Japan Data

Economy

Lifestyle

Aug 6, 2025

A recent survey in Japan found that the most common method for cashless payments is to use a barcode or QR code displayed on a smartphone.

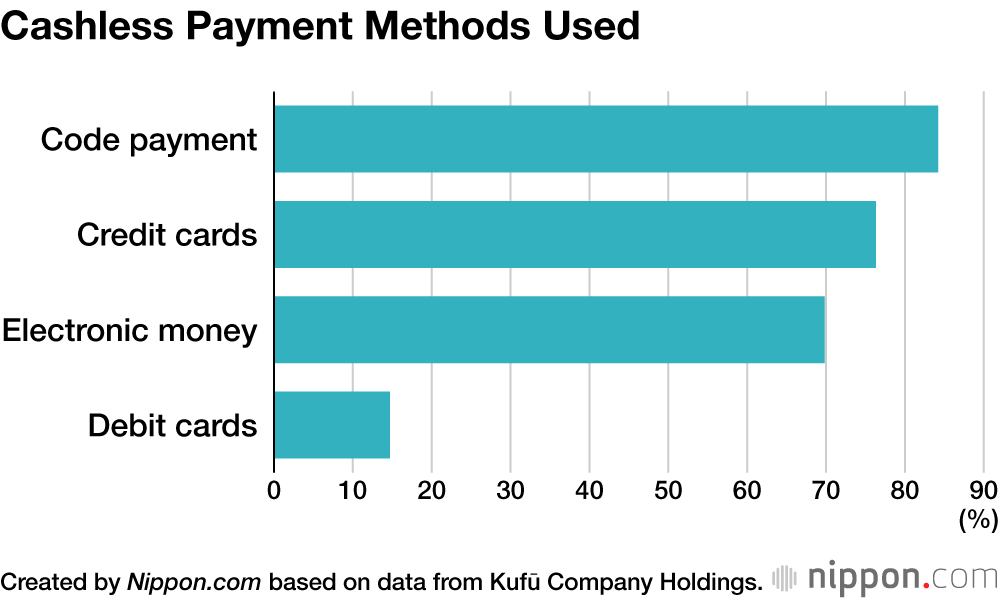

A July survey in Japan found that 84.2% of respondents make use of code payments for purchases, using a barcode or QR code displayed on a smartphone. The survey was conducted by Kufū Company Holdings on 2,559 users of its household budgeting app and related services.

Code payments have become a standard for cashless transactions in Japan, even surpassing the 76.3% of respondents who use physical credit cards. The next most popular form of payment, at 69.8%, is electronic money, which includes systems used on public transportation such as Suica and Pasmo, or money issued by retailers like Aeon. Meanwhile, only a minority of respondents, at 14.7%, use debit cards.

