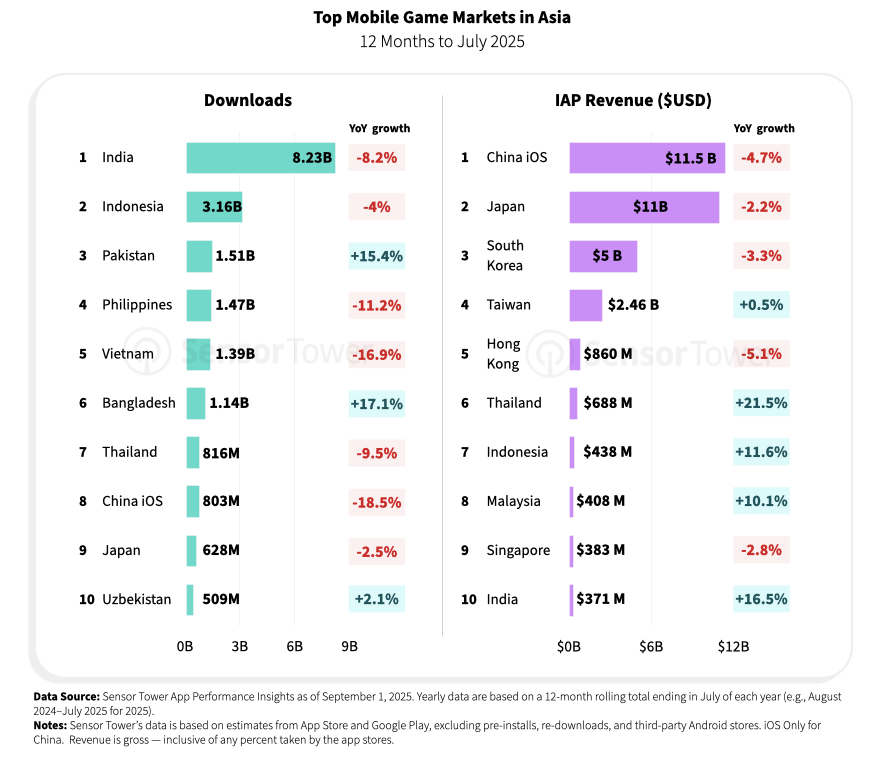

In 2025, Japan reaffirmed its position as a global mobile gaming powerhouse, generating $11 billion in IAP revenue—ranking second only to China’s iOS market in Asia. While downloads held at a more modest 628 million, this performance underscores the resilience of Japan’s mature gaming ecosystem, shaped by decades of console heritage, iconic IPs, and a culture where gaming is deeply embedded in daily life.

Japan’s defining advantage remains its exceptionally high ARPU. Despite slight market contraction, the country continues to deliver outsized profitability, driven by loyal player bases and efficient monetization strategies. This dynamic reinforces Japan’s role as one of the world’s most lucrative and strategically important mobile gaming markets.

Note: The download data in this report are based on estimated downloads from the App Store and Google Play, excluding pre-installs, re-downloads, and downloads from third-party Android marketplaces. Google Play is not available in Mainland China.

For more insights, please click the button below to view the full report for free.

