Japan Cycle Tourism Market Size & Trends

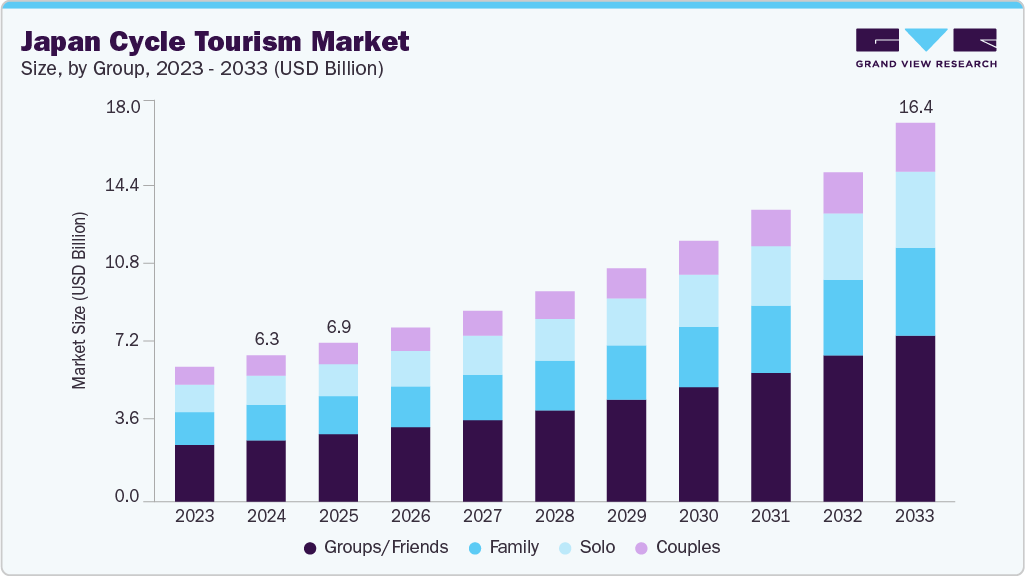

The Japan cycle tourism market size was estimated at USD 6.34 billion in 2024 and is projected to reach USD 16.40 billion by 2033, growing at a CAGR of 11.4% from 2025 to 2033. The Japan cycle tourism industry is steadily expanding as travellers increasingly seek meaningful engagement with nature, culture, and community through non-motorised, immersive experiences.

Unlike passive sightseeing, cycling enables slow-paced interaction with Japan’s rural scenery, seasonal changes, and regional traditions. The country’s natural topography, from the volcanic peaks of Kyushu to the rice terraces of Tohoku, offers a canvas for riders of all skill levels. A growing demographic of health-conscious domestic travellers, along with inbound visitors looking to escape dense urban tourism corridors, drives demand for cycling as a medium for authentic exploration.

Government bodies at both the national and local levels have taken active steps to integrate cycling into broader tourism and environmental goals. Through the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), Japan has launched initiatives to designate national cycling routes such as the “National Cycle Route” network, connecting regions via well-maintained, scenic, and signposted trails. Municipal efforts in areas like Shimanami Kaido, Biwaichi (Lake Biwa), and Hokkaido have introduced cyclist support facilities, including rest stations, repair kiosks, and multi-language guidance systems. Public transport systems are also being modified to accommodate bicycles, reflecting a push towards integrated, multimodal tourism. These developments are not just infrastructure upgrades; they represent a strategic pivot to foster regional revitalization, offload pressure from urban hotspots, and enhance the appeal of lesser-visited prefectures.

Tour operators are innovating with diversified offerings that blend physical adventure with cultural immersion. Companies such as Japan Cycling Tours and Samurai Sports deliver structured itineraries that include temple stopovers, farm stays, and locally guided experiences. Many now provide e-bike options, enabling older travellers and less experienced cyclists to participate in longer or hilly routes without physical strain. Experiences are often tailored to seasonal highlights, like cherry blossom routes or autumn foliage trails, making cycling a thematic, repeatable travel choice. Operators also collaborate with ryokans, sake breweries, and craft workshops to deepen local engagement. These curated routes go beyond sightseeing; they are designed to narrate regional identity through rhythm, taste, and terrain.

Consumer Insights

In a country where over 80 million bicycles are in circulation and cycling is embedded in daily life, the shift toward cycle tourism feels evolutionary rather than disruptive. Urban commuters, university students, and homemakers regularly use bicycles for daily transport, while an increasing number of domestic and international travellers are embracing multi-day cycling experiences through scenic coastal roads, river paths, and historic mountain routes.

