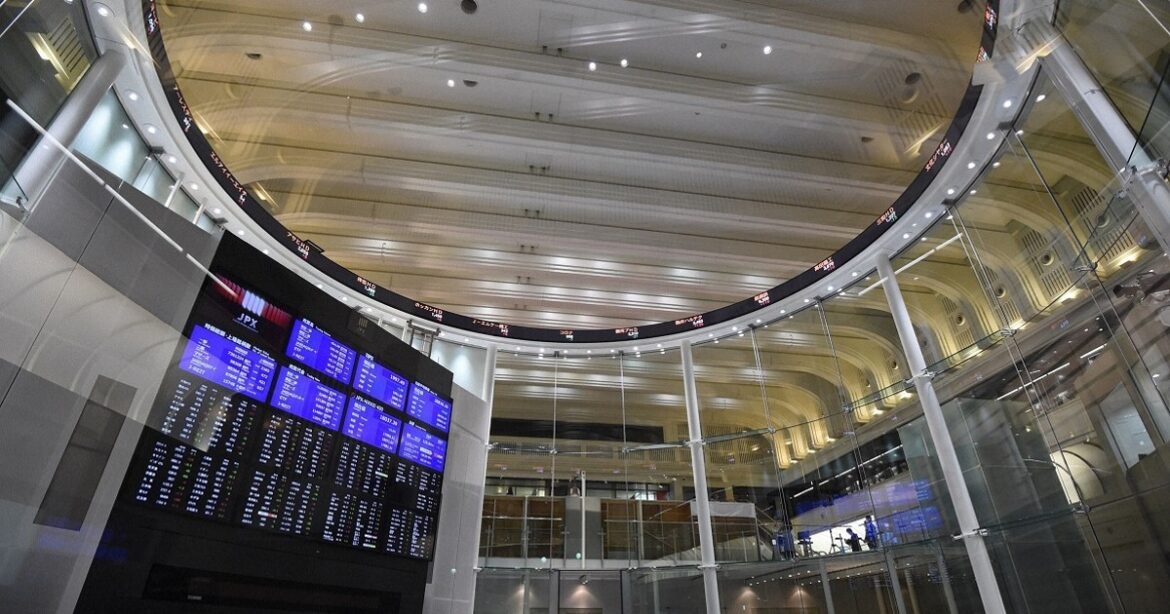

This photo shows the Tokyo Stock Exchange. (Mainichi)

TOKYO (Kyodo) — Tokyo stocks climbed Wednesday for a third consecutive trading day, with the Nikkei index ending at a new four-month high, helped by a weaker yen against the U.S. dollar amid fears of the Israel-Iran conflict escalating and rises in game-related issues including Nintendo.

The 225-issue Nikkei Stock Average ended up 348.41 points, or 0.90 percent, from Tuesday at 38,885.15, its highest since Feb.19. The broader Topix index finished 21.40 points, or 0.77 percent, higher at 2,808.35.

On the top-tier Prime Market, gainers were led by pulp and paper, securities house and precision instrument issues.

The dollar, often sought in times of crisis, remained firm mostly in the lower 145 yen range in Tokyo, as hopes for a cease-fire in the Middle East receded after news reports that U.S. President Donald Trump is considering attacking Iranian nuclear sites.

The yen was also sold after Bank of Japan chief Kazuo Ueda expressed Tuesday a cautious stance on further raising interest rates, citing uncertainty about economic prospects caused by steep U.S. tariffs, dealers said.

Stocks initially declined, tracking falls overnight on Wall Street amid caution over Middle East tensions. But they soon erased their losses and rose as a weaker yen helped lift export-oriented auto shares.

The market later gained upward momentum, as game-related stocks were notably sought on growing expectations for an improved business performance after Nintendo Co. said it had sold over 3.5 million units of its Switch 2 console worldwide in four days following its launch this month.

“The strong sales are extremely positive for the market,” said Makoto Sengoku, senior equity market analyst at Tokai Tokyo Intelligence Laboratory Co.

“The (game) content industry has been setting the theme of the market, and although Trump’s tariffs may have some impact on the industry, it has dedicated fans” supporting it, Sengoku added.

Nintendo rose for the fifth straight trading day, ending up 6.59 percent at 13,260 yen.

AloJapan.com