Japan Mobile Games: Sustained IAP Spending as Downloads Plateau

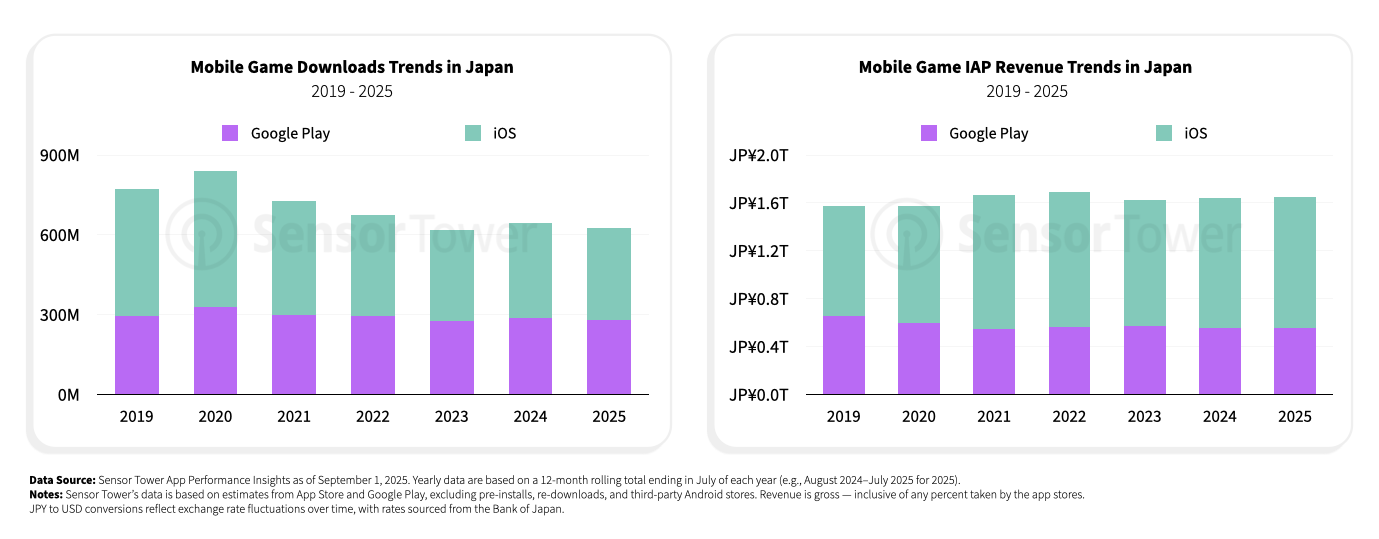

Japan’s mobile game downloads have plateaued since peaking in 2020, stabilizing above 600 Million annually. iOS continues to lead, underscoring Apple’s dominance, while Google Play holds a steady but smaller share, reflecting long-standing platform preferences.

Despite declining downloads, IAP revenue remains strong, consistently exceeding JP¥1.6 trillion. iOS drives the majority of spend through its high-value users, while Google Play contributes steady growth. This highlights Japan’s mature, loyal market, where retention and monetization sustain revenues even amid slowing user acquisition.

Japan’s 2025 Mobile Game Leaders: Pokémon Surges, Strategy Genre Expands

Pokémon TCG Pocket claimed the top revenue spot in Japan, highlighting the enduring strength of established IPs. Strategy titles surged, with Whiteout Survival entering the top 10, while RPG stalwarts Monster Strike and Fate/Grand Order remain firmly in the top 10, underscoring their enduring relevance even as player attention shifts within Japan’s competitive market.

