“It’s becoming harder to maintain our margins with the 5% increase in labor costs,” a Japanese grower stresses. Even here, growers cannot escape the increasing numbers, and at the end of the day, the margin stays the same. Or does it? “Luckily, we’re able to slightly increase prices in retail to make sure we’re not losing too much of our profits.”

View the Photo report: 2nd JPFA Symposium, Chiba here.

Most Japanese farms are quite labor-dependent and thus face higher operating costs, which leads them to consider deploying more automation. Bringing us to the next focus of the growers: automation! An often-recurring word at the symposium. To maintain a proper product margin, growers are looking into automating specific processes in their farms. As many Japanese operators have specialized in mass-producing this commodity crop, some of them have omitted automation components. Main areas are: transplanting, harvesting, and packaging, which seem to be ‘easily’ resolved given the abundance of offerings available in the market.

View the Photo report: 2nd JPFA Symposium, Chiba here.

© Rebekka Boekhout | HortiDaily.com

© Rebekka Boekhout | HortiDaily.com

1.2.3. Orange!? Rianne Vink with Dutch Greenhouse Delta, Jeroen Ratterman with Wesenmael Group, Maurice Verbakel with BOAL Systems, Rene Ratterman with Wesemael Group, Remko Bakelaar with GreenSquare International, Johan Kreeft with Gearbox Innovations, and Daisuke Sakurai were all about collaboration.

Automation for the win?

Yet, as seen in last year’s GPEC observation, that’s easier said than done. Solutions provided by overseas suppliers are considered ‘large scale’ and expensive for the level of automation required by domestic growers. Therefore, this narrows options for vertical farm operators. This goes hand in hand with farming software. Despite many farms already utilizing cloud-based management programs, it is now necessary to optimize these systems further to enable better communication between farms that will deploy more automation factors.

View the Photo report: 2nd JPFA Symposium, Chiba here.

The Japanese industry seems to be in the upward curve of a maturing industry, in contrast to other countries. As showcased in the symposium, Japanese researchers are in a more mature stage of the industry curve. Where Western vertical farming companies would raise money to grow fruiting crops, potentially, or even more specifically grow soybeans and rice, Japanese research has already proven to be successful. Of course, this is not Japan-bound research, but rather shifting from potential to accelerating the development of valuable products, such as medicine. For example, Japanese researchers have found that rice-based oral medication is more effective than vaccinations, as it supports the entire immune system. Needless to say, the potential of soybeans is put to work, where trials are held on a larger scale. Previously labeled potential crops are now being realized as commercial projects with domestic businesses.

© Rebekka Boekhout | HortiDaily.com

© Rebekka Boekhout | HortiDaily.com

Dice K. Isayama and Edwin Ong of Arianetech Co. showcasing their growing lights

Collaboration across farms

Transparency is a highly preferred term across global industry players. However, in Japan this is a reality, with operators gathering on a bi-weekly basis to discuss pitfalls, opportunities and create a problem-solving or strategy tackling these. “By sharing data with colleagues, we can prevent issues that others have already faced. As well as, collaboratively tackle demand, and supply to maintain a strong market position,” a Japanese grower shared.

View the Photo report: 2nd JPFA Symposium, Chiba here.

Considered a commodity crop, and priced at a decent 110 – 160 Japanese Yen (0,63 – 0,92 EUR), vertically farmed heads of lettuce build on their consistent quality and price. To meet this constant supply stream, most vertical farms collaborate when a producer cannot meet a supply due to unforeseen circumstances. In this way, vertical farms maintain their strong position in the market and can always meet set contracts.

© Rebekka Boekhout | HortiDaily.com

© Rebekka Boekhout | HortiDaily.com

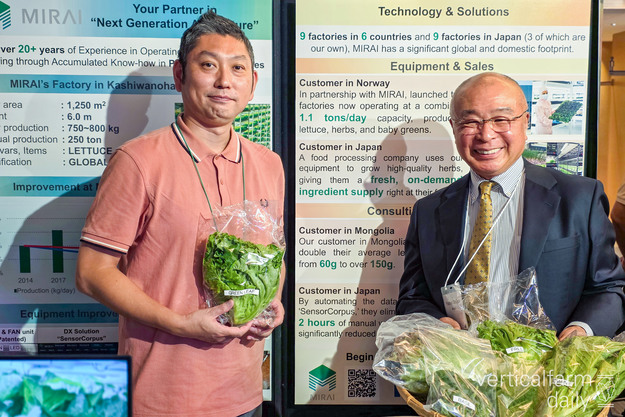

Nagateru Ozawa and Yoshio Shiina with MIRAI showcasing their produce. View the Photo report: 2nd JPFA Symposium, Chiba here.

Greenhouses vs vertical farms

When asked about the subsidies for CEA facilities, polytunnel greenhouses seem to be the most affordable option and are supported by the government. Vertical farms, however, are deemed the next best trustworthy production facilities, along with glass greenhouses. Yet, a supplier explained that it’s prefecture dependent on whether you’d receive a green light or not.

Due to the extreme climate changes, low- to mid-tech glass greenhouses are exposed to tornadoes, floods, and tsunamis, which are a high risk to nature, and mostly, soil. Yet, high-tech greenhouses with firm foundations and robust infrastructure are more resilient to these weather events. Therefore, greenhouses and vertical farms are expected to be the solutions of the future. Hopefully, able to withstand the rising costs, just as the rest of the industry.

This article series is in collaboration with:

Japan Plant Factory Association

Eri Hayashi, President

[email protected]

www.npoplantfactory.org

AloJapan.com