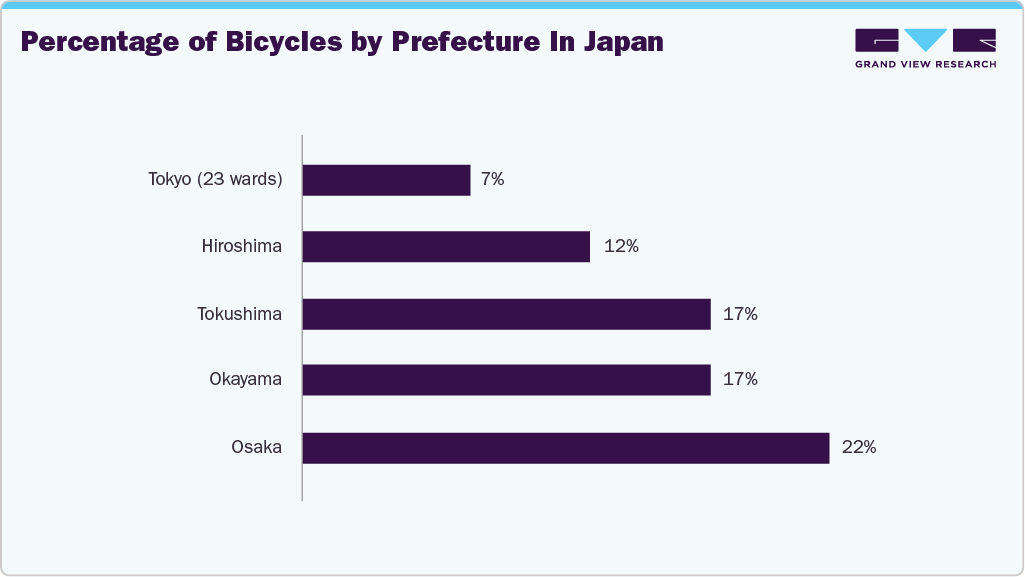

Government statistics and spatial data reinforce this behavioural foundation. According to the 2021 Japan Census, bicycle commuting rates exceed 20% in some prefectures, with Osaka, Okayama, and Shiga topping the list. In several urban regions such as Kyoto, Nara, and Hiroshima, commuting rates fall between 10% and 19.9%, underscoring widespread familiarity with bicycles as an efficient and trusted transport mode. This commuter culture supports a ready transition to tourism, particularly as Japanese travellers seek out immersive, low-impact leisure formats that align with national values of environmental consciousness, localism, and wellness.

This infrastructure and behavioural readiness, combined with a national push toward decarbonisation, is fuelling interest in recreational cycling routes such as the Shimanami Kaido, the Biwaichi Lake Biwa Loop, and the Oita cycling highways. These trails offer curated scenic journeys featuring cycling stations, rest cafes, and cultural touchpoints, making them ideal for both beginners and avid cyclists. Such developments are being supported by Japan’s Bicycle Use Promotion Act (2017) and local tourism boards, who increasingly view cycle tourism as a tool to revitalise rural economies and attract wellness-focused travellers.

Digital discovery and community engagement are key to this shift. Apps like Strava and Instagram have created spaces for cyclist communities to share itineraries, gear advice, and scenic finds, while international platforms promote Japan’s routes to adventure-seeking foreign tourists. Influencers, cycling bloggers, and niche travel agencies are also helping translate the practical familiarity of cycling into aspirational leisure. Notably, inbound travellers from Europe and Southeast Asia are showing rising interest in guided cycle tours that combine nature, temples, food experiences, and ryokan stays.

Japanese consumer expectations also show a clear trend toward quality, safety, and convenience. E-bike rentals, multilingual route maps, and tech-enabled support services are becoming standard offerings. Tourists increasingly expect seamless booking experiences, luggage transfers, and localised storytelling, similar to other premium tourism formats like ski holidays or luxury rail journeys. This positions cycle tourism as a mid- to premium-tier segment, especially appealing to health-conscious retirees, solo travellers, and urban professionals from both Japan and abroad.

Group Insights

The group/friends cycle tours segment led the market with the largest revenue share of 42.16% in 2024. Japan’s extensive network of safe, scenic cycling routes, such as the Shimanami Kaido, Biwaichi, and the Oita-Kumamoto Coastal trail, is well-suited for group rides that blend leisure, fitness, and sightseeing. These tours are often packaged with accommodations in traditional ryokans, shared meals, and coordinated cultural activities, making them attractive for families, friend circles, and cycling clubs seeking immersive travel without the logistical burden of planning. In addition, group tours benefit from economies of scale, shared support vehicles, and multilingual guides, enhancing both cost-effectiveness and comfort.

