On May 21, 2025, Saba Capital Management, L.P. (Trades, Portfolio) executed a notable transaction involving Japan Smaller Capitalization Fund Inc (JOF, Financial). The firm added 302,416 shares to its holdings, marking a 16.75% increase in its position in the stock. This strategic move highlights the firm’s interest in expanding its investment in JOF, a fund focused on smaller Japanese equity securities. The transaction was completed at a price of $8.98 per share, impacting 0.07% of the firm’s portfolio. Post-transaction, Saba Capital Management holds a total of 2,107,952 shares, representing 7.44% of the firm’s holdings in JOF.

Profile of Saba Capital Management, L.P. (Trades, Portfolio)

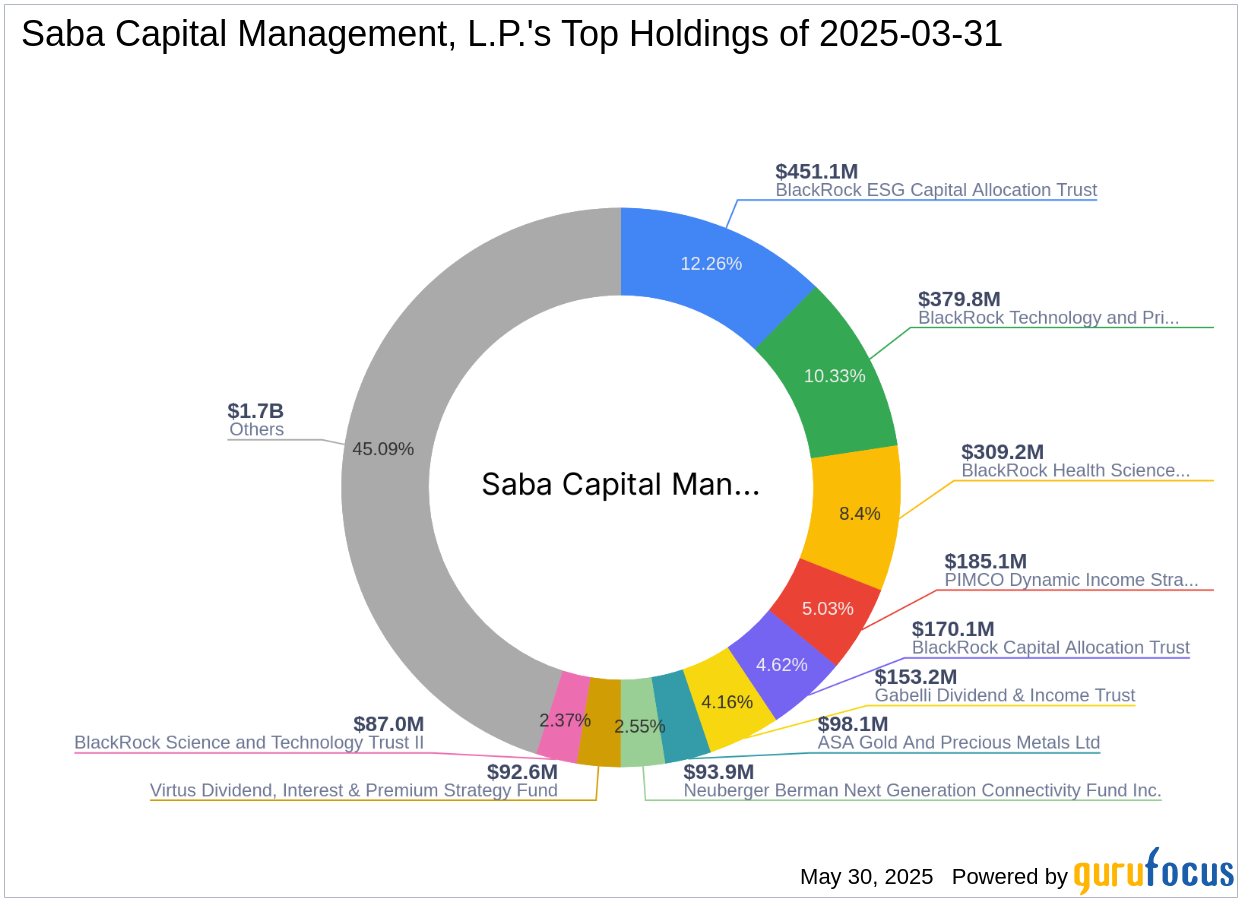

Saba Capital Management, L.P. (Trades, Portfolio) is a prominent investment firm headquartered in New York. The firm specializes in the financial services and consumer cyclical sectors, managing an equity portfolio valued at $3.68 billion. Among its top holdings are PIMCO Dynamic Income Strategy Fund (PDX, Financial) and BlackRock Capital Allocation Trust (BCAT, Financial). Saba Capital Management is known for its strategic investment approach, focusing on maximizing returns through diversified holdings across various sectors.

Overview of Japan Smaller Capitalization Fund Inc

Japan Smaller Capitalization Fund Inc is a closed-end management investment company with a primary objective of achieving long-term capital appreciation. The fund invests in smaller capitalization Japanese equity securities, with a diverse portfolio spanning sectors such as banks, chemicals, and electric appliances. As of the latest data, the fund has a market capitalization of $266.338 million. The fund’s focus on smaller Japanese companies offers investors exposure to potential growth opportunities in the Japanese market.