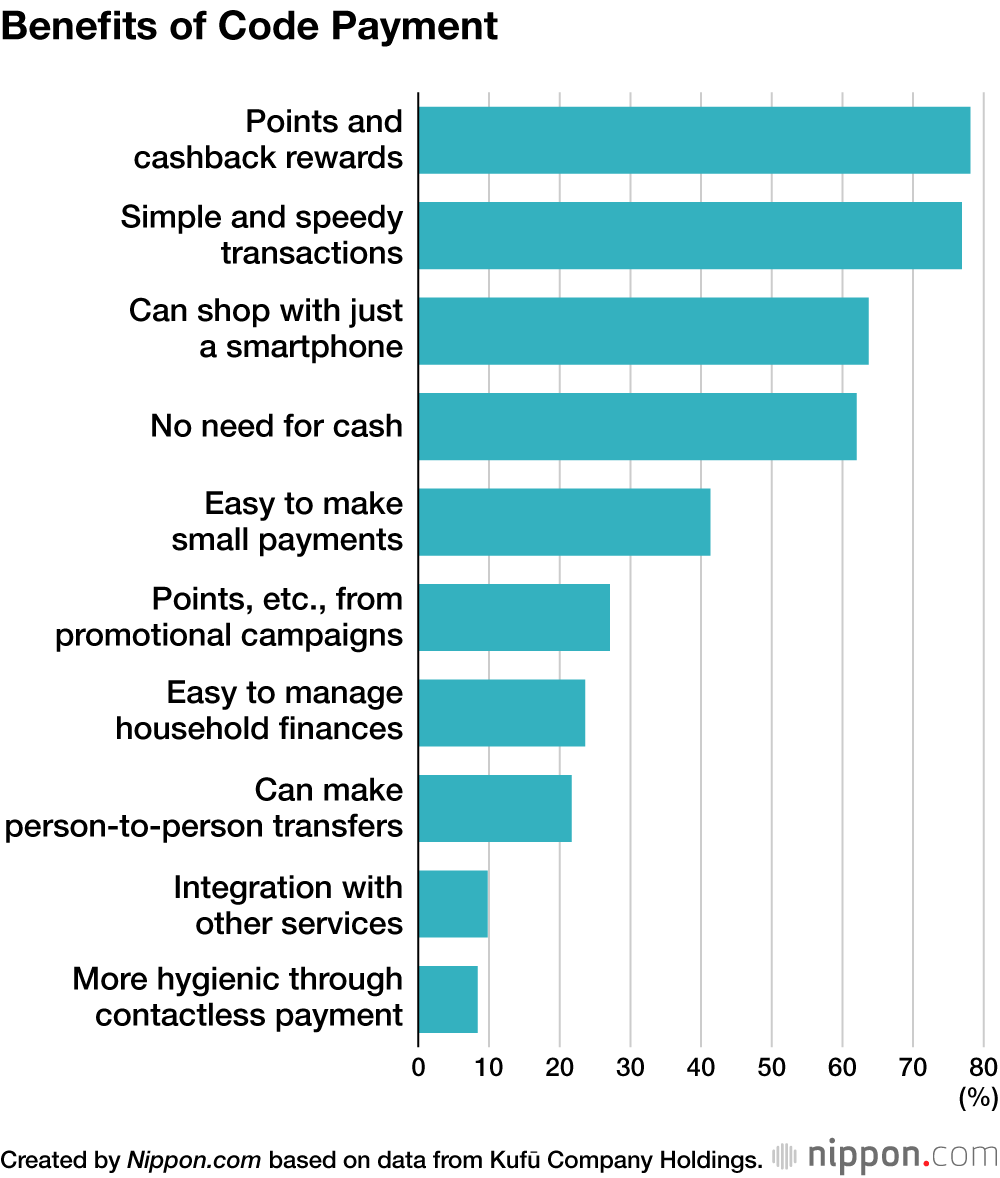

Over 75% of the survey respondents cited “earning points or receiving cashback” as well as “easy and speedy payment” as a benefit of using code payments. In today’s era of rising prices, consumers seem to be motivated by the desire to get something in return. Additionally, 21.7% of the respondents mentioned the convenience of “peer-to-peer money transfer functions,” which are useful for such situations as splitting the bill for a group outing.

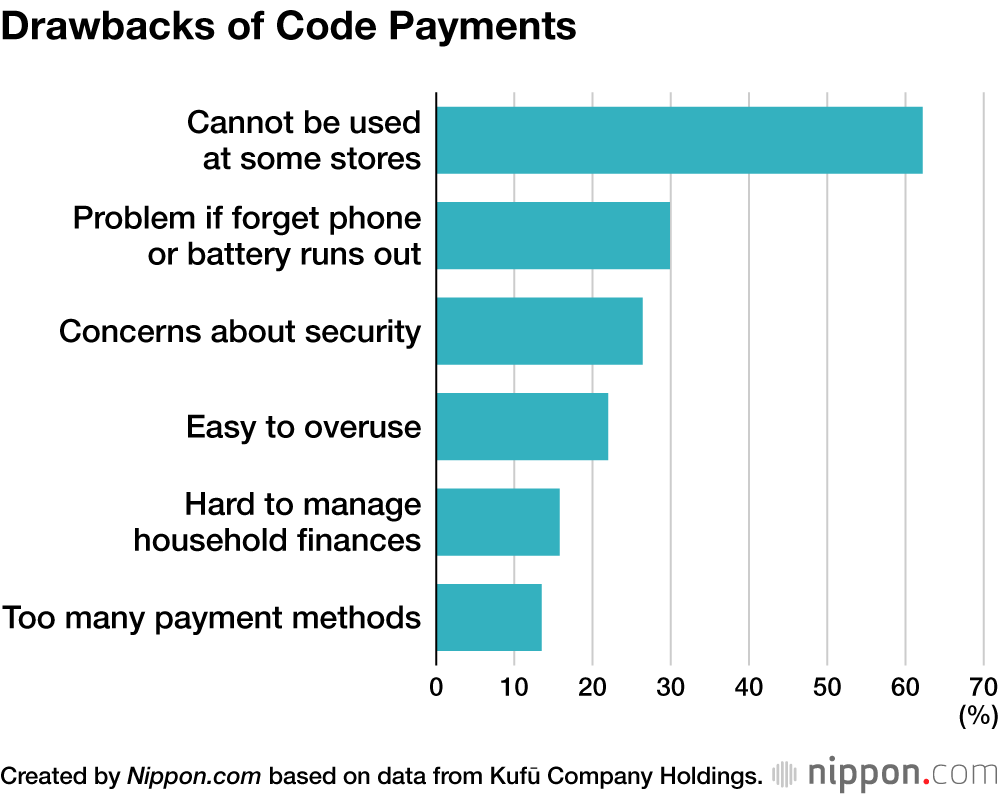

The most commonly mentioned inconvenience or concern related to code payments is that it is not accepted by some stores, as mentioned by 62.2% of the recipients. Meanwhile, only 26.4% expressed concerns about unauthorized use and other security issues.

(Translated from Japanese. Banner photo © Pixta.)

smartphone

cashless

AloJapan.com