Japan’s national debt, which has long been at the centre of the country’s economic policy, is now straining under its own weight. The government’s borrowing has reached unprecedented levels, with outstanding debt surpassing $9 trillion—more than double the size of the nation’s GDP.

This vast debt load, accumulated over decades of low interest rates and heavy government spending, is now starting to show signs of fragility, as the Bank of Japan gradually phases out its ultra-low interest rate policy. With interest rates climbing, the cost of servicing Japan’s debt is poised to rise, triggering alarm bells in both domestic and global financial markets.

Japan’s recent bond market struggles reflect growing concerns about its fiscal health. A bond auction for 40-year government bonds last week met the weakest demand in almost a year, exacerbating fears over the country’s financial future. Yields on long-term government bonds have surged, and analysts are watching these movements closely, fearing that rising borrowing costs could further undermine the country’s already strained fiscal position.

Japan’s 40-year bond yield recently hit 3.13 per cent, its highest level in two decades. A failed bond auction on May 20, where the bid-to-cover ratio plummeted to 2.50 from 2.96, only added to investor unease.

The situation is further complicated by Japan’s demographic challenges. The country’s ageing population has led to an explosion in social security spending, including pensions and healthcare. As the country’s population continues to shrink and age—over 30 per cent of its population will be 65 or older by 2024—government expenditures are expected to rise sharply, placing additional pressure on an already stretched budget.

‘Only 2% water left in dams…’: PM Modi highlights demerit of key clause in Indus Water Treaty

‘Only 2% water left in dams…’: PM Modi highlights demerit of key clause in Indus Water Treaty  Another dire prophecy for humans, this time from a GHOST. ‘…or Earth will die’

Another dire prophecy for humans, this time from a GHOST. ‘…or Earth will die’  Pahalgam terror attack an assault on ‘humanity’ and ‘brotherhood’: PM Modi during Sikkim@50 programme

Pahalgam terror attack an assault on ‘humanity’ and ‘brotherhood’: PM Modi during Sikkim@50 programme  ‘Adulting 101’: From US to Canada, schools are introducing crash courses for Gen Zs on how to be an adult

‘Adulting 101’: From US to Canada, schools are introducing crash courses for Gen Zs on how to be an adult  Elon Musk exits US government. Is this Donald Trump’s plan to ‘Make America Great Again?’

Elon Musk exits US government. Is this Donald Trump’s plan to ‘Make America Great Again?’  Spirit row: Internet labels Deepika Padukone ‘alpha’ and Sandeep Reddy Vanga ‘Andhra Tate’ amid casting controversy

Spirit row: Internet labels Deepika Padukone ‘alpha’ and Sandeep Reddy Vanga ‘Andhra Tate’ amid casting controversy  New COVID 19 variant linked to China detected in US, fresh cases emerge

New COVID 19 variant linked to China detected in US, fresh cases emerge  Who is Rachel Gupta? 20-year-old Miss Grand International steps down citing ‘toxic environment’ – read full story here

Who is Rachel Gupta? 20-year-old Miss Grand International steps down citing ‘toxic environment’ – read full story here  Prajwal Revanna’s phone had 2,000 obscene photos, 40 videos; mother knew about his amorous deeds

Prajwal Revanna’s phone had 2,000 obscene photos, 40 videos; mother knew about his amorous deeds  New OTT release of this week – Criminal Justice, Captain America and more

New OTT release of this week – Criminal Justice, Captain America and more  US court blocks Trump’s ‘America First’ global tariffs, says POTUS overstepped constitutional authority

