Japan Data

Economy

Politics

Jun 20, 2025

Japanese automakers face a difficult choice as to whether absorbing the impact of US tariffs or passing them on to consumers will be better for their bottom line.

Export Slowdown

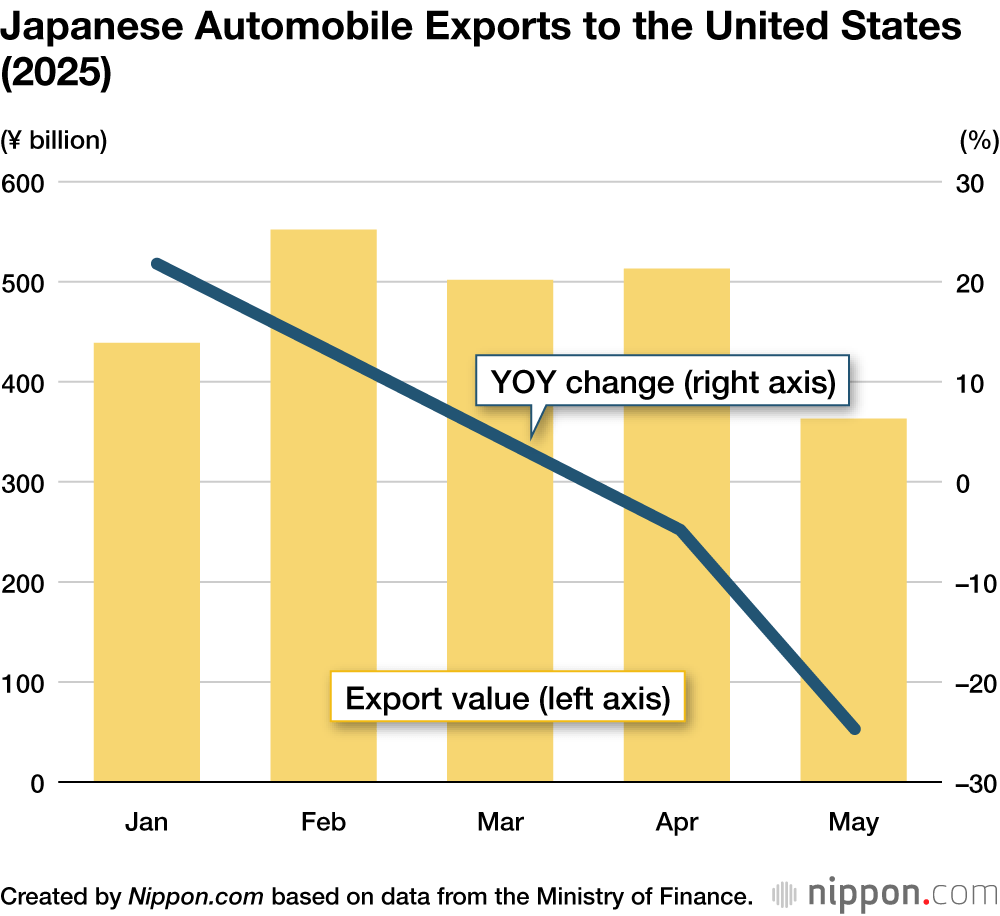

The impact of US President Donald Trump’s tariffs has led to a sudden slowdown in Japanese auto exports to the United States. Japan’s auto industry appears to have responded by lowering its prices to absorb the impact of the tariffs, prompting some analysts to predict a major blow to the profits of the industry as a whole.

On top of his tariffs applied across the board to Japanese exports to the US market, Trump imposed an additional 25% tariff on automobiles and auto parts. The Japanese government has been negotiating with the United States in an effort to have the tariffs removed, but no agreement has been reached as of June. Recently, Trump has talked about further increasing the automotive tariffs.

Trade statistics from the Ministry of Finance show that in May, the second month since the initial imposition of tariffs on automobiles, the export value of Japanese cars to the United States was ¥363.4 billion, which was the lowest level for over a year. This was down 24.7% compared with May 2024, far greater than the equivalent 4.8% year-on-year drop in April. While the decrease in the number of vehicles sold was only 3.9%, the fall in unit price was 21.7%.

As there has been little change in the value of the yen since April, this is not a factor in reduced prices. NLI Research Institute suggests that Japanese automakers are absorbing a certain amount of the tariff costs by lowering prices.

An estimate produced by the institute forecasts that if export prices continue to be reduced by 10%, this would mean a decrease in ordinary profits of ¥1.3 trillion for Japan’s auto industry in fiscal 2025. This could be a greater hit than the fall resulting from a 10% reduction in sales volume, such as that seen if tariff costs were passed on to buyers in the form of higher prices. As noted by Saitō Tarō, who heads the institute’s economic research department, “Even if lower prices keep volume high, variable costs for things like materials will put major pressure on profits.”

Impact of Trump Tariffs on Japanese Auto Industry (YOY)

10% reduction in sales volume

Ordinary profits: Down ¥0.2 trillion

Variable costs rate: Unchanged

10% reduction in prices

Ordinary profits: Down ¥1.3 trillion

Variable costs rate: Up 1.2%

Taken by Nippon.com from an estimate by NLI Research Institute. The variable costs rate refers to the ratio of variable costs to sales.

Data Sources

(Translated from Japanese. Banner photo © Pixta.)

tariff

automobile

AloJapan.com