A fifth of Japanese companies use one of Japan’s big three megabanks as their main financial institution.

Heavy Reliance on the “Big Three”

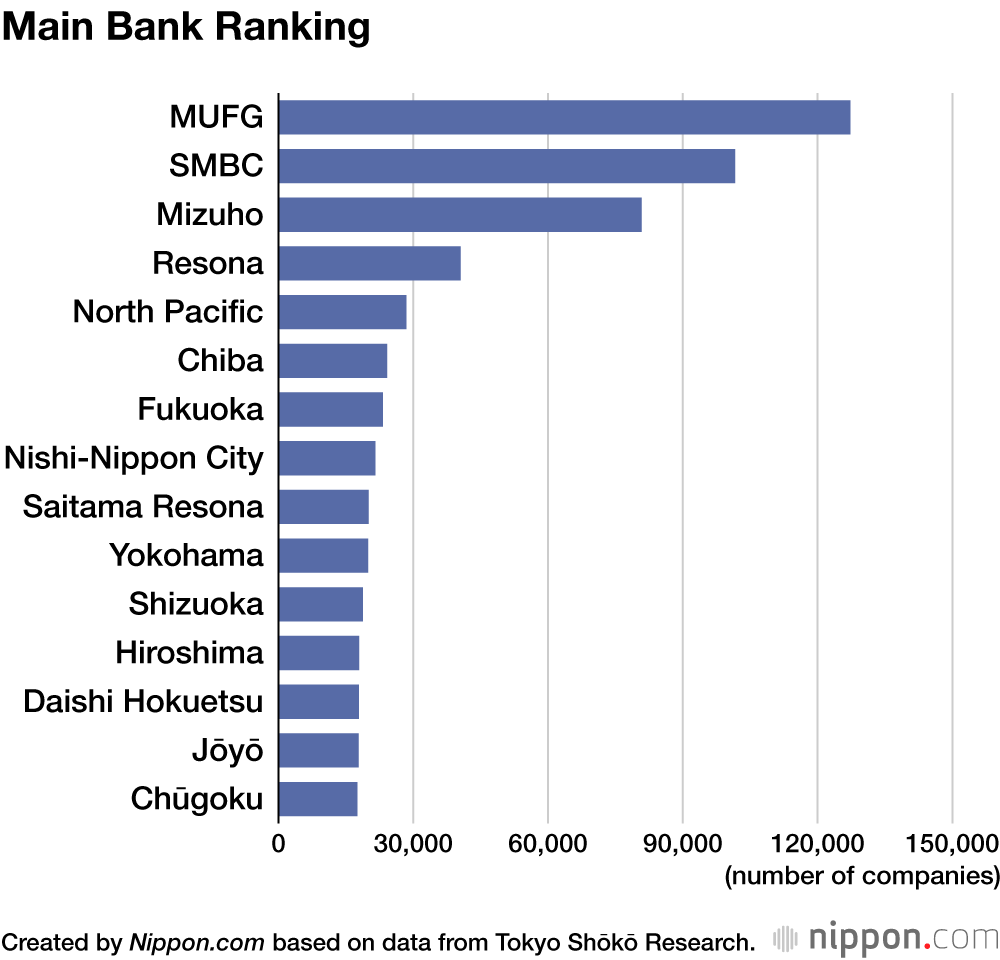

A Tokyo Shōkō Research survey of 1,605,166 companies across Japan found that 127,264, or 7.93%, had MUFG as their main bank. The subsidiary of the Mitsubishi UFJ Financial Group has topped the survey, which was first conducted in 2013, for thirteen consecutive years. Ranking second was SMBC, which was the main bank for 101,697 or 6.34% of the surveyed companies, followed by Mizuho at 80,840 or 5.04%. These three megabanks alone account for 19.3% of client companies. Notably, SMBC has risen above 100,000 and is closing the gap on MUFG, while Mizuho has given up ground to its two leading rivals.

The next highest ranking banks according to the survey were Resona (main bank for 40,511 companies), North Pacific (28,462), Chiba (24,203), and Fukuoka (23,214).

The top-ranked shinkin (regional cooperative) banks in the survey were Kyoto Chūō, Osaka City, and Tama, while the leading shinkumi (credit cooperative) banks were the Ibaraki-ken Credit Cooperative, the Hiroshimashi Credit Cooperative, and the Nagano-ken Shinkumi Bank.

While still small, the internet banking sector is growing in strength, with GMO Aozora Net Bank enjoying the biggest increase in the ranking by far, with a 120.0% growth in client companies to 1,958. In second place, SBI Sumishin Net Bank, set to be acquired by NTT Docomo, saw a 51.1% increase to 1,750, while PayPay Bank (18.6%) and Rakuten Bank (16.9%) also had large rises.

Data Sources

(Translated from Japanese. Banner photo © Pixta.)

AloJapan.com