Japan’s real estate market continues to perform strongly. In 2024, domestic investment exceeded JPY 6 trillion, with an additional JPY 2.3 trillion in foreign capital. Despite gradual rate hikes by the Bank of Japan, investor confidence remains high. In light of the current global macroeconomic climate, what makes Japan such an attractive destination for foreign investors? And what is your outlook for market performance moving forward?

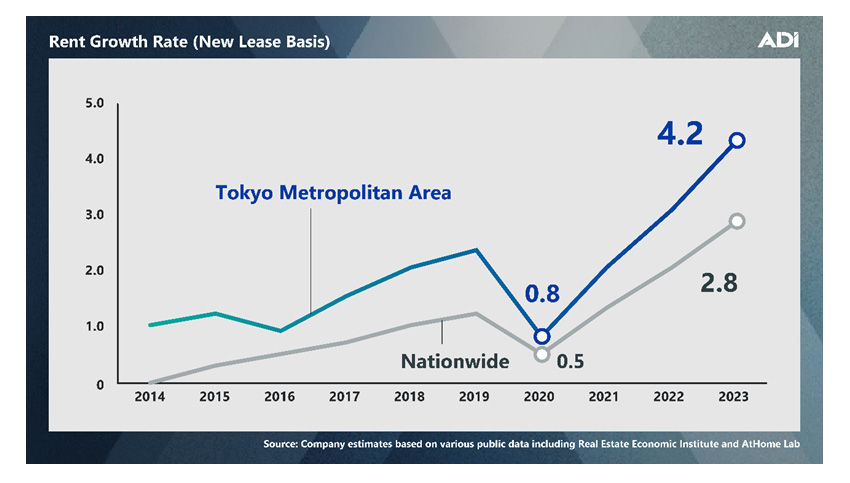

Our focus is exclusively on the residential segment, so I’ll limit my comments to that area. Compared to the past three decades, we’re now seeing a significant shift in this segment. For example, the following chart illustrates the annual increase in rental prices.

In Japan, there has traditionally been an understanding that for any residential building available for lease, the rent is highest in the first year. From there, it gradually declines as the building ages. Generally speaking, a building that’s 10 years old might see a 2% to 5% drop from its original rent, and by around 30 years, it’s often demolished and rebuilt.

That stands in stark contrast to cities like London, where many buildings are over 100 years old. In most OECD countries, rents tend to increase over time, and both landlords and tenants expect periodic rent hikes as a normal part of the market cycle.

However, if you look at the chart, you’ll see that in recent years, residential rents in Japan have started to rise. One of the key reasons is wage growth. As income levels increase, tenants have more spending power, which in turn drives rent levels higher.

There are other contributing factors as well. While rising interest rates may be viewed as a challenge for real estate investors, they also make mortgages more expensive. For many people who had considered buying, higher borrowing costs are pushing them to continue renting instead. At the same time, housing prices are climbing due to rising construction costs, further discouraging home ownership and reinforcing the rental market.

Looking at the data, there were more people renting in 2023 than in 2013. While that trend varies by age group, it is especially pronounced among younger people. Homeownership is becoming more difficult to attain, so many are opting to stay in the rental market—driving demand and pushing rents higher.

At the same time, supply is constrained. The high cost of construction makes it difficult to increase the number of new residential units, so inventory remains limited.

Another major driver is demographic: Japan has more single-person households than ever before. Fewer people are getting married, and because men tend to have shorter lifespans, women often live alone in later years. Most of our tenants are single, so for that segment—particularly in Tokyo—demand is very strong relative to supply.

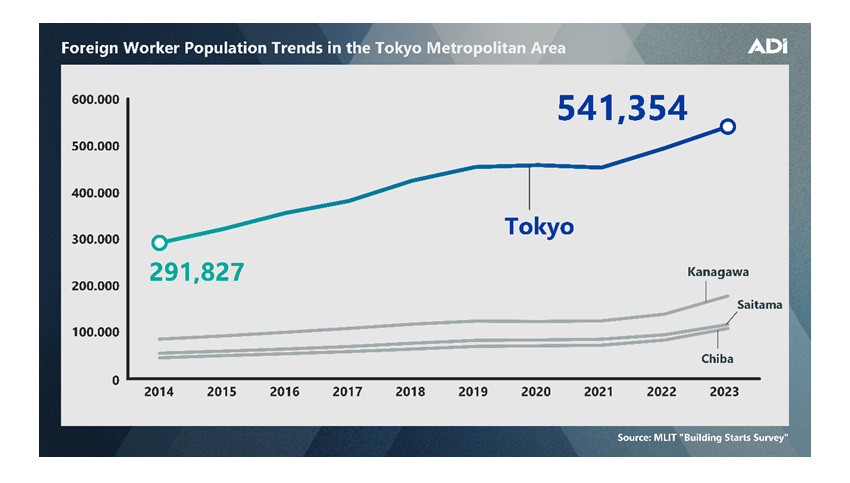

Another important factor to consider is the growing number of foreign workers in Japan. The chart above highlights this trend across Tokyo, Kanagawa, Saitama, and Chiba. Focusing on Tokyo specifically, the number of foreign residents increased from 495,000 in 2022 to 545,000 in just one year—a jump of 50,000. Given that Tokyo’s total population is around 10 million, that’s a significant increase.