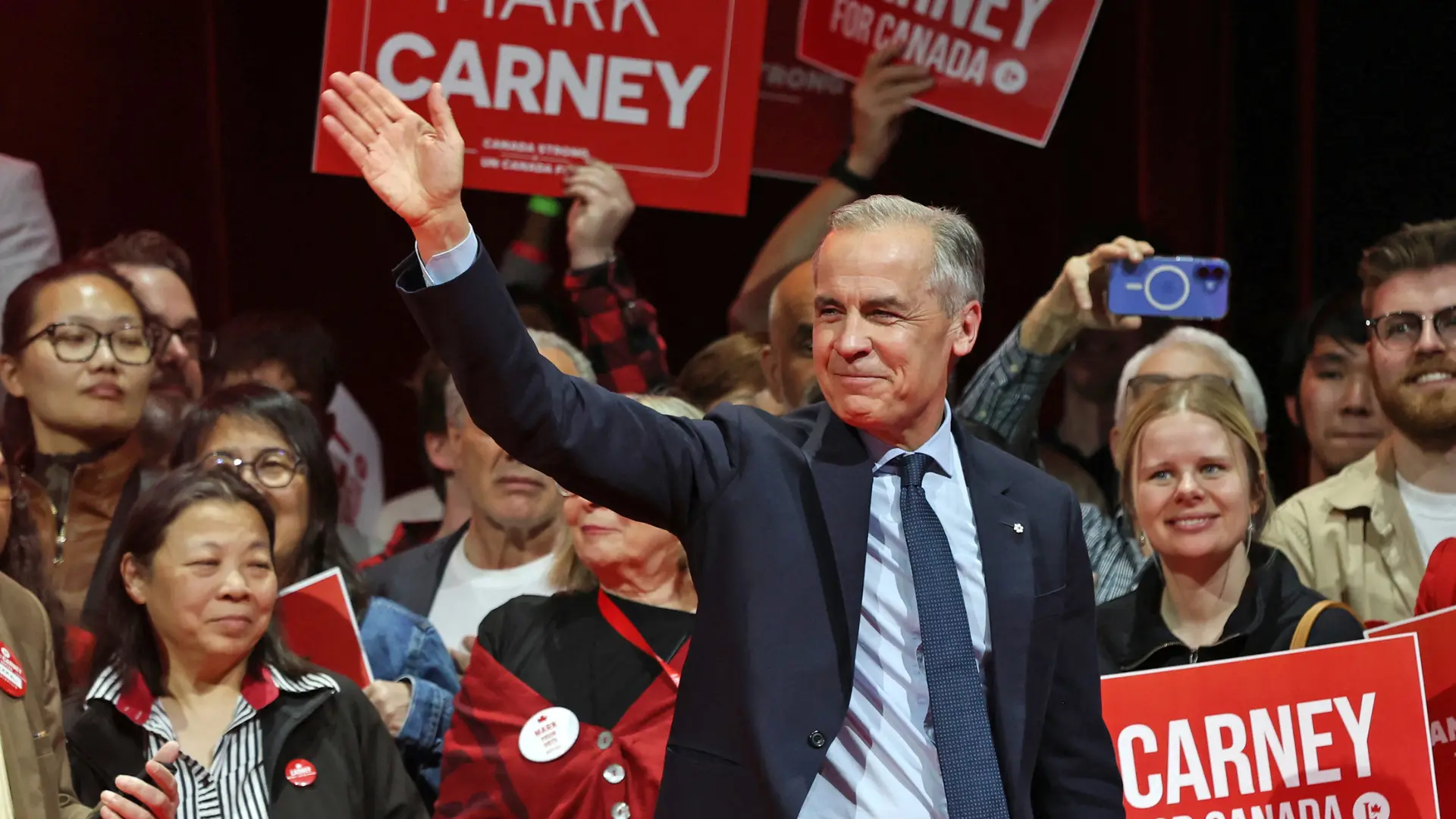

US court blocks Trump’s ‘America First’ global tariffs, says POTUS overstepped constitutional authority  ‘Knife behind the back of PM’: Canada’s Liberals want power to remove Mark Carney just weeks after he took office

‘Knife behind the back of PM’: Canada’s Liberals want power to remove Mark Carney just weeks after he took office  Top 10 world news: Hamas Gaza chief Muhammad Sinwar killed; 3 Indians go missing in Iran, and more

Top 10 world news: Hamas Gaza chief Muhammad Sinwar killed; 3 Indians go missing in Iran, and more  Tu Meri Main Tera Main Tera Tu Meri: Kartik Aaryan and Ananya Panday reunite on set

