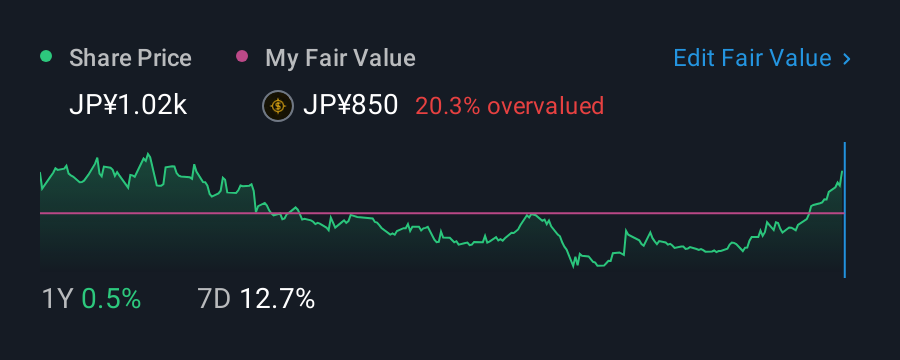

TSE:9509 1 Year Share Price vs Fair ValueExplore Hokkaido Electric Power Company’s Fair Values from the Community and select yours

TSE:9509 1 Year Share Price vs Fair ValueExplore Hokkaido Electric Power Company’s Fair Values from the Community and select yours

Hokkaido Electric Power Company, Incorporated (TSE:9509) shares have continued their recent momentum with a 26% gain in the last month alone. Longer-term shareholders would be thankful for the recovery in the share price since it’s now virtually flat for the year after the recent bounce.

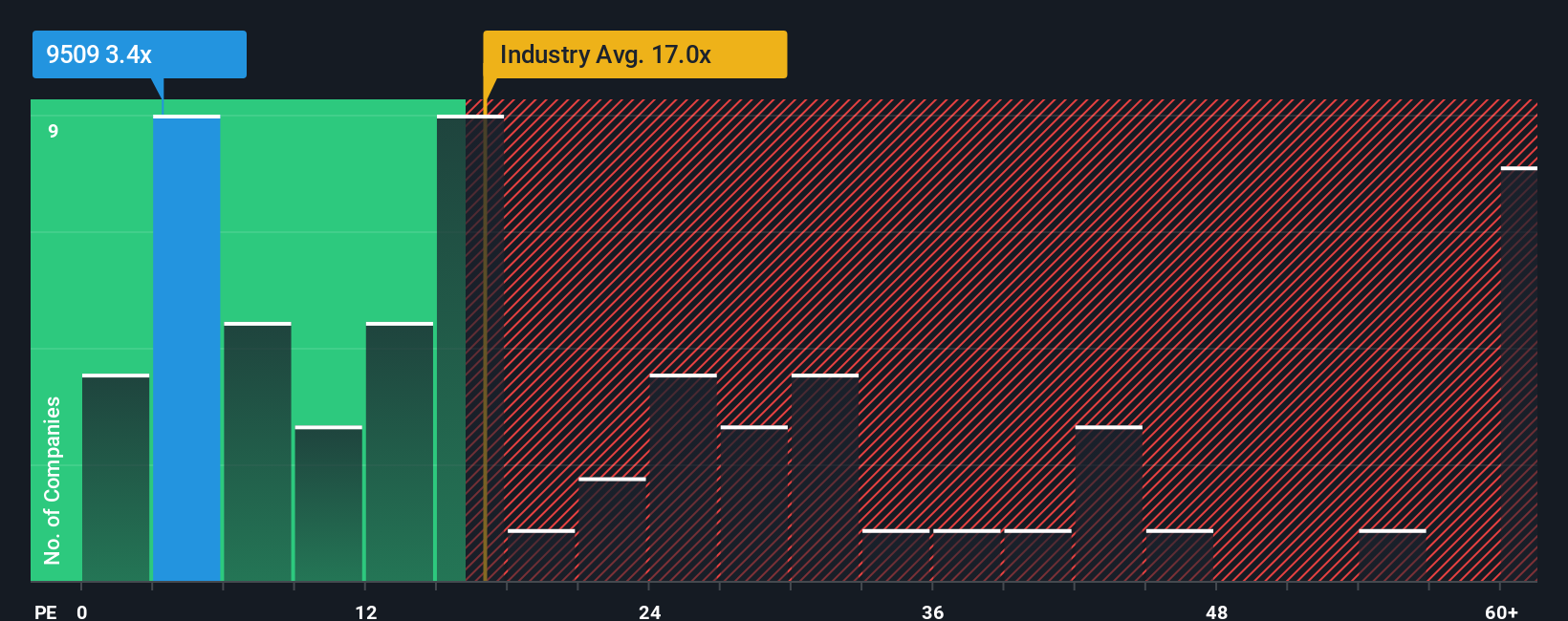

In spite of the firm bounce in price, Hokkaido Electric Power Company may still be sending very bullish signals at the moment with its price-to-earnings (or “P/E”) ratio of 3.4x, since almost half of all companies in Japan have P/E ratios greater than 15x and even P/E’s higher than 23x are not unusual. Nonetheless, we’d need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10bn in marketcap – there is still time to get in early.

Hokkaido Electric Power Company could be doing better as it’s been growing earnings less than most other companies lately. It seems that many are expecting the uninspiring earnings performance to persist, which has repressed the P/E. If you still like the company, you’d be hoping earnings don’t get any worse and that you could pick up some stock while it’s out of favour.

Check out our latest analysis for Hokkaido Electric Power Company

TSE:9509 Price to Earnings Ratio vs Industry August 8th 2025 Want the full picture on analyst estimates for the company? Then our free report on Hokkaido Electric Power Company will help you uncover what’s on the horizon. Is There Any Growth For Hokkaido Electric Power Company?

TSE:9509 Price to Earnings Ratio vs Industry August 8th 2025 Want the full picture on analyst estimates for the company? Then our free report on Hokkaido Electric Power Company will help you uncover what’s on the horizon. Is There Any Growth For Hokkaido Electric Power Company?

Hokkaido Electric Power Company’s P/E ratio would be typical for a company that’s expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 846% overall rise in EPS, in spite of its uninspiring short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 20% each year as estimated by the four analysts watching the company. Meanwhile, the broader market is forecast to expand by 9.0% each year, which paints a poor picture.

With this information, we are not surprised that Hokkaido Electric Power Company is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There’s potential for the P/E to fall to even lower levels if the company doesn’t improve its profitability.

The Final Word

Hokkaido Electric Power Company’s recent share price jump still sees its P/E sitting firmly flat on the ground. It’s argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Hokkaido Electric Power Company’s analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn’t great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 4 warning signs for Hokkaido Electric Power Company (2 are a bit concerning!) that we have uncovered.

If you’re unsure about the strength of Hokkaido Electric Power Company’s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we’re here to simplify it.

Discover if Hokkaido Electric Power Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

AloJapan.com