Most of these foreign residents are unable to secure mortgages from Japanese banks, which means they rely on the leasing market. This further drives demand for rental housing, particularly in metropolitan areas like Tokyo.

Our company focuses on developing condominiums for both leasing and investment purposes. Given all these market dynamics—from rising wages and construction costs to limited supply and growing foreign demand—the leasing side of the residential market is especially strong. That’s why we believe Japan’s residential real estate sector presents a very attractive opportunity for investors right now.

The factors you’ve outlined seem to have clearly resonated with foreign investors. From 2023 to 2024, we saw a 12% year-on-year increase in transactions involving foreign capital. What’s particularly interesting is that this isn’t just coming from major institutional players like Goldman Sachs or BlackRock, who have quietly entered Japan’s multifamily housing market, but also from wealthy individual investors—especially from the Asia region. What kinds of opportunities does this influx of foreign buyers present for your company?

Foreign buyers initially rushed into the high-end condo market in areas like Roppongi and Tokyo’s Minato Ward, driving prices up significantly. But today, it’s difficult to turn a profit in those areas, as values have likely peaked. It made sense at the time—these are famous locations with strong global recognition—but we’re now seeing growing concerns about the sustainability of those prices.

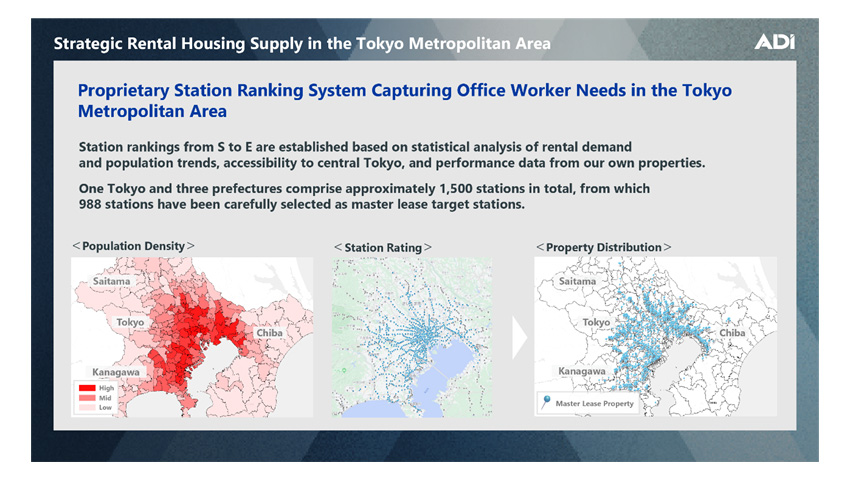

This shift actually presents a strong opportunity for our business. Our focus is not on prestige, but on performance. We prioritize yield. If you look at a map of our developments, you’ll notice that we’re not concentrated in central Tokyo. Instead, we’re building in areas where we can generate yields of 4.5% to 5%, which simply isn’t possible in high-profile locations like Ginza. We focus on places like Kawaguchi, Fujisawa, and Yamato. These areas may be less known to international investors, but they’re home to large residential populations and are part of the greater Tokyo area, which has around 40 million residents.

As foreign investors began realizing that central Tokyo condos no longer offer attractive yields, we’ve seen growing interest in the kinds of properties we develop. That’s why we’ve started marketing directly to foreign buyers as well, and interest has been steadily increasing.

One of the key milestones for us was the sale of a portfolio of 17 properties last year to a private investment fund based in Asia. This deal sparked greater interest in our business, and we are now seeing more international investors paying attention to what we do.

It’s clear that the demand is shifting toward high-yield residential opportunities in the greater Tokyo area, which aligns perfectly with our strategy.

We had a meeting the other day with a fund based in Hong Kong and in our discussions, there seemed to be two big apprehensions regarding investing in the Japanese market. One was a strong fear of the impact of increasing interest rates. The other was a fear of oversupply in those premium asset classes you mentioned, especially because the rising construction costs have led many developers to abandon mid-tier market projects in favor of premium projects.

