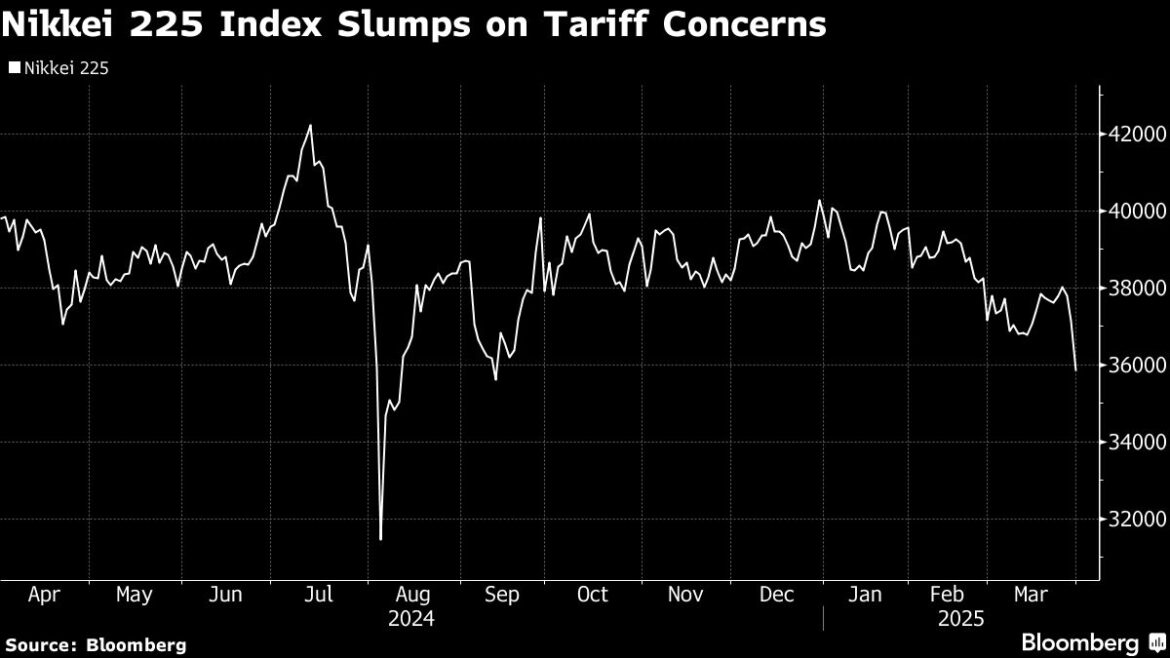

(Bloomberg) — Japanese shares plunged, putting the Nikkei stock gauge on track for its worst quarter since March 2020, as export-related stocks slid on concerns about the global trade war.

Most Read from Bloomberg

The Nikkei 225 Stock Average fell as much as 4.2%, its biggest intraday drop since September, as chip-related shares including Renesas Electronics Corp. and Disco Corp. tumbled more than 7%. The broader Topix index retreated 3.9%, with financials and electronic appliance companies the biggest drags. A stronger yen added to pressure on exporters’ shares.

“The market is likely nervous ahead of the tariffs on April 2,” said Jumpei Tanaka, head of investment strategy at Pictet Asset Management Japan Ltd., referring to the upcoming US reciprocal levies. “The continued fall in US stock futures on Monday is contributing to the weakness in Japanese shares.”

The Nikkei gauge has declined more than 10% since end-December, while the Topix has dropped over 4%.

“This is a risk-averse move based on concerns that economic activity will be suppressed due to the lack of clarity over the landing point of the Trump administration’s policies, including tariffs,” said Tetsuo Seshimo, a portfolio manager at Saison Asset Management Co. “In the case of Japan, when there is a risk-off, the yen appreciates at the same time, so that also has an impact.”

–With assistance from Toshiro Hasegawa.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

AloJapan.com