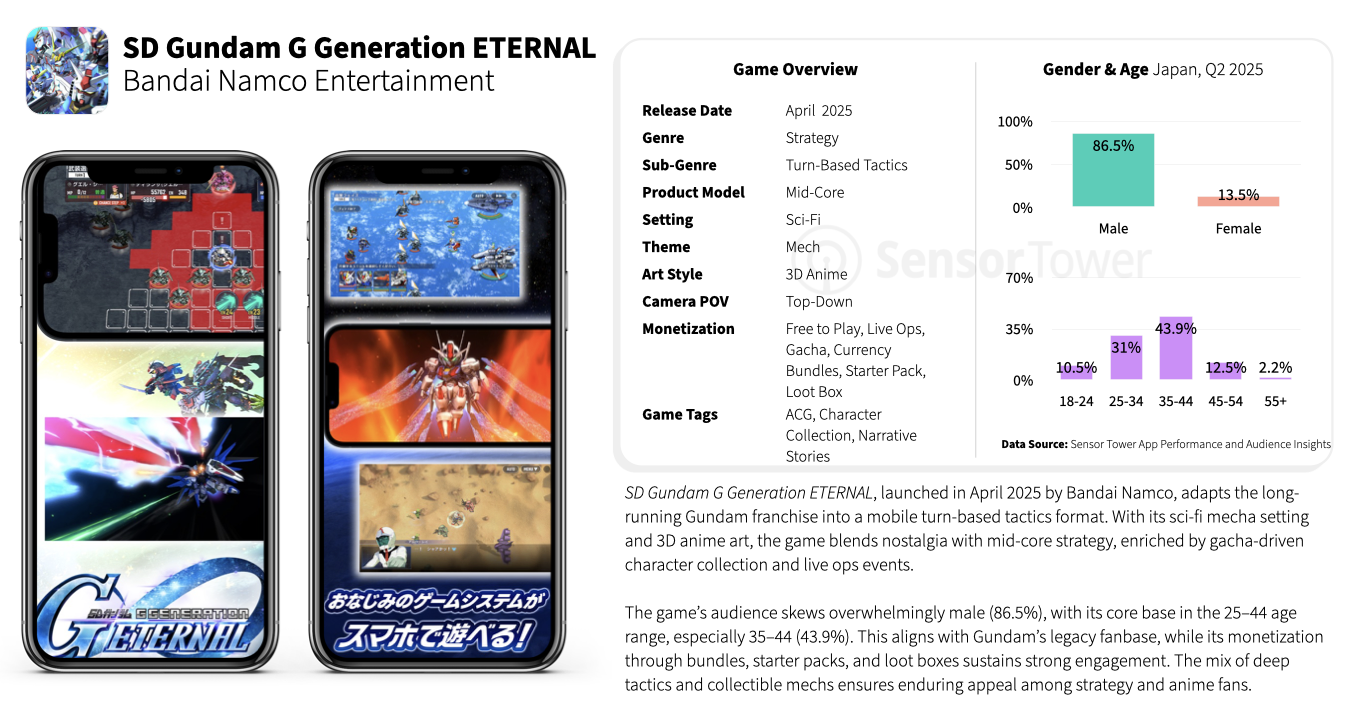

Revenue growth rankings emphasize emerging hits and genre diversification. SD Gundam G Generation ETERNAL and Shadowverse: Worlds Beyond debuted strongly, while The Battle Cats and Gossip Harbor posted remarkable climbs. This signals robust demand for both nostalgic franchises and new mechanics, driving growth opportunities across card battlers, RPGs, and strategy subgenres.

Japan HQ’d Publishers Maintains Download Leadership While Expanding Revenue Share

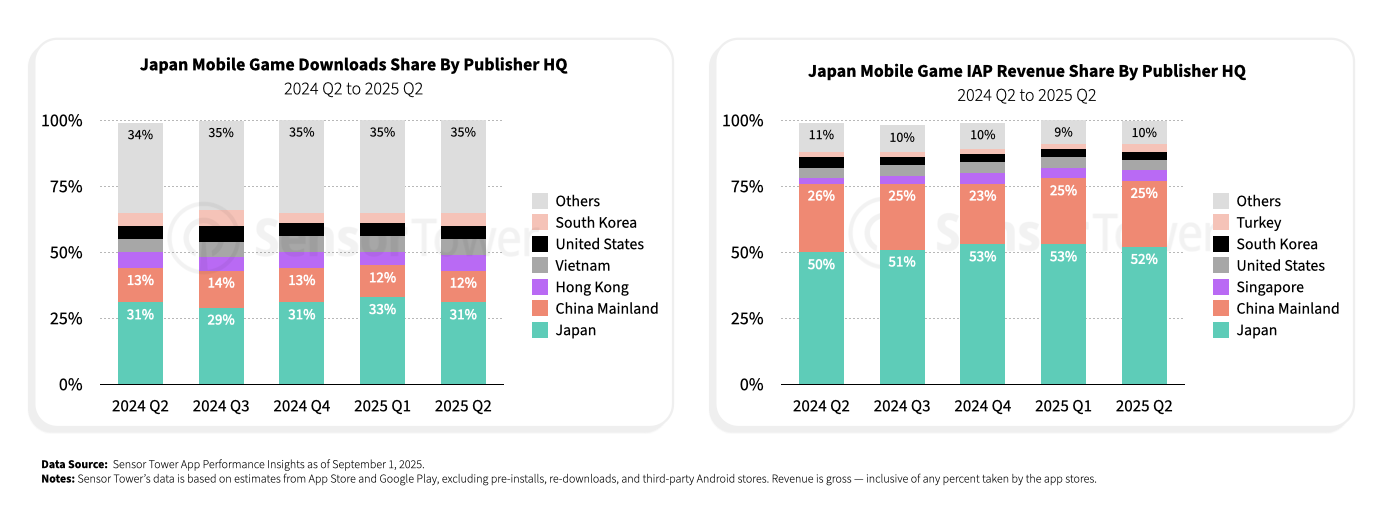

Japan HQ Publishers continues to lead domestic mobile game downloads, consistently holding around one-third of market share despite rising global competition. This highlights the strength of homegrown publishers in sustaining engagement across both core and casual gaming genres.

On the revenue side, Japan’s dominance has grown even stronger. Local publishers now capture more than half of total IAP revenue, reflecting successful monetization models and loyal high-spending audiences that reinforce Japan’s global leadership in mobile game profitability.

