According to Spheric Research’s ranking of land-based aquaculture projects around the world, Japan is the field’s leader — and its forward-thinking attitude could be a big part of why.

At the World Expo 2025 in Osaka, Japan, the country’s largest conveyor-belt sushi chain, Sushiro, is hosting an eco-conscious, futuristic pop-up restaurant at which all the fish is farmed.

While farmed fish can be a taboo topic in European and US restaurants due to negative consumer perceptions, Sushiro is adopting a “farmed is good” marketing strategy, aligning aquaculture with sustainability.

Japan was a net seafood exporter back in the 1960s, but now relies on other countries for half its seafood needs, with imports reaching $16 billion in 2023. Japan has struggled to build a coastal aquaculture industry beyond yellowtail kingfish, whose producers are suffering from low prices, rising sea temperatures, and aging farmers retiring or quitting early.

Highly automated land-based aquaculture could help Japan reduce its dependence on imported seafood. Just a short drive from Osaka in Tsu City, a dozen bulldozers are preparing the site that will host Asia’s largest recirculating aquaculture system (RAS) salmon farm. Abu Dhabi-based Pure Salmon chose Japan to host the first of several RAS salmon farms that it plans to build around the world.

Pure Salmon’s warm welcome in Japan contrasts with the red tape and local hostility the company encountered in the US and France. The governor of Mie Prefecture personally helped Pure Salmon locate a site for its proposed farm that will produce 10,000 metric tons per year when fully operational. Real estate company Mori Trust invested in Pure Salmon’s local subsidiary, which also obtained a loan from Sumitomo Mitsui Banking Corporation.

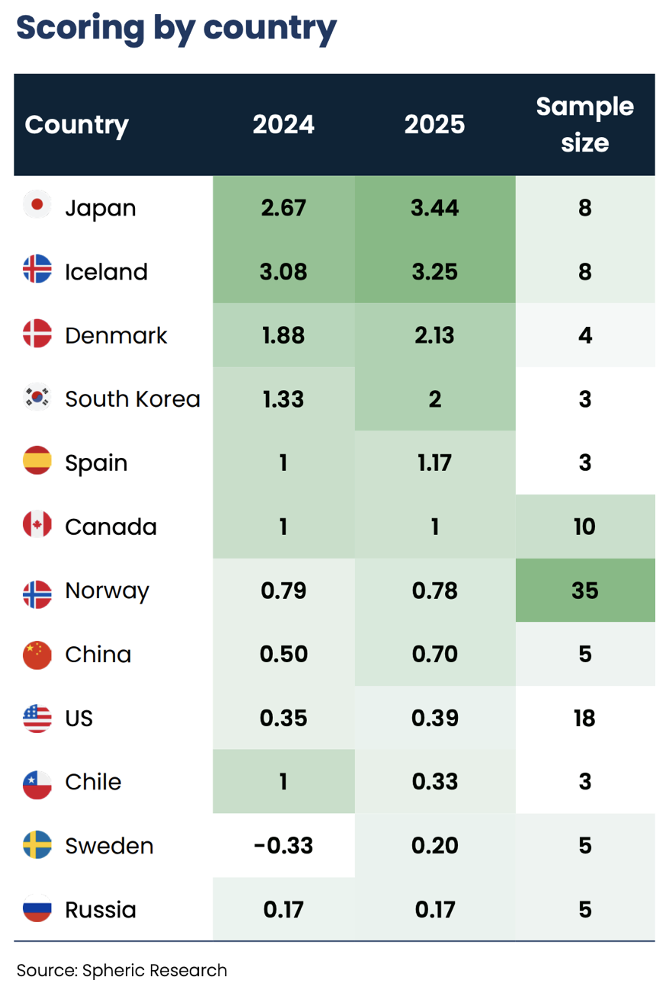

Japan’s receptiveness to fish farming explains why it took the top spot in Spheric Research’s proprietary scoring system that ranks countries by their success in nurturing land-based salmon projects from concept to working farms. The scoring system is included in the recently published fifth edition of Spheric Research’s Land-based Aquaculture Report.

Spheric Research only considers countries with at least three projects for its scoring index. Each country’s score is the average of the individual project scores in that country.

It awards one point each for a permitted project, grow-out construction and completed smolt capacity, with half a point assigned for each year of operations. That might not sound like much, but it quickly boosts the standing of the handful of projects with several harvests under their belts.

Expo Osaka aquaponics and fish farming display

Japan and runner-up Iceland have a lot in common when it comes to seafood. Both are major seafood-eating nations with fishing heritages that stretch back hundreds of years. Their respective aquaculture industries also enjoy the financial backing of local institutional investors and established seafood or fishing companies.

Japan’s land-based aquaculture industry still has plenty of room to run. Proximar, a publicly traded Norwegian company, commissioned a 5,300t-per-year RAS salmon farm last year.

FRD Japan Co., whose backers include conglomerate Mitsui & Co., plans to commission a 3,500t trout RAS in 2027, and Kansai Electric Power Co. is backing an indoor shrimp farm.

These projects could be the tip of the iceberg if investors start to repurpose former industrial buildings for aquaculture. Spheric predicts with a high degree of confidence that Japan will continue to be a leading developer of land-based aquaculture projects going forward.

Stay on the pulse

Get recommendations, data, editor’s picks, and the latest news from around the seafood world straight to your in-box.

AloJapan.com