Matthews Japan Fund (Trades, Portfolio) recently submitted its N-PORT filing for the second quarter of 2025, revealing strategic investment decisions made during this period. Established on December 31, 1998, the Matthews Japan Fund (Trades, Portfolio) Investor Class (MJFOX) aims for long-term capital appreciation by investing at least 80% of its net assets in Japanese companies’ common and preferred stocks. The fund employs a bottom-up, fundamental investment philosophy, focusing on long-term performance. Matthews emphasizes active management, a long-term focus on Asia, and bottom-up research, conducting over 2,000 company meetings annually to identify sustainable growth opportunities. The fund also defines Asia investment strategies, offering a range of options across the risk-reward spectrum.

Matthews Japan Fund Exits Sumitomo Mitsui Financial Group Inc, Impacting Portfolio by -4.51%

Matthews Japan Fund (Trades, Portfolio) added a total of 11 stocks, with the most significant addition being Fujitsu Ltd (TSE:6702), acquiring 516,400 shares, which account for 1.87% of the portfolio and a total value of 12,527,550 million. The second largest addition was Kao Corp (TSE:4452), with 273,800 shares, representing approximately 1.83% of the portfolio, valued at 12,267,780 million. The third largest addition was T&D Holdings Inc (TSE:8795), with 519,800 shares, accounting for 1.7% of the portfolio and a total value of 11,409,670 million.

Matthews Japan Fund (Trades, Portfolio) also increased stakes in a total of 17 stocks. The most notable increase was in Tokyo Electron Ltd (TSE:8035), with an additional 42,700 shares, bringing the total to 145,800 shares. This adjustment represents a significant 41.42% increase in share count, a 1.22% impact on the current portfolio, and a total value of 27,922,080 million. The second largest increase was in Tokio Marine Holdings Inc (TSE:8766), with an additional 175,200 shares, bringing the total to 736,000. This adjustment represents a 31.24% increase in share count, with a total value of 31,192,460 million.

Matthews Japan Fund (Trades, Portfolio) completely exited 9 holdings in the second quarter of 2025, including:

Sumitomo Mitsui Financial Group Inc (TSE:8316): The fund sold all 1,041,100 shares, resulting in a -4.51% impact on the portfolio.

Miura Co Ltd (TSE:6005): The fund liquidated all 479,900 shares, causing a -1.61% impact on the portfolio.

Matthews Japan Fund (Trades, Portfolio) also reduced positions in 19 stocks. The most significant changes include:

Story Continues

Reduced Toyota Motor Corp (TSE:7203) by 486,000 shares, resulting in a -46.97% decrease in shares and a -1.45% impact on the portfolio. The stock traded at an average price of 2,607.15 during the quarter and has returned 0.88% over the past 3 months and -6.97% year-to-date.

Reduced Mitsubishi Heavy Industries Ltd (TSE:7011) by 310,400 shares, resulting in a -52.21% reduction in shares and a -0.9% impact on the portfolio. The stock traded at an average price of 2,972.36 during the quarter and has returned 52.45% over the past 3 months and 85.72% year-to-date.

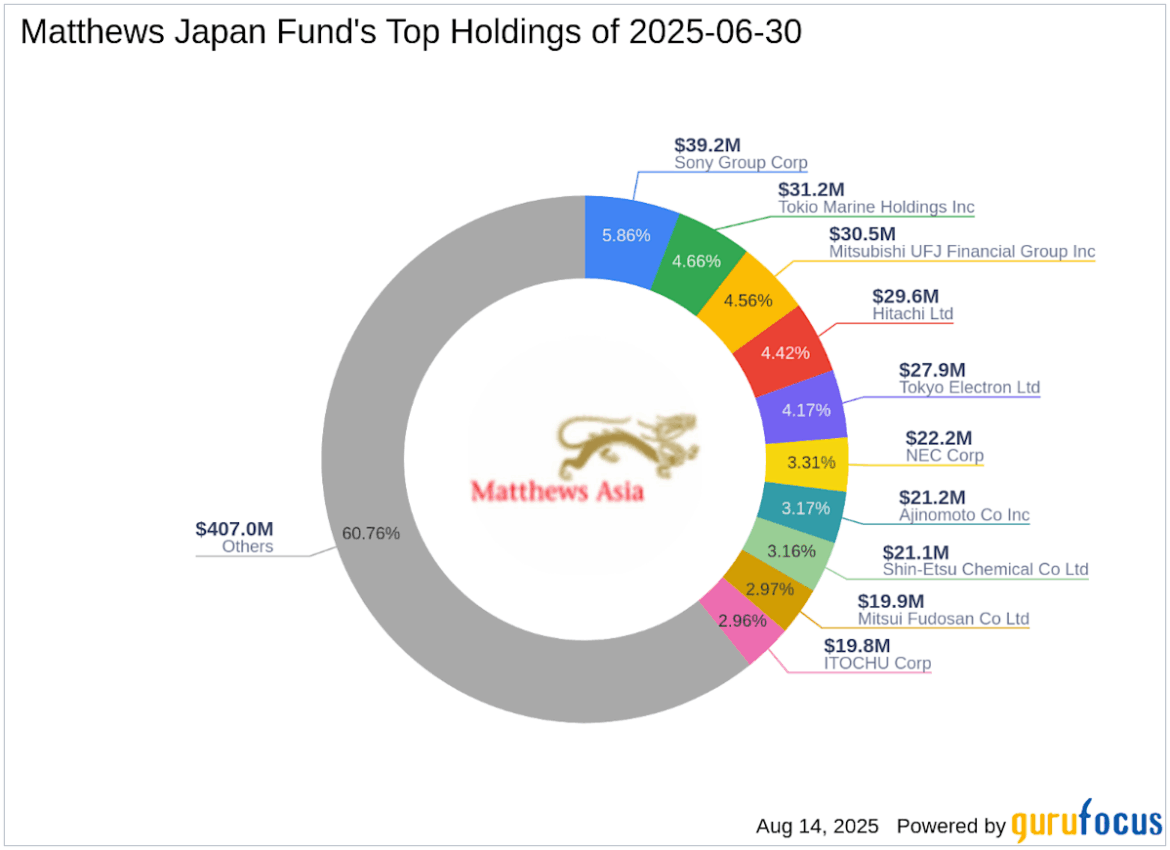

As of the second quarter of 2025, Matthews Japan Fund (Trades, Portfolio)’s portfolio included 49 stocks. The top holdings were 5.86% in Sony Group Corp (TSE:6758), 4.66% in Tokio Marine Holdings Inc (TSE:8766), 4.56% in Mitsubishi UFJ Financial Group Inc (TSE:8306), 4.42% in Hitachi Ltd (TSE:6501), and 4.17% in Tokyo Electron Ltd (TSE:8035).

The holdings are mainly concentrated in 9 of the 11 industries: Technology, Industrials, Financial Services, Consumer Cyclical, Consumer Defensive, Communication Services, Healthcare, Basic Materials, and Real Estate.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

AloJapan.com