The solo cycle tours segment is projected to grow at the fastest CAGR of 11.4% over the forecast period. Japan’s well-marked cycling routes, excellent public transport connectivity, and widespread availability of rental bikes and digital navigation tools have made solo travel more accessible and secure. This growth is also fueled by a cultural shift toward personal wellness, outdoor activity, and solo exploration, especially among younger and middle-aged travelers seeking flexible itineraries. Moreover, local governments and tourism boards have developed infrastructure catering to independent cyclists, including rest stops, signage, and mobile apps, reinforcing Japan’s position as a safe and enriching solo cycling destination.

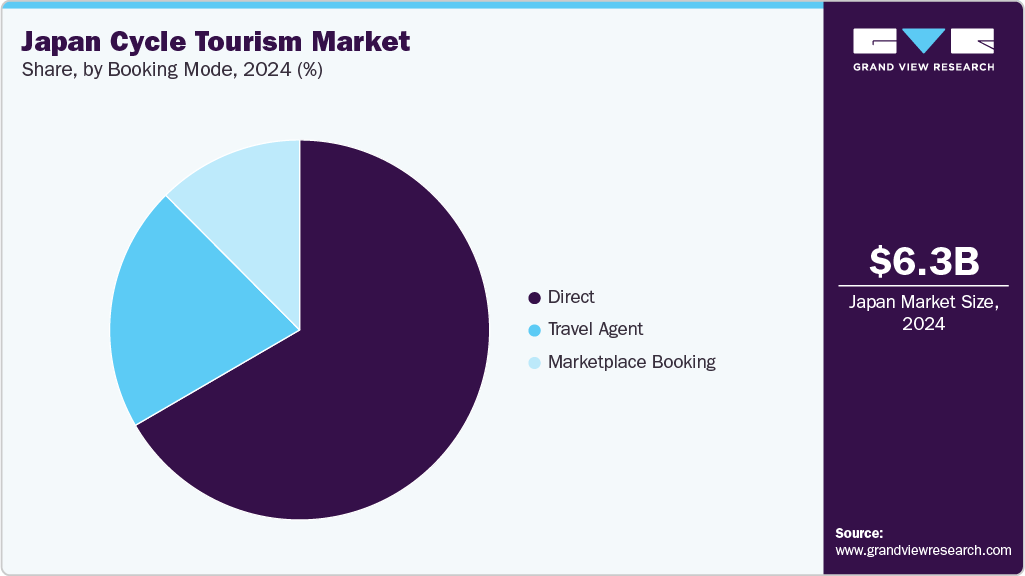

Booking Mode Insights

The direct bookings segment led the market with the largest revenue share of 66.63% in 2024. Tourists increasingly prefer to engage directly with local operators, cycling clubs, or accommodation providers through official websites, social media, and dedicated mobile apps. This approach allows greater flexibility in itinerary planning, real-time communication, and access to custom offerings, such as bike rentals, route choices, and cultural add-ons. In addition, Japanese operators have enhanced their digital presence and multilingual capabilities, making it easier for both domestic and international cyclists to book directly without third-party involvement.

The marketplace bookings segment is projected to grow at the fastest CAGR of 12.6% over the forecast period, supported by the expanding presence of digital aggregators and travel platforms offering curated cycling experiences. These marketplaces cater to a new generation of travelers seeking convenience, comparative pricing, and customer reviews before finalizing their bookings. The rise of mobile-first travel planning and increasing trust in third-party platforms, especially among international tourists unfamiliar with local operators, has contributed to this trend. Marketplaces also provide bundled services, including accommodation, equipment rental, and multilingual guides, making them attractive for less-experienced cyclists or those seeking hassle-free options.

Age Group Insights

The age group of 31 to 50 years segment led the market with the largest revenue share of 45.66% in 2024. Many in this age group seek sustainable, health-conscious travel alternatives and value the structured itineraries, local interactions, and comfort-focused offerings that cycle tourism provides. In addition, they often travel with family or peers, increasing average spending per booking. Their familiarity with digital platforms and proactive approach to lifestyle-oriented vacations make them a dominant consumer segment.

The age group of 18 to 30 years segment is projected to grow at the fastest CAGR of 11.8% over the forecast period. This demographic values outdoor adventure, cultural immersion, and sustainability. Their strong engagement with social media platforms amplifies interest in visually rich and authentic experiences, encouraging peer-driven discovery of lesser-known cycling routes and local interactions. In addition, the growing popularity of solo and small-group travel among younger individuals, supported by flexible work and study arrangements, is fostering more spontaneous and extended cycling trips.

Key Japan Cycle Tourism Company Insights

The Japan cycle tourism industry is a refined ecosystem of regional tourism bureaus, heritage route operators, and wellness-focused travel agencies, responding to growing domestic and international interest in immersive, sustainable travel. Key service providers deliver guided and self-guided experiences that combine Japan’s scenic diversity with cultural depth, offering curated routes through coastal towns, rural farmlands, ancient temples, and mountainous landscapes. Operators collaborate with ryokans, community guesthouses, and cycling-friendly resorts to provide inclusive packages with bike rentals, GPS mapping, multilingual support, and luggage transport.