Current Stock Performance and Valuation

As of the latest data, JOF’s stock price stands at $9.40, reflecting a 4.68% gain since the transaction. The stock has a price-to-earnings (PE) ratio of 34.81, although it lacks a [GF Valuation](https://www.gurufocus.com/term/gf-value/JOF), indicating insufficient data for a comprehensive evaluation. Despite this, the stock’s year-to-date price change ratio is 21.45%, showcasing a positive trend in its market performance.

Financial Metrics and Growth Potential

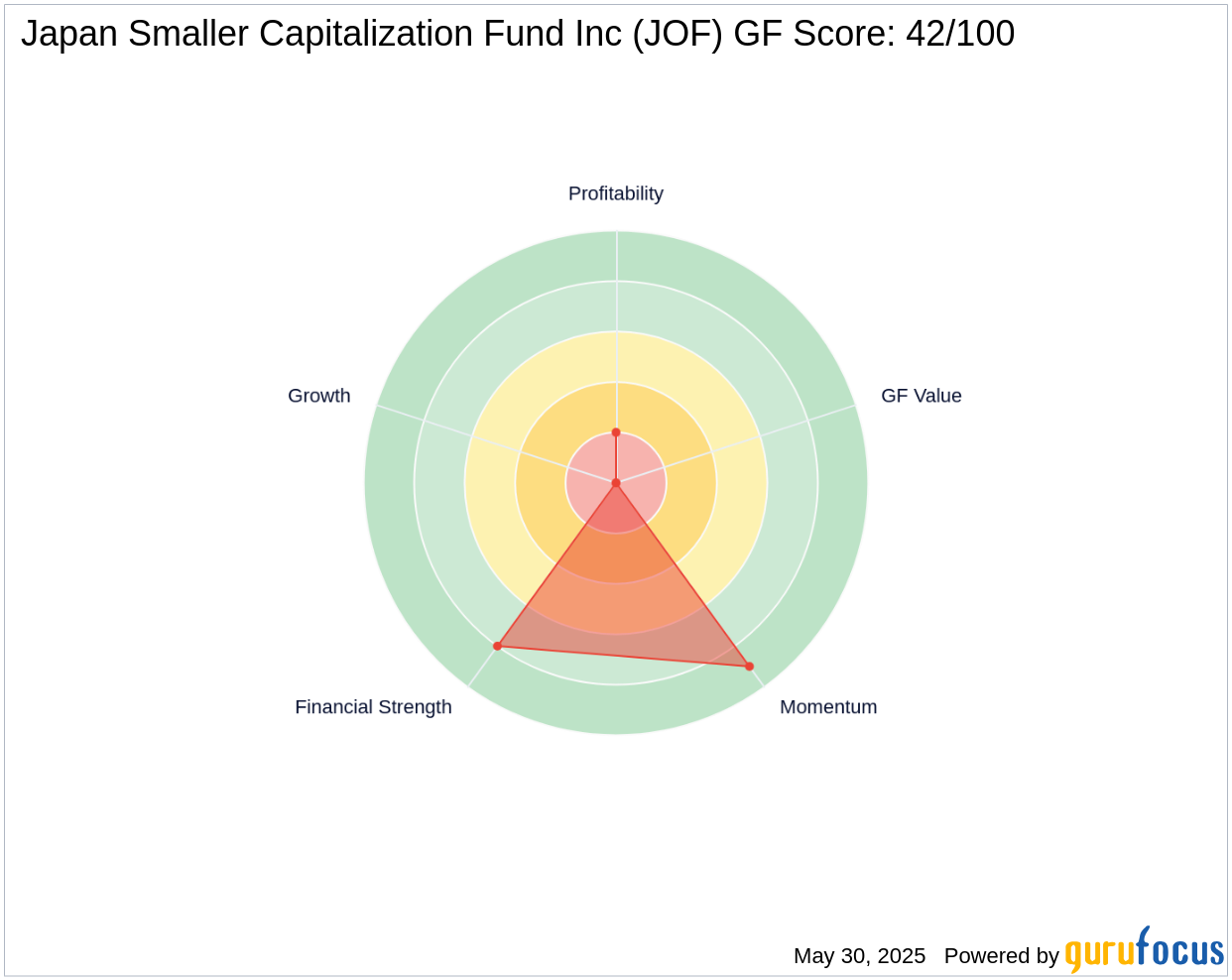

JOF’s [GF Score](https://www.gurufocus.com/term/gf-score/JOF) is 42/100, suggesting limited future performance potential. The fund’s [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/JOF) is 2/10, and its [Growth Rank](https://www.gurufocus.com/term/rank-growth/JOF) is 0/10, indicating challenges in profitability and growth. However, the stock exhibits a strong [Momentum Rank](https://www.gurufocus.com/term/rank-momentum/JOF) of 9/10, and its balance sheet and cash to debt rank are moderate, at 8/10 and 4, respectively. These metrics provide a mixed outlook on the stock’s financial health and growth potential.

Market and Investment Implications

The addition of shares by Saba Capital Management may signal confidence in JOF’s potential for capital appreciation. Investors should consider the stock’s current valuation metrics and growth prospects when evaluating its suitability for their portfolios. While the stock’s [Piotroski F-Score](https://www.gurufocus.com/term/fscore/JOF) is 3, indicating moderate financial strength, its [Altman Z score](https://www.gurufocus.com/term/zscore/JOF) is not available, suggesting caution in assessing its financial stability. Overall, the transaction reflects Saba Capital Management’s strategic interest in JOF, potentially influencing other investors’ perceptions of the fund’s future performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

AloJapan.com