TSE:5726 1 Year Share Price vs Fair ValueExplore OSAKA Titanium technologiesLtd’s Fair Values from the Community and select yours

TSE:5726 1 Year Share Price vs Fair ValueExplore OSAKA Titanium technologiesLtd’s Fair Values from the Community and select yours

The OSAKA Titanium technologies Co.,Ltd. (TSE:5726) share price has done very well over the last month, posting an excellent gain of 26%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 25% over that time.

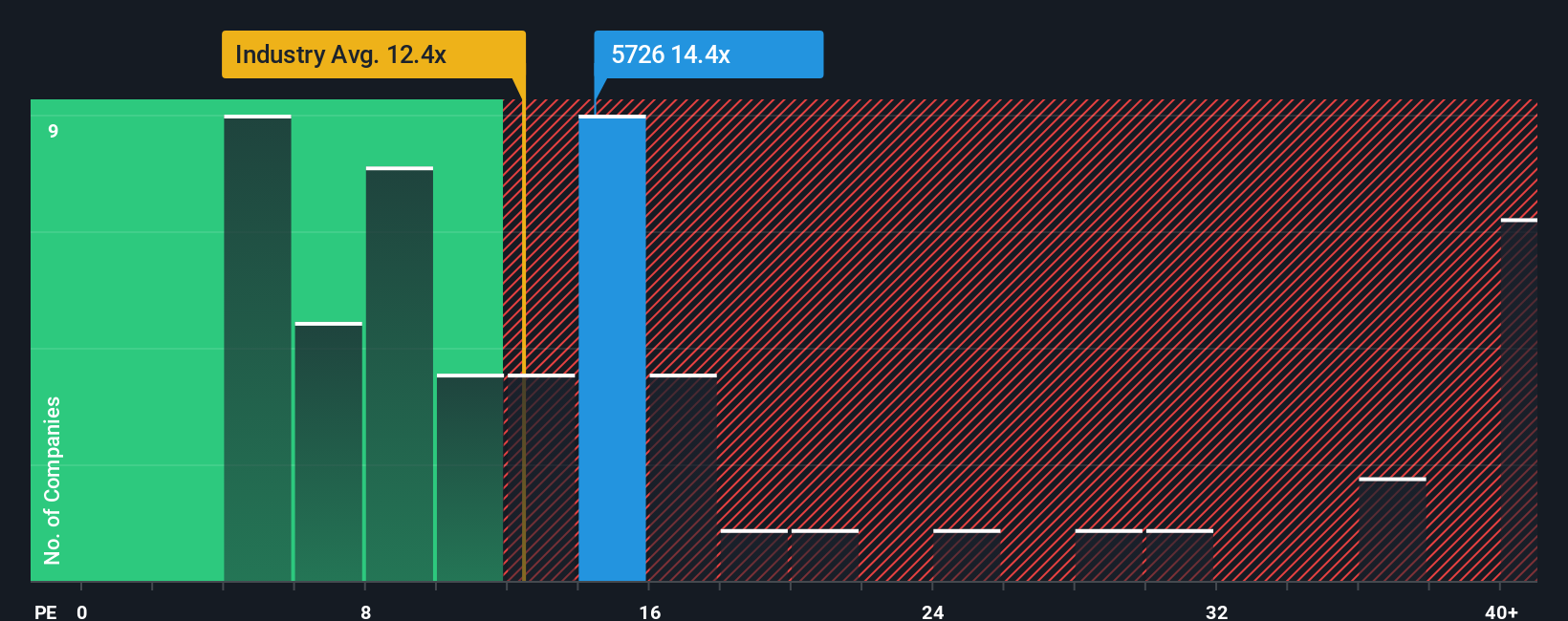

In spite of the firm bounce in price, it’s still not a stretch to say that OSAKA Titanium technologiesLtd’s price-to-earnings (or “P/E”) ratio of 14.4x right now seems quite “middle-of-the-road” compared to the market in Japan, where the median P/E ratio is around 14x. Although, it’s not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10bn in marketcap – there is still time to get in early.

OSAKA Titanium technologiesLtd hasn’t been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You’d really hope so, otherwise you’re paying a relatively elevated price for a company with this sort of growth profile.

See our latest analysis for OSAKA Titanium technologiesLtd

TSE:5726 Price to Earnings Ratio vs Industry August 20th 2025 Keen to find out how analysts think OSAKA Titanium technologiesLtd’s future stacks up against the industry? In that case, our free report is a great place to start. How Is OSAKA Titanium technologiesLtd’s Growth Trending?

TSE:5726 Price to Earnings Ratio vs Industry August 20th 2025 Keen to find out how analysts think OSAKA Titanium technologiesLtd’s future stacks up against the industry? In that case, our free report is a great place to start. How Is OSAKA Titanium technologiesLtd’s Growth Trending?

The only time you’d be comfortable seeing a P/E like OSAKA Titanium technologiesLtd’s is when the company’s growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 54% decrease to the company’s bottom line. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it’s fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 26% per annum over the next three years. That’s shaping up to be materially higher than the 9.5% each year growth forecast for the broader market.

With this information, we find it interesting that OSAKA Titanium technologiesLtd is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From OSAKA Titanium technologiesLtd’s P/E?

Its shares have lifted substantially and now OSAKA Titanium technologiesLtd’s P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of OSAKA Titanium technologiesLtd’s analyst forecasts revealed that its superior earnings outlook isn’t contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It’s always necessary to consider the ever-present spectre of investment risk. We’ve identified 3 warning signs with OSAKA Titanium technologiesLtd (at least 1 which is significant), and understanding them should be part of your investment process.

It’s important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

AloJapan.com