The prices are just so high. It’s insane. For example, if you look at a place in Roppongi, the price is higher than in New York. Tokyo is a great city, but I don’t know that it should be more expensive than New York.

How realistic do you think those two fears are?

If interest rates rise and you’re holding an asset with a 1% to 1.5% yield, you’re effectively sitting on a negative return, and the value of that asset can collapse—this is what we’re seeing in cities like Paris, New York, and Singapore. In contrast, with an asset yielding 4.5% to 5%, a rate hike is much more manageable. You may not see major capital gains, since few buyers will accept low yields, but you’re playing for stable income and sustainability. And as we discussed, with rents steadily rising in Japan, that income should continue to strengthen, helping to cushion any interest rate pressure.

While Japan’s overall population is shrinking, that trend doesn’t apply to Tokyo—and to a lesser degree, Osaka. In fact, Tokyo’s metro area reached a record population in 2023, which continues to fuel strong market demand, especially in the residential leasing segment.

Japan’s overall population may be declining, but within Tokyo, the demographic picture is more nuanced. The Japanese population in the city remains relatively stable, and more importantly, the number of foreigners living in Tokyo continues to grow. From our perspective, this shift means population decline won’t present a serious challenge for at least the next few decades.

Long term, I believe Japan will need to open up further. If that happens, the population dynamics a century from now could look very different. Already, roughly 2% of newborns in Tokyo have two foreign parents, and many others are born to mixed-nationality couples. While Japan can’t expect to suddenly become an immigration-heavy society, this gradual change is already underway and will reshape the country’s demographics over time.

Many firms say that they offer a fully integrated service, but in your case, that’s definitely true because on top of the developments and property management, you also have your own land utilization and consulting capabilities with architecture and design all done in-house. Why did you decide to have this fully integrated model?

That integrated, stock-focused approach is precisely what differentiates us. While many developers aim to profit from construction margins or service contracts, our focus is squarely on building long-term asset value. That’s why we’ve made the deliberate decision to keep everything—architecture, property management, leasing, and consulting—under one roof.

If you split these into subsidiaries, you inevitably create silos. Teams start operating like subcontractors, morale and ownership suffer, and the holistic perspective needed to maximize asset value is lost. We’ve built a model where every team sees the full picture and works toward the same end: increasing the value and performance of the property as a long-term asset.

You can really see the benefit of this approach in our rebranding projects. Take one case where we acquired a building with a 74% occupancy rate. Through CapEx investment and internal collaboration, we not only upgraded the asset but used our in-house leasing network to reposition and market it properly. Today, it commands significantly higher rents and occupancy. That kind of turnaround isn’t possible without deep integration between the property management team and the design and development team.

Now, even large asset-heavy players like utilities and rail companies are coming to us for help. They have aging portfolios but lack the capabilities to unlock value through renovation and repositioning. We’re one of the few players who can take that CapEx plan, align it with rental yield expectations, and actually execute the leasing strategy—all from within the same organization. That’s why our model isn’t just efficient—it’s highly scalable and uniquely positioned for Japan’s evolving real estate market.

I think the advantages of the model that you have are clear, especially when you talk about the synergies you have with other asset managers that are now contacting you to use your asset management and design capabilities. Why do you think there aren’t more companies doing this?

Exactly. The Japanese market is still catching up when it comes to viewing renovation through an investment lens. Many of the existing players—especially boutique renovation firms—approach the work from a consumer perspective, helping individuals with their personal homes. They don’t think in terms of rental uplift or ROI. Meanwhile, property management companies often focus on surface-level upgrades just to retain occupancy, rather than taking a strategic view of how CapEx can reposition an asset and increase long-term value.

That’s where we see a clear arbitrage opportunity. Because we think like asset managers, we’re constantly evaluating whether a heavier investment—say, in structural improvements or a full rebranding—will pay off through higher rents and better tenant quality. Most owners are asking how little they can spend to maintain the status quo. We’re asking how much we should invest to maximize returns. It’s a fundamentally different philosophy.

Our advantage is that we’re not only thinking this way—we’re actually capable of executing it. With around 2,300 new condo units per year, we’ve developed purchasing power and deep relationships with suppliers and craftsmen. That gives us the capacity to execute both new developments and significant renovations with precision, scale, and cost-efficiency. So when an aging property comes our way, we’re uniquely positioned to handle every step—from the concept to the CapEx planning to the leasing and long-term management—with a cohesive, return-focused strategy.