In Japan, non-domestic publishers are increasingly competitive, with 4X strategy titles like Last War: Survival and Whiteout Survival topping revenue charts. RPG hits such as Honkai: Star Rail and Genshin Impact also maintained strong positions, showing that international studios can capture loyal, high-spending audiences. On downloads, casual puzzle games from overseas publishers—Block Blast!, Color Block Jam, and Car Jam—dominate rankings, proving that accessible, universal gameplay can break into Japan’s traditionally IP-driven market. Success for non-domestic titles lies in combining mass-appeal mechanics with consistent live ops to engage both casual and core Japanese gamers.

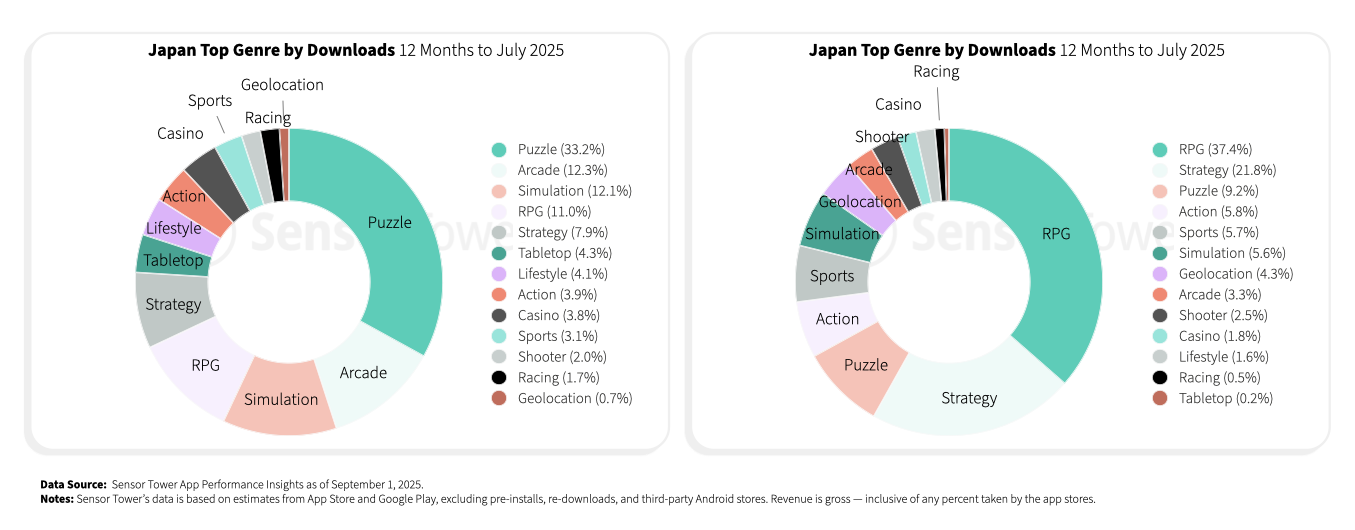

Japan’s Mobile Game Market: Puzzle Dominates Downloads, RPGs Lead Revenue

Puzzle games account for one-third of downloads, reflecting mass appeal and accessibility, while Arcade and Simulation follow. Casual genres continue to drive broad adoption, securing high visibility across Japan’s mobile app ecosystem despite lower long-term monetization potential.

Revenue trends tell a different story—RPGs dominate with over one-third share, supported by Strategy titles at nearly 22%. Deep narrative content, gacha mechanics, and event-driven monetization ensure RPGs remain Japan’s most profitable genre, balancing casual adoption with high-value core player spending.

