Dublin, June 09, 2025 (GLOBE NEWSWIRE) — The “Japan Family Offices Market, By Region, Competition, Forecast & Opportunities, 2020-2030F” has been added to ResearchAndMarkets.com’s offering.

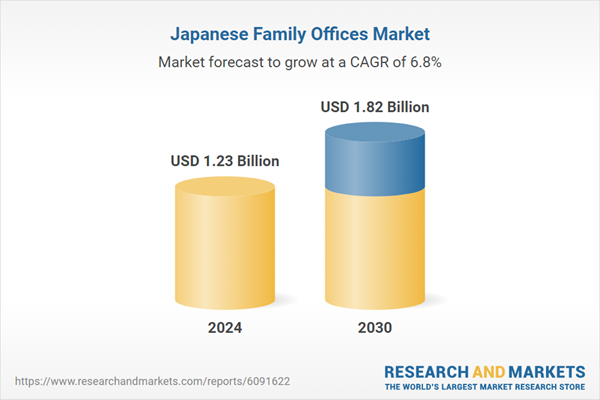

The Japanese Family Offices Market was valued at USD 1.23 Billion in 2024, and is expected to reach USD 1.82 Billion by 2030, rising at a CAGR of 6.75%.

The market is expanding steadily, driven by intergenerational wealth transfer, an aging population, and increasing demand for professional asset management. As of 2024, nearly one-third of Japan’s population is aged 65 or older, intensifying the need for structured wealth preservation strategies.

Family offices are playing a crucial role in managing diversified portfolios that include alternative assets like private equity, real estate, and venture capital. Enhanced regulatory transparency and stronger investor protections are further encouraging the formation of family offices.

Additionally, Japanese households collectively hold over USD 17 trillion in financial assets, highlighting the immense market potential. As globalization and technological advancements reshape the wealth management landscape, family offices are evolving to offer sophisticated, personalized solutions that cater to both domestic and international investment needs.

Key Market Drivers: Rising Ultra-High-Net-Worth Individuals (UHNWIs)

The increasing number of Ultra-High-Net-Worth Individuals (UHNWIs) in Japan is a key factor accelerating the growth of the family office sector. As of 2025, approximately 90,000 Japanese households qualify as high-net-worth, each holding assets of at least USD 3.3 million, with average net assets of about USD 7.7 million. This accumulation of wealth is driving demand for customized wealth management services.

Next-generation UHNWIs are particularly inclined toward strategic portfolio diversification involving private equity, venture capital, and tech investments. They also emphasize succession planning, tax efficiency, and legacy management. With wealth transfer from aging generations gaining momentum, family offices are becoming essential for navigating complex inheritance structures and international financial planning. These factors are collectively contributing to the expansion and sophistication of Japan’s family office market.

Key Market Challenges: Regulatory Complexity

Navigating Japan’s complex regulatory environment remains a significant hurdle for the family office industry. The absence of a clear legal framework specific to family offices leads many to operate under broader asset management classifications, creating legal ambiguity. In addition, compliance with domestic financial regulations and international mandates like AML, KYC, FATCA, and CRS adds substantial operational complexity.

Cross-border investments require thorough reporting and legal oversight, increasing administrative costs. These regulatory burdens often necessitate extensive legal and compliance expertise, deterring some wealthy families from establishing formal family offices. Without streamlined regulatory guidelines, the market’s growth potential remains partially constrained.

Key Market Trends: Growth of Multi-Family Offices (MFOs)

The rising prominence of Multi-Family Offices (MFOs) is reshaping Japan’s wealth management landscape. As more UHNWIs seek professionalized, yet cost-effective financial management, MFOs offer a shared services model encompassing investment advisory, tax planning, and estate structuring.

These offices allow families to benefit from collective expertise and economies of scale without the overhead of running individual Single-Family Offices (SFOs). The adoption of MFOs is further supported by advancements in digital wealth platforms and an increasing interest in ESG and impact investing. This trend reflects a broader shift toward collaborative, efficient, and holistic wealth management in Japan’s affluent segments.

Key Market Players:

Ernst & Young Global LimitedThe Family Office Co. BSCJPMorgan Chase & Co.PwC Japan GroupCascade Family OfficeBessemer TrustStonehage Fleming Family & Partners LimitedGlenmedeBank of America CorporationWe Family Offices LLC

Report Scope:

In this report, the Japan Family Offices Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Japan Family Offices Market, By Type:

Single-Family OfficeMulti-Family OfficeVirtual Family Office

Japan Family Offices Market, By Asset Class of Investment:

BondsEquityAlternative InvestmentsCommoditiesCash Equivalent

Japan Family Offices Market, By Region:

Hokkaido & TohokuChubuChugokuKyushuRest of Japan

Key Attributes:

Report AttributeDetailsNo. of Pages82Forecast Period2024 – 2030Estimated Market Value (USD) in 2024$1.23 BillionForecasted Market Value (USD) by 2030$1.82 BillionCompound Annual Growth Rate6.7%Regions CoveredJapan

For more information about this report visit https://www.researchandmarkets.com/r/hycq93

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Japanese Family Offices Market

AloJapan.com