It’s a straightforward business, but one you’ve clearly optimized. You just mentioned strong volume—if I’m not mistaken, you manage more than 50,000 units with an occupancy rate exceeding 99%. Over time, you’ve also made significant investments in both property and rental management. One example is the LiVLi CLUB, an exclusive members-only tenant community. Could you share more about the rental and property management side of your business—particularly how you empower not only your tenants but also the investors who choose to partner with you?

In development or real estate investment, there are always risks—but those risks can be mitigated if the building is fully leased. If you achieve 100% occupancy, there’s usually not much of a problem. The real challenge arises when you’re funding a development and the building is completed, but a market shock occurs before you secure tenants and begin generating income—while the debt still needs to be repaid. In that scenario, the bank isn’t happy because the property isn’t producing cash flow. You may be forced to sell at a loss, which hits your P&L, and that only worsens the bank’s position. It becomes a kind of death spiral.

On the other hand, if income is coming in, the bank is more willing to accept interest payments or partial principal repayments from that income—they can afford to wait. You can’t control cap rates or interest rates, as those are dictated by the macroeconomic environment, but if you can control cash flow, it offers a great deal of stability. That’s why our company is very focused on achieving 100% occupancy. Of course, it’s a balancing act—maximizing both occupancy and rental income. But if you can accurately identify where units can be leased, you’re in a strong position. To support this, we have a dedicated evaluation team, independent from the development and construction teams, that uses big data to analyze both our own 50,000 units and broader market data to determine the optimal rent for each property.

At our rent assessment process, we leverage integrated sources of information incorporating the surrounding environment, market data, proprietary data and statistical data.

Firstly, in step one, we conduct a survey of the surrounding environment. This involves analyzing demographics such as the distribution of male and female populations, income levels, and local amenities to better understand the community around the planned location. Moving on to step two, we delve into market data. Here we gather information similar to ADI properties, examining the distribution of rents. In step two continued, we utilize AI assessment to calculate past rent fluctuations using accumulated ADI data. Additionally, we forecast future rents one year ahead using alternative data. Step two also includes conducting rent forecasts based on statistical analysis to further refine our evaluations. In step three, utilizing our proprietary data. We assess the occupancy rates and layout proportions of nearby properties. We visualize our portfolio of properties and track rent fluctuations at each station. Finally, in step four, based on future population profiles, we examine age-specific population changes to predict future population trends. In conclusion, by integrating these diverse data sources, we comprehensively grasp the overall market landscape, enabling us to make informed decisions and proactively respond to market trends.

Do you provide the data from the evaluation department to your clients?

When I joined ADI, a very smart friend of mine at Goldman Sachs offered to help—he heads their digital management department. Since our group is built around digital management, I was fortunate to have his support. I don’t understand all the technical details, but there are many vendors who specialize in areas like rent assumptions and mapping. These vendors help us reach our goals, but we don’t share the results externally. The reason is simple: external parties aren’t willing to pay enough. If we tried to sell our data system, the market wouldn’t value it highly—so we prefer to keep it internal, where the return is significantly greater.

There are plenty of PropTech startups offering AI-based or data-driven pricing tools, claiming they can help landlords set rent levels for their condos. But how much are property owners really willing to pay for that? Maybe USD 100—if that. It’s not a high-revenue opportunity. On top of that, selling externally would require us to invest in packaging, quality assurance, and marketing, which would be costly. That’s my thinking. By keeping it in-house, we’ve achieved a very high occupancy rate, and we’re confident that whatever we build will maintain strong occupancy and deliver solid returns.

Our managed portfolio has grown from 40,000 to 50,000 units. While managed properties are increasing by 3%, our gross margin is rising by 10%. That’s because we’ve been actively reviewing the portfolio to maximize profitability—a strategy we’ve pursued over the past few years, and it seems to be working well.

Could you share a bit about your M&A activity?

We acquired a division of House Do that primarily focused on single-family properties. They also operated an apartment management business with around 3,000 units and approximately 3,000 parking spaces. House Do decided to divest these operations, and I believe the main reason was that property management has effectively become an infrastructure business. It didn’t make sense for them to invest in the personnel and systems required to manage just 3,000 units. There are many smaller players out there managing 500 or 800 units across various areas, so we’re now working to acquire these smaller companies one by one.

Are you looking to do more acquisitions in the upcoming years?

Yes. In fact, we completed four smaller deals before the House Do acquisition. Through those, we gained a better sense of appropriate valuations and the kind of upside M&A can offer. Most property management companies don’t handle construction—but we do—and many of the properties are aging. Once we take over operations, we can leverage our scale and capabilities, which creates significant added value. That’s one of the key upsides, and it’s why we expect to see more of this kind of activity going forward.

