Tokyo Electric Power Company Holdings, Incorporated (TSE:9501) shares have continued their recent momentum with a 40% gain in the last month alone. Unfortunately, despite the strong performance over the last month, the full year gain of 7.2% isn’t as attractive.

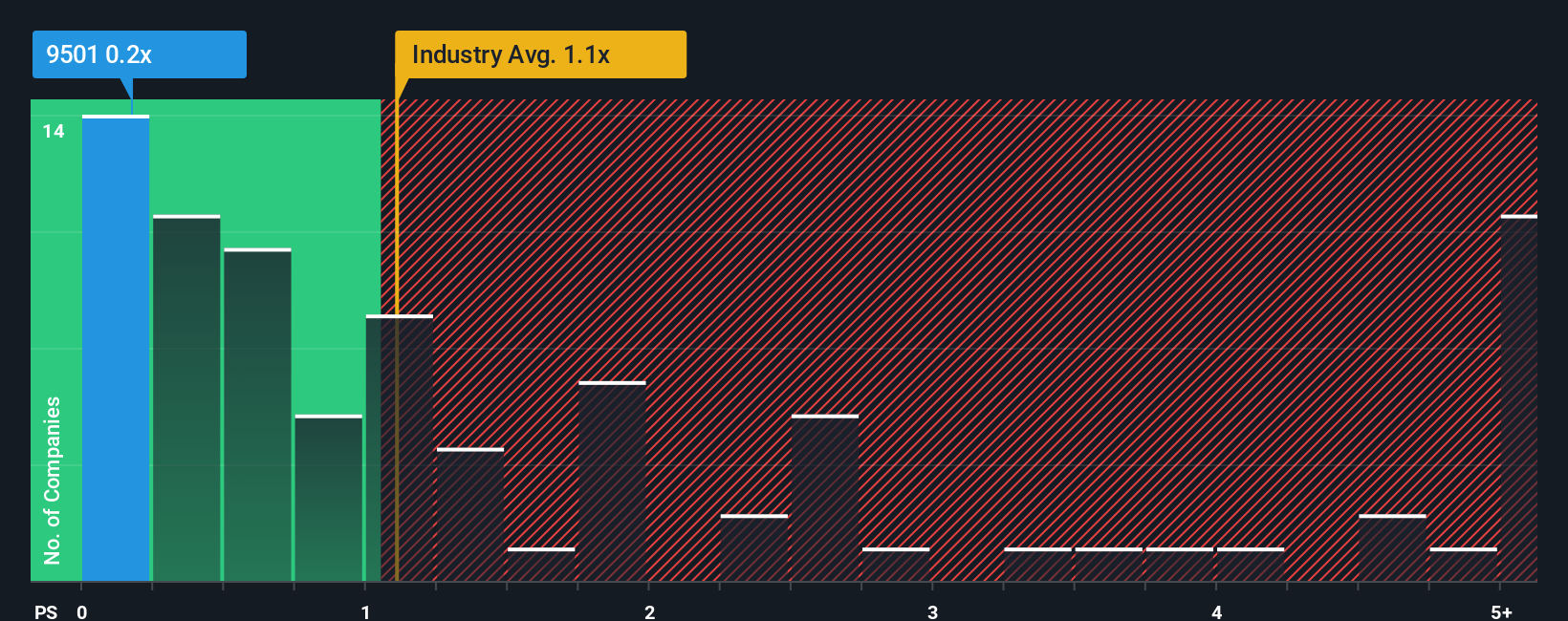

In spite of the firm bounce in price, there still wouldn’t be many who think Tokyo Electric Power Company Holdings’ price-to-sales (or “P/S”) ratio of 0.2x is worth a mention when the median P/S in Japan’s Electric Utilities industry is similar at about 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

We’ve found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Check out our latest analysis for Tokyo Electric Power Company Holdings

TSE:9501 Price to Sales Ratio vs Industry August 14th 2025 What Does Tokyo Electric Power Company Holdings’ Recent Performance Look Like?

TSE:9501 Price to Sales Ratio vs Industry August 14th 2025 What Does Tokyo Electric Power Company Holdings’ Recent Performance Look Like?

Tokyo Electric Power Company Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You’d really hope so, otherwise you’re paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Tokyo Electric Power Company Holdings’ future stacks up against the industry? In that case, our free report is a great place to start. How Is Tokyo Electric Power Company Holdings’ Revenue Growth Trending?

In order to justify its P/S ratio, Tokyo Electric Power Company Holdings would need to produce growth that’s similar to the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period was better as it’s delivered a decent 16% overall rise in revenue. Therefore, it’s fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to remain somewhat buoyant, growing by 1.4% per year during the coming three years according to the four analysts following the company. While this isn’t a particularly impressive figure, it should be noted that the the industry is expected to decline by 1.0% each year.

Even though the growth is only slight, it’s peculiar that Tokyo Electric Power Company Holdings’ P/S sits in line with the majority of other companies given the industry is set for a decline. It looks like most investors aren’t convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Bottom Line On Tokyo Electric Power Company Holdings’ P/S

Tokyo Electric Power Company Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It’s argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We’ve established that Tokyo Electric Power Company Holdings currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We assume that investors are attributing some risk to the company’s future revenues, keeping it from trading at a higher P/S. The market could be pricing in the event that tough industry conditions will impact future revenues. However, if you agree with the analysts’ forecasts, you may be able to pick up the stock at an attractive price.

It’s always necessary to consider the ever-present spectre of investment risk. We’ve identified 2 warning signs with Tokyo Electric Power Company Holdings (at least 1 which is potentially serious), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you’ll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we’re here to simplify it.

Discover if Tokyo Electric Power Company Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

AloJapan.com