Tu Meri Main Tera Main Tera Tu Meri: Kartik Aaryan and Ananya Panday reunite on set  Trump fed up with ‘CRAZY’ Putin? US president says ‘will find out in 2 weeks if he wants to end Russia-Ukraine war’

Trump fed up with ‘CRAZY’ Putin? US president says ‘will find out in 2 weeks if he wants to end Russia-Ukraine war’  ‘Is he a rapist?’ Anushka Yadav’s brother breaks silence days after Tej Pratap Yadav’s expulsion, cautions RJD patriarch Lalu

‘Is he a rapist?’ Anushka Yadav’s brother breaks silence days after Tej Pratap Yadav’s expulsion, cautions RJD patriarch Lalu  Secret tunnels seen only in Leonardo da Vinci’s painting have been discovered under an ancient Italian castle

Secret tunnels seen only in Leonardo da Vinci’s painting have been discovered under an ancient Italian castle  ‘Very inappropriate’: Trump told Israeli PM Netanyahu not to strike Iran amid nuclear talks with US, stays hopeful for the deal

‘Very inappropriate’: Trump told Israeli PM Netanyahu not to strike Iran amid nuclear talks with US, stays hopeful for the deal  Israel hit Sanaa international airport in Yemen AGAIN, last plane used by Houthis destroyed – Video

Israel hit Sanaa international airport in Yemen AGAIN, last plane used by Houthis destroyed – Video  Morning News Brief: Trump tariffs blocked by US court, Musk exits DOGE, and more

Morning News Brief: Trump tariffs blocked by US court, Musk exits DOGE, and more  ‘I am not…,’ Coach Gambhir breaks silence on Shreyas Iyer’s snub from India squad for England Tests

‘I am not…,’ Coach Gambhir breaks silence on Shreyas Iyer’s snub from India squad for England Tests  Harry Potter movies in order: A complete chronological guide

Harry Potter movies in order: A complete chronological guide

Rising deficits and political strain

Japan’s national debt has ballooned to an unsustainable 195 per cent of GDP in 2023, the highest among major advanced economies. Much of this debt stems from persistent fiscal deficits, as government spending consistently outpaces revenue.

In particular, Japan’s social security deficit has been a key driver of the country’s fiscal imbalance. Despite efforts at fiscal consolidation, including tax hikes in 2014 and 2019, the country has struggled to rein in its deficits. Financing the growing debt has largely relied on domestic bond issuance, but with bond yields rising, this approach is becoming less viable.

Prime Minister Shigeru Ishiba faces mounting political pressure as the country’s fiscal outlook grows more precarious. With upper house elections approaching, Ishiba is under increasing pressure from voters struggling with inflation and the economic impact of tariffs imposed by the United States.

Populist demands for tax cuts are growing louder, even as Ishiba cautions against the dangers of higher interest rates. The prospect of a fiscal crisis similar to that of Greece’s 2009 debt debacle is being raised by analysts, further intensifying concerns about Japan’s financial future.

Rising concern

Japan’s fiscal troubles are not just a domestic issue. As one of the world’s largest economies, Japan’s bond market plays a significant role in global financial markets. Its recent bond market volatility, characterised by sharp increases in long-term bond yields, has had ripple effects in global markets, particularly in the US Treasury market. Japan is the largest foreign holder of US government debt, and any significant shift in its bond market could reverberate across global financial systems.

A sharp rise in Japanese bond yields could also divert capital back into Japan, as investors may seek higher returns on its bonds. This could affect other major economies by driving up borrowing costs worldwide. With Japan’s economic growth stagnant and its demographic challenges deepening, many economists believe that Japan must implement serious fiscal reforms to address its unsustainable debt trajectory.

While Japan’s fiscal problems are not expected to lead to an immediate collapse, the country’s fiscal trajectory is unsustainable in the long term. Experts argue that Japan must begin serious fiscal consolidation to avoid a full-blown crisis. Ageing demographics, rising social security costs, and now higher interest rates mean the country faces a shrinking window of opportunity to enact meaningful fiscal reforms.

For now, Japan’s fiscal woes remain a major concern for policymakers and investors alike. With rising bond yields, a growing debt burden, and an uncertain political landscape, Japan’s economic future hangs in the balance.

AloJapan.com