Oracle Corporation Japan (TSE:4716) experienced a 10% share price increase last week amid a tech-heavy market. While the Nasdaq surged to a record high driven by gains in major tech stocks, Oracle Japan’s performance stood out in a week marked by positive consumer price data and anticipation of potential Federal Reserve interest rate cuts. Although the stock’s rise substantially outpaced the general market, which saw a modest 1.8% increase, it’s important to note that overall investor confidence in the tech sector was elevated, aligning Oracle Japan’s gains with broader favorable trends, rather than solely relying on company-specific events.

Buy, Hold or Sell Oracle Corporation Japan? View our complete analysis and fair value estimate and you decide.

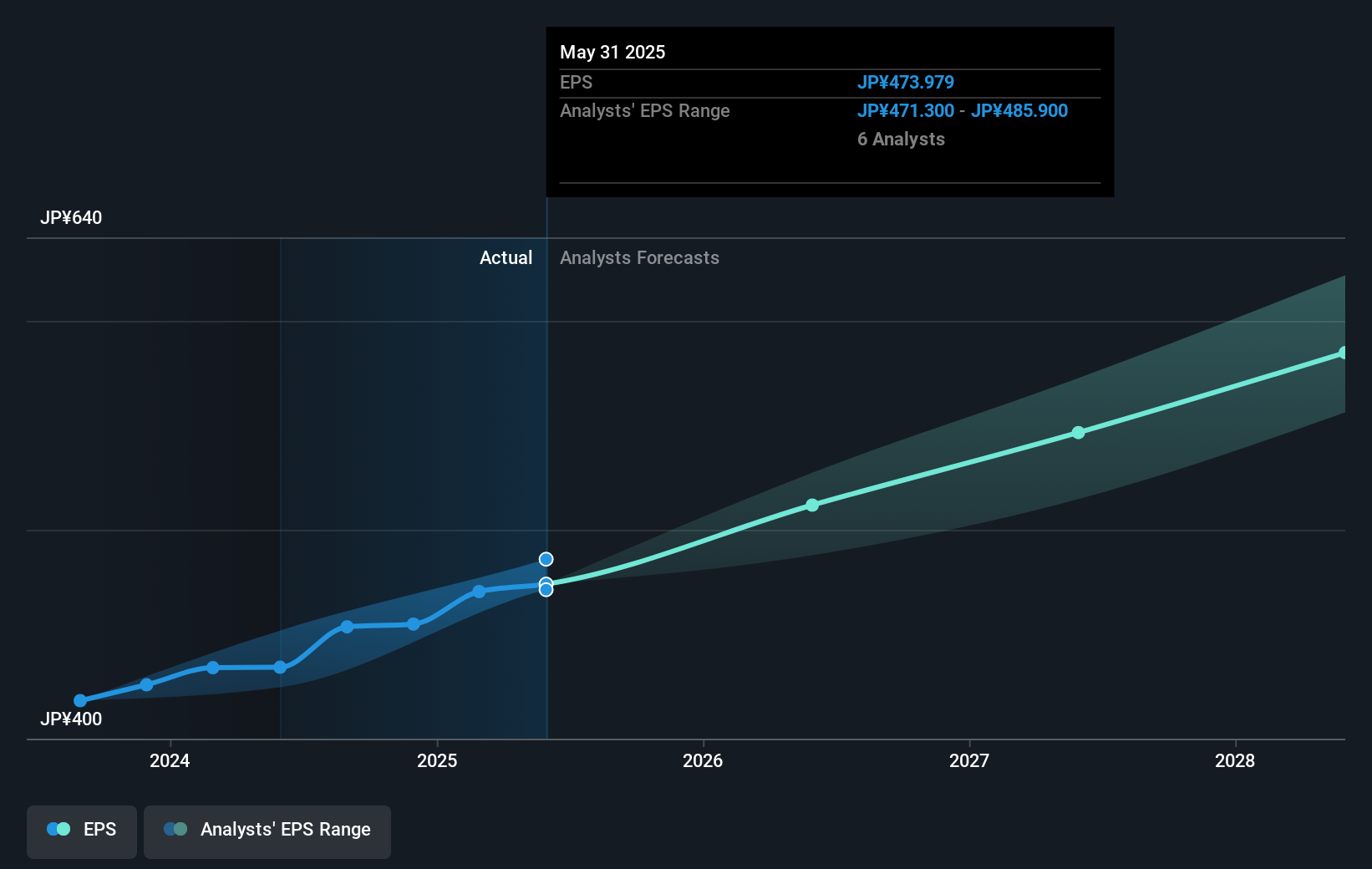

TSE:4716 Earnings Per Share Growth as at Sep 2025

TSE:4716 Earnings Per Share Growth as at Sep 2025

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

The recent surge in Oracle Corporation Japan’s share price, which rose 10% in just a week, highlights a significant market reaction amidst broader tech sector enthusiasm. While the immediate rise may align with positive market conditions and prospective Federal Reserve policy changes, the longer-term investment story reflects a more nuanced performance. Over the past three years, Oracle Japan’s total return, including both share price appreciation and dividends, reached 125.92%, underscoring a robust growth trajectory. This longer-term performance stands in stark contrast to its 1-year return, which matched the JP Market at 20.6%, but did not exceed the exceptional growth seen within the JP Software industry at 15.9%.

The recent news could bolster revenue and earnings forecasts if Oracle Japan effectively capitalizes on increased cloud service demand and enhances strategic collaborations, particularly with Toyota. Given the current focus on cloud services and AI, the anticipated improvements in client migrations, efficiencies, and margins may contribute to sustained financial growth. However, the company’s current share price of ¥16,480 still represents a 6.92% discount to the analyst consensus price target of ¥17,620. This suggests potential future upside, albeit tempered by the higher valuation multiples compared to the industry. Investors should critically assess whether the expected growth aligns with these valuation benchmarks in light of current market dynamics.

Gain insights into Oracle Corporation Japan’s past trends and performance with our report on the company’s historical track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AloJapan.com