There are competitors eyeing the same opportunities, so it’s not exactly a blue ocean. In the case of House Do, there was some competition. But I believe that after we presented how we operate, how we think about people, and how we manage our business, House Do ultimately chose to sell to us. If the price was the same, I think they preferred to work with ADI.

Real estate is a relatively straightforward business. Simply by transferring land from party A to B, you can earn a solid fee and margin. Because of that, the opportunity for major transformation is somewhat limited.

We also don’t hold fixed assets from an accounting standpoint. On our balance sheet—currently around JPY 50 billion—roughly 90% or more is in liquid assets such as cash and inventory. We don’t own land or buildings, at least not up to this point, although that could change. I think this approach stems from my background in investment banking. As long as a lender doesn’t require you to sell a property, it’s fine to keep it on your books. The real challenge comes when the macro environment shifts, lenders grow uneasy, and suddenly demand that you sell—often at a price below what you paid.

Within the residential sector, there’s growing demand for smart technologies and sustainable living solutions. We saw that you recently launched the Pabbit system to help reduce CO2 emissions, among other goals. How do you see technologies like this reshaping tenant expectations in Japan’s residential market?

From the property side, I’m still a bit skeptical. For example, you can now turn on your A/C from your phone—but would you really want to? Personally, I’d rather just go home and press the button. So, I’m not entirely sure, and I’m genuinely curious about how people around the world view smart homes.

On the other hand, I think there’s a lot of valuable technology being applied on the development side. When we purchase land, architects and sales teams assess what can be built in terms of structure, volume, and compliance with local regulations—and technology is a big help there. New apps are constantly emerging, and we’re actually developing a system that tracks new property listings and highlights the most promising ones. That kind of tech is quite compelling.

We’re not a large company, but I believe our size allows us to do things that bigger players might struggle with. For instance, on the leasing side, we’ve transitioned to fully electronic document signing. Anyone who wants to lease one of our properties must complete the process digitally. That was a significant change. It was challenging because we work with many leasing agents who’ve been in the market for a long time. When we told them we were eliminating paper-based contracts, we had to make it clear that if they couldn’t adapt, we couldn’t continue doing business together. Some resisted, of course, but ultimately, it’s about adapting and using technology to reduce costs and increase efficiency. In those ways, I think technology is definitely proving valuable to the industry.

You’ve experienced significant growth over the past five years—not just in the number of units under management, but also in revenue. Are there any plans for an IPO in the near future?

Yes, we do. The business is taking shape, and I believe it will be even stronger in the next couple of years. Technically, we could go public now, but I think it’s more important to reach a point where the business is compelling enough to attract strong interest from the market and investors—setting us up for future growth.

Looking ahead to the end of the decade—if we were to sit down for another interview at that time—what do you hope to have achieved, and how would you like ADI to have evolved by then?

I’m currently considering two possible paths, and I haven’t fully decided which direction to take yet. If you look at a company like Daiwa House—they’re a major player today, but they weren’t nearly as large two decades ago. Maybe 40 years ago, they were just a small real estate company in Osaka. They had a presence, but nothing like what they’ve become. I believe we have the potential to grow on that scale, because that’s the nature of real estate. If you have the right business model and the right people, capital will follow. You don’t need a best-selling product—you just need to make smart decisions. With the right capital, growth is achievable. That’s one possible path.

But on the other hand, I truly enjoy working with residential assets. It’s a very interesting and fulfilling business. So, while I may eventually take the company public, I also want to keep it grounded. That’s the second option. Some days, I’m drawn to the idea of scaling up significantly. Other days, I think it might be better to manage that ambition and keep things more humble.

In residential real estate, you typically have two choices: condos or single-family homes. In Japan, we don’t really have high-quality single-family homes that cater to international high-net-worth individuals. Luxury condos exist, but luxury houses are lacking. Why is that? Some say it’s because of earthquakes or the humid climate—but I don’t agree. I think it’s more historical. After World War II, Japan had to rebuild from nothing, and many homeowners started from scratch. In contrast, many Western countries have a long-standing tradition of luxury homes. That tradition simply doesn’t exist here. Another factor is that our lifestyles shifted from Japanese-style to Western-style relatively recently, so Western ideas of luxury housing aren’t deeply embedded in the culture.

Given that, we want to build homes that meet international standards—starting at the high end. We’ve already purchased a plot of land that is considered quite large by Japanese standards. The plan is to build a detached house with four or more bedrooms, multiple bathrooms, and four parking spaces. We acquired the land one year ago and are currently in the design consultation phase with architects. If all goes well, it should be ready for sale by 2028.

For more information, please visit their website at: https://architectdeveloper.com

AloJapan.com