As demand shifts towards slow travel, fitness-centric itineraries, and cultural authenticity, the industry is increasingly influenced by interest in spiritual cycling trails, traditional cuisine, and local artisan experiences. Younger travellers are drawn to short, flexible routes with digital integrations, while the 31-50 segment prefers multi-day journeys with wellness elements and historical immersion. E-bike accessibility is expanding inclusivity for senior tourists and families. Areas such as Shimanami Kaido, Hokkaido, and Noto Peninsula are emerging as cycling hotspots, underpinned by local government efforts and smart tourism infrastructure that support Japan’s vision of low-impact regional revitalisation.

Key Japan Cycle Tourism Companies:

O Cycle Japan

Oka Tours Co., Ltd.

Cycle Japan Tours

RideJapan

Rindō Bike Tour Japan

We Ride Japan

Bicycle Tours Japan.

Grasshopper Adventures

RAID Cycling

Eco Tours Japan

Recent Developments

In February 2025, Tabbit Tours, headquartered in Ibaraki Prefecture, introduced a unique travel experience in Ishioka City that blends cycling with bus transport. Known as the “Sports Support Bus × Bicycle” tour, the offering is designed to give travelers the freedom to explore select areas by bicycle while using a bus to navigate longer or more challenging parts of the route. The bus is equipped to carry up to ten bicycles, making it easy for participants to switch between cycling and resting as needed. This approach supports flexible, active tourism and allows riders to discover regional attractions, such as historical sites, without committing to a full cycling route.

In August 2023,Ride & Seek, a global cycling tour company, expanded its operations in Asia by acquiring Cycle Japan, a boutique operator known for its culturally immersive rides. This strategic move enables Ride & Seek to deepen its presence in Japan by integrating Cycle Japan’s local expertise and routes into its existing tour portfolio. Among the additions is an extended version of Ride & Seek’s Samurai-themed journey, which now includes areas like Shikoku, the Noto Peninsula, and regions near Mt. Fuji. These enhanced itineraries combine traditional ryokan stays and hot spring experiences with scenic cycling. The acquisition also sets the stage for future offerings, including independent self-guided routes in Hokkaido, aimed at attracting solo riders and more flexible travel styles.

Japan Cycle Tourism MarketReport Scope

Report Attribute

Details

Market size value in 2025

USD 6.89 billion

Revenue forecast in 2033

USD 16.40 billion

Growth rate

CAGR of 11.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 – 2023

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Group, booking mode, age group

Country scope

Japan

Key companies profiled

O Cycle Japan; Oka Tours Co., Ltd.; Cycle Japan Tours; RideJapan; Rindō Bike Tour Japan; We Ride Japan; Bicycle Tours Japan.; Grasshopper Adventures; RAID Cycling; Eco Tours Japan

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Japan Cycle Tourism Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Japan cycle tourism market report based on the group, booking mode, and age group:

Group Outlook (Revenue, USD Billion, 2021 – 2033)

Groups/Friends

Couples

Family

Solo

Booking Mode Outlook (Revenue, USD Billion, 2021 – 2033)

Direct

Travel Agent

Marketplace Booking

Age Group Outlook (Revenue, USD Billion, 2021 – 2033)

18 to 30 Years

31 to 50 Years

Above 50 Years

Frequently Asked Questions About This Report

b. The Japan cycle tourism market was estimated at USD 6.34 billion in 2024 and is expected to reach USD 6.89 billion in 2025.

b. The Japan cycle tourism market is expected to grow at a compound annual growth rate of 11.4% from 2025 to 2033 to reach USD 16.40 billion by 2033.

b. Groups/friends cycle tours accounted for a revenue share of 42.16% in the Japan cycle tourism industry in 2024. due to growing interest in recreational travel with social interaction. Japan’s scenic cycling routes, such as Shimanami Kaido, are popular among friend groups seeking shared experiences.

b. Some of the key players in the Japan cycle tourism market is O Cycle Japan; Oka Tours Co., Ltd.; Cycle Japan Tours; RideJapan; Rindō Bike Tour Japan; We Ride Japan; Bicycle Tours Japan.; Grasshopper Adventures; RAID Cycling; Eco Tours Japan

b. The growth of cycle tourism in Japan is driven by increasing health consciousness, government investment in dedicated cycling routes like the Shimanami Kaido, and the rising use of e-bikes, which are making hilly terrains more accessible to domestic and international tourists alike.

AloJapan.com