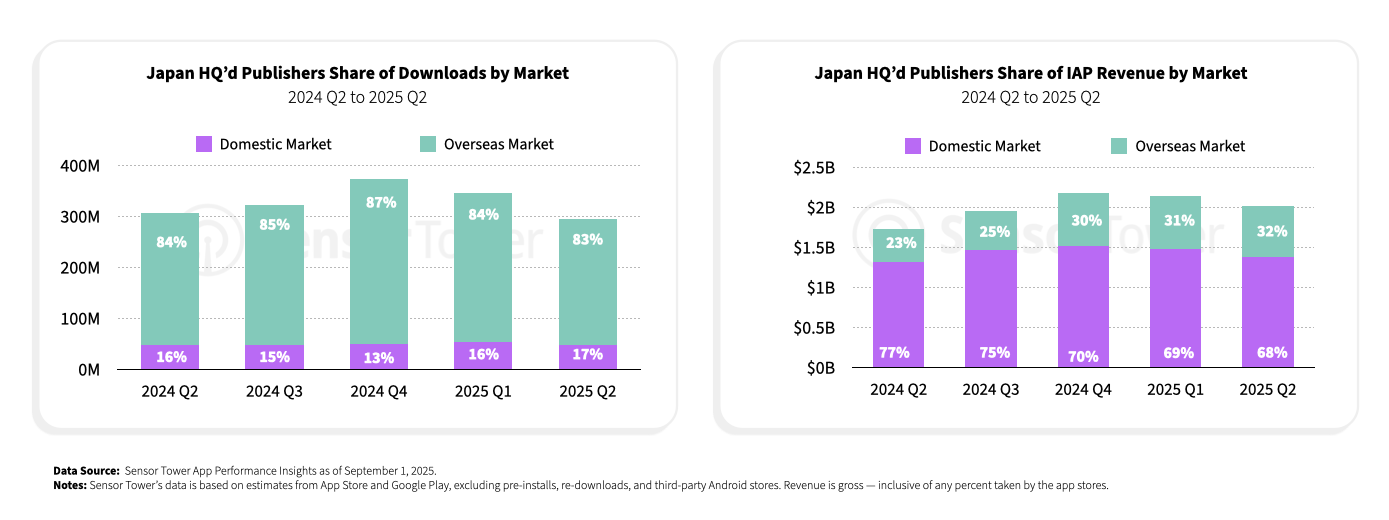

Japan-Based Publishers Maintain Domestic Strength While Tapping Overseas Revenue Growth

Japanese mobile game developers exert strong global influence, with the majority of downloads coming from overseas markets. This underscores Japan’s role as a major content exporter, as their titles attract international audiences across diverse genres. Despite this global scale, revenue remains heavily domestic-driven. Over two-thirds of IAP earnings still originate in Japan, where high-value local players fuel consistent monetization. This dual dynamic highlights Japan’s export strength in downloads but continued reliance on domestic spending power for revenue leadership.

Kayac and Sega drive global downloads with casual hits like Number Master: Run and merge and Sonic Dash, while Pokémon remains a strong contender. Smaller publishers like Geisha Tokyo and Tokyo Communications also highlight the breadth of Japan’s export-driven mobile gaming ecosystem.

Revenue leadership is anchored by Bandai Namco, The Pokémon Company, and Konami, fueled by iconic IPs including Dragon Ball Z Dokkan Battle, Pokémon TCG Pocket, and eFootball. Rising performers like Umamusume and Dragon Quest Walk underscore Japan’s dominance in sustaining high-spending, loyal player bases.

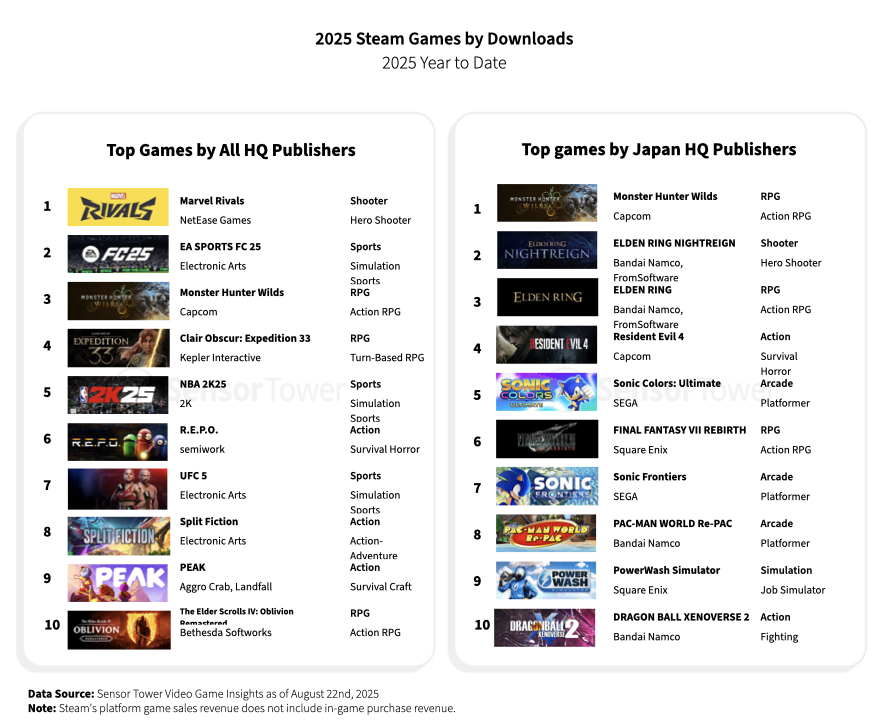

Japanese Publishers Secure Strong Presence on Steam’s Global Revenue Charts

Japan maintains a powerful footprint on Steam, with Bandai Namco, SEGA, and Capcom ranking among the global top ten publishers by all-time revenue. Their AAA portfolios highlight Japan’s continued strength in cross-platform gaming.

