one insight. Make your portfolio work harder by uncovering standout stocks, high-value assets, and emerging industries that others might overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com