Global downloads were led by shooters and sports titles such as Marvel Rivals and EA Sports FC 25, while RPGs like Clair Obscur: Expedition 33 also showed strong traction, reflecting a broad appetite for immersive, competitive, and action-driven experiences.

Japanese publishers stood out with hits like Monster Hunter Wilds, Elden Ring, and Resident Evil 4, underscoring their dominance in RPG and action genres. SEGA’s Sonic franchise and Pac-Man reboots highlight Japan’s enduring influence in arcade and platformer gaming.

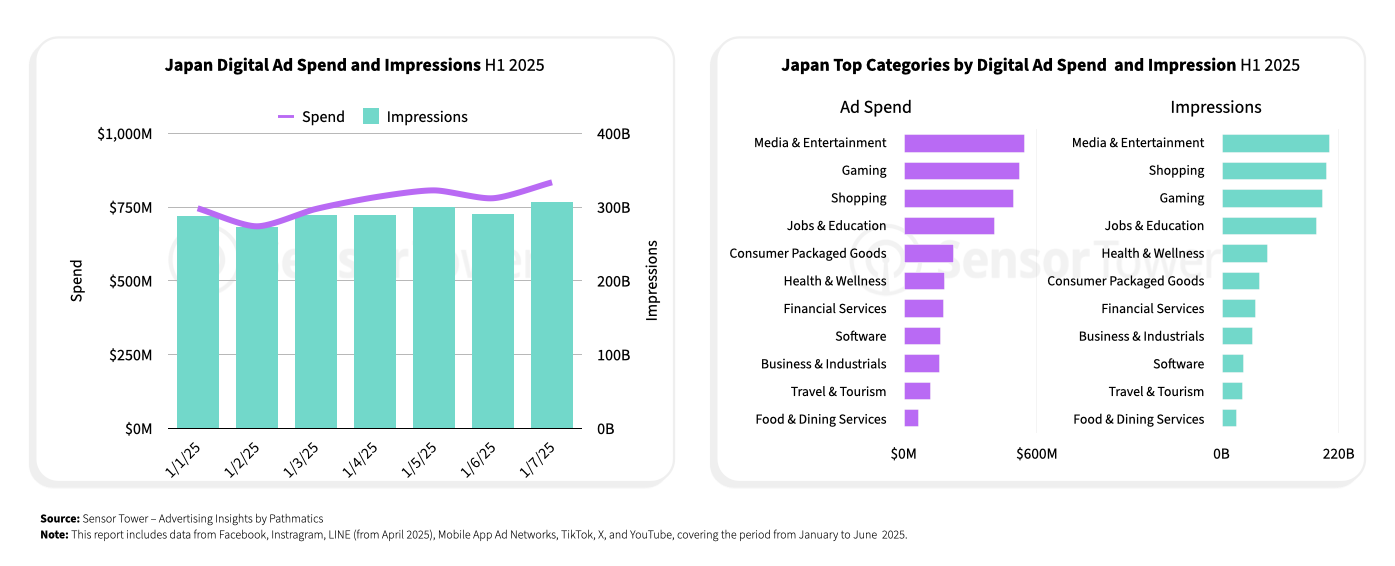

Gaming Emerges as a Core Growth Driver in Japan’s Digital Advertising

Japan’s digital ad spend in H1 2025 remained steady at around $750M monthly, with impressions surpassing 300B. Media & Entertainment led overall investment, but Gaming secured a top-three position, signaling its critical role in digital ad growth.

Gaming’s prominence highlights rising competition for player attention across PC, console, and mobile. With impressions rivaling shopping and entertainment, the sector demonstrates its influence as both a cultural and commercial driver, reinforcing gaming’s importance in Japan’s digital advertising landscape.

Looking Ahead: The Future of Japan Gaming

As Japan’s gaming market evolves, publishers face the challenge of sustaining high-value monetization while appealing to a broadening audience across mobile, PC, and console. With a mature player base, entrenched cultural affinity for gaming, and growing global influence, Japan remains one of the world’s most lucrative yet competitive markets.

For a deeper look at Japan’s mobile, PC, console, and advertising trends—along with genre insights, publisher strategies, and case studies of standout titles—download the